Fresh out of the Oven! The Singapore Department of Statistics has recently released The Census of Population 2020 which is conducted once in ten years. The Census is the most comprehensive national statistical study with 2 separate publications. We will be taking a deep dive into the 2nd Study relating to Households, Geographic Distribution, Transport and Difficulty in Basic Activities with some references to the 1st Study relating to Demographic Characteristics, Education, Language and Religion.

How will the Census affect Singapore’s Property market and your Investment Decision in the next 10 years?

Quoting our Boss at PLB “These are some JUICY statistics”

Populating the Property Market

Courtesy of Singapore Department of Statistics

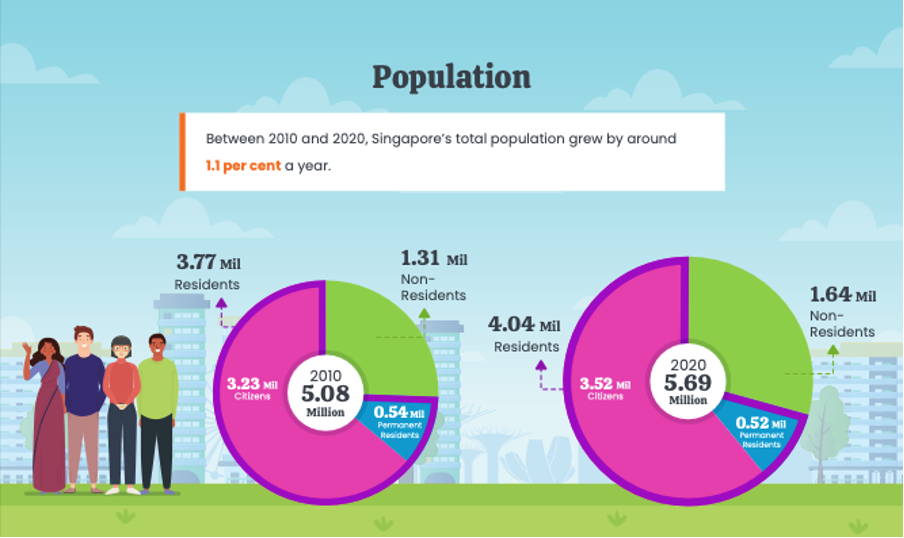

Singapore’s Total Population has grown by around 1.1% per year, totaling to 5.69 million till date. Sighting a similar increase in Resident and Non-Residents by about 300,000 in each group while Permanent Residents has seen a slight decrease of about 200,000. The total number of Non-Residents has also seen a significant decrease from 2019 to 2020 by about 2.1% which is resultant of the uncertain economic conditions brought about by the COVID-19 pandemic.

Courtesy of Singapore Department of Statistics

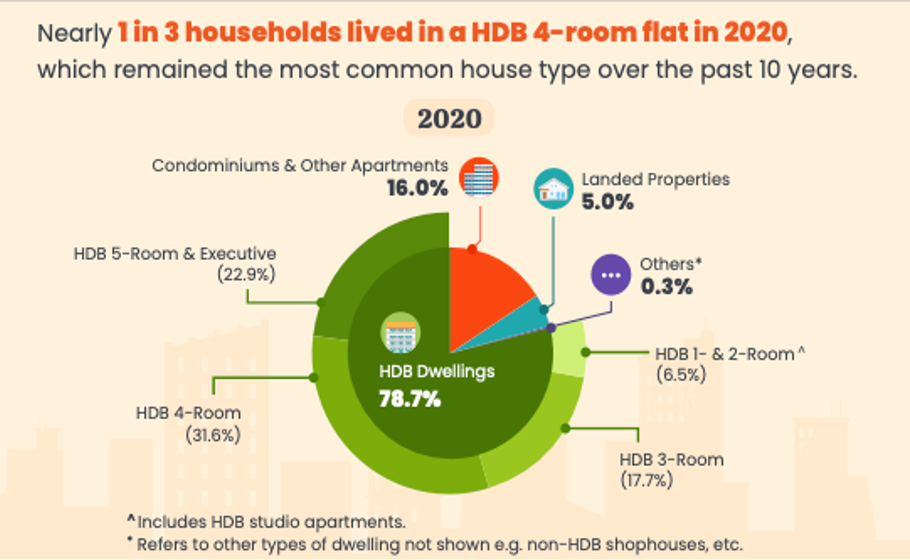

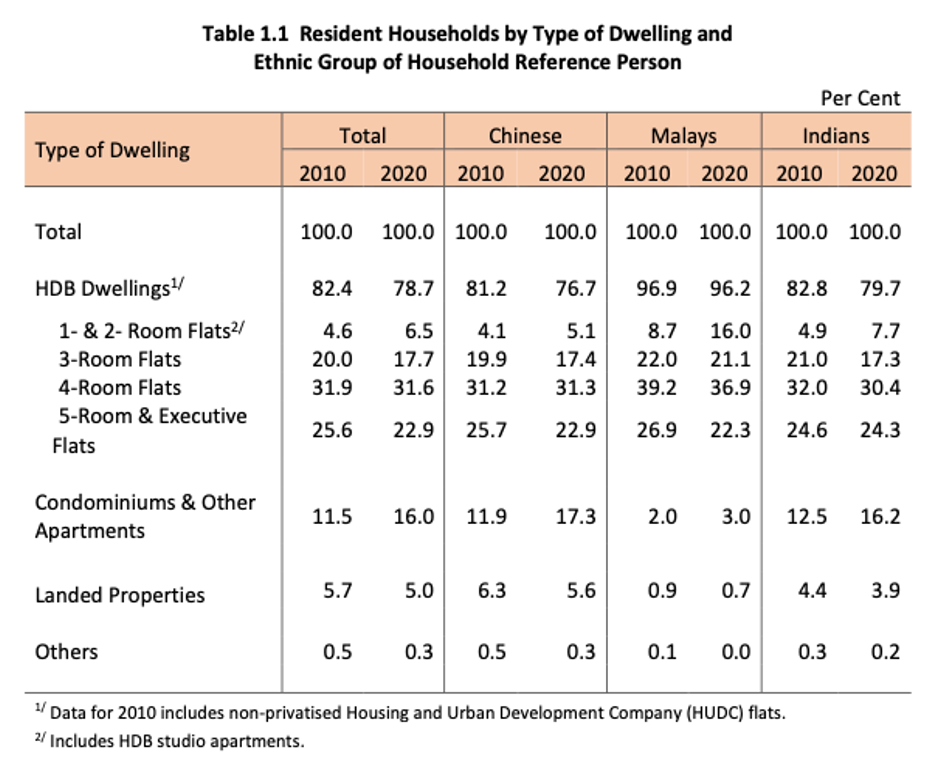

In tandem with the increase in Population growth, there was also an increase in resident households from 1.15 million in 2010 to 1.37 million in 2020. The most noteworthy statistic presented would be the increase in Condominiums & Other Apartments household. Along with three-quarters of the households being HDB 4-Room and above which has seen a 0.8% increase from 2010. With the work from home conditions which started to be more prominent since the start of 2020, households choosing larger units where possible, due to the increase in spatial preference, could have been the underlying factor to this increase.

Interestingly, there was a decrease in percentage of HDB Dwellings and Landed Properties of about 4.4% of the Total Population. Although the total number of households in these categories did see an increase in actual figures, the decrease in percentage reflects the change in preferences of Homeowners.

Citing the change in HDB Dwellings and Landed Properties, there is a significant increase in Condominiums & Other Apartments households. This increase could very well have seen an even greater climb riding on the enthusiasm from the Post-Pandemic purchases following the “Hotcake” performance by developments such as Irwell Hill Residences, Normanton Park, The Reef at King’s Dock and One-North Eden Condominium. Just to name a few. Following the popularity of these developments, we have taken a deep dive to offer Insights to these developments. The Sterling performance of the new launches would just be reflective of Singaporeans interest in new things.

Courtesy of Singapore Department of Statistics

There is also a slight increase in Owner-Occupied Households from 87.2% in 2010 to 87.9% in 2020. This could possibly be translated into an increase in home ownership amongst residents amid confidence and enthusiasm in Singapore’s Property market. Along with the increase in ownership, we would also like to highlight the decrease in percentage points of Landed Properties. While the overall statistics reflect a decrease in percentage, it will be prudent to remember that Landed Properties is a category with an ever-dwindling limited supply. In fact, the actual figures have shown an increase from 65,550 (5.7% of 1.15 million) in 2010 to 68,500 (5% of 1.37 million) which is about an additional 3000 Landed Households. Amongst this increase are some notable purchases like the Good Class Bungalow purchased in Nassim Road by the wife of Nanofilm’s Founder and Chairman at a whopping $4,005PSF, totaling to about $128.8million and the purchase of an under construction bungalow in Cluny Hill with a Quantum half that of the GCB in Nassim Road purchase, at $63.7million, at an even more shocking $4,291PSF.

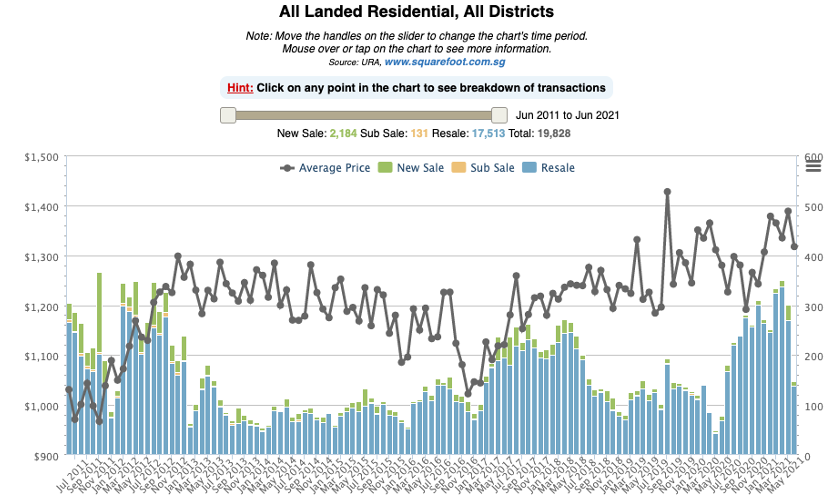

For more Insights on the Landed Property Market, do catch up with our Landed Homes Series. Here is a brief overview of the Landed Property climate;

We foresee that the property market is on a train headed northwards. The pandemic situation has highlighted Singapore’s versatility and value in a highly competitive world. With more businesses setting up shop here and fuelling our economy, more jobs and opportunity will be created for Residents and Foreigners alike. This will help boost an already thriving Property Market to an even better position from where it stands now. As the current trend in 2021 stands, larger units and Landed Housing are in high demand. As our population continues to grow, space will prove to be a commodity of luxury, as such we do foresee the current trend in 2021 to carry on further as our land space becomes lesser.

Let’s Talk Money

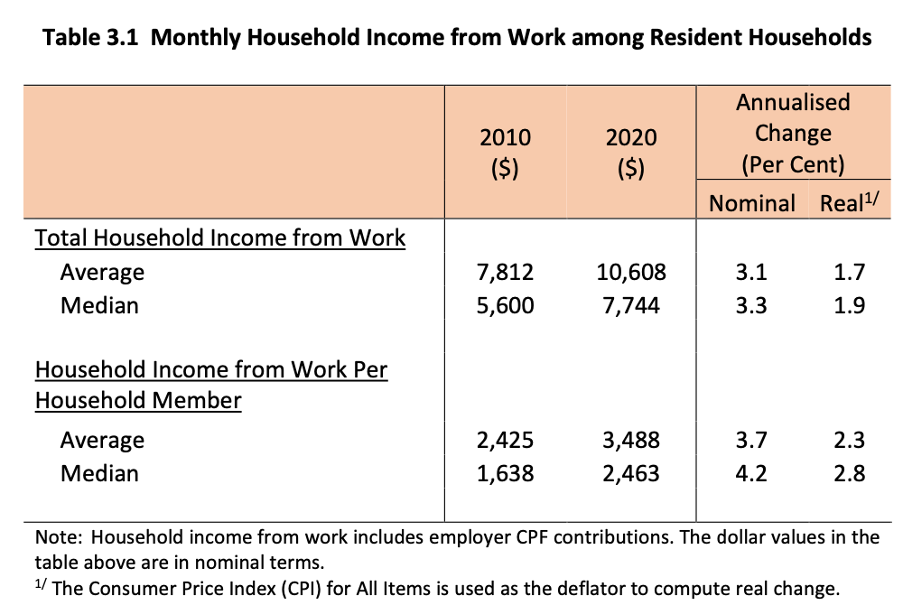

Courtesy of Singapore Department of Statistics

Resident Household monthly income has seen an increase in the average and the median figures. These are the JUICIEST statistics that we think provides some clarity to the enthusiastic Property Market. Although the recent highlights of the bullish Property Market have been attributed to the low interest rates. Ultimately the loan quantum is still regulated by the TDSR framework by the Monetary Authority of Singapore (MAS). But of course, low interest rates are still a big driver in fueling the market, hand in hand with several other factors.

In the year 2020 the Median Household income is at $7,744 which has seen an Annualized Nominal change of 3.3% and Real change (Accounting for Inflation) of 1.9% from $5,600 in 2010. Perhaps some readers will take the stand of “Have meh? How come I don’t see in my bank?” Before we address the “missing” cash from your bank accounts, let’s elaborate on what this means from the Property standpoint.

TDSR

We are all very aware to qualify for a housing loan, (for Private Properties) the banks will use 60% of gross income to determine the Max Loan Amount that they will be able to loan to you. Which then in turn, provides you with a budget figure of the Max Property Price you will be able to purchase. With the increase in Median Household income naturally the loan amount is stretched to allow people to make larger purchases.

Let’s take a look at the numbers to make sense of these figures.

2010

Median Household Income: $5,600

Assuming both Husband and Wife at age 35, to take advantage of the max loan tenure of 30 years.

Max Loan Amount: $748,255

Max Property Price: $997,673.53

Total Cash/CPF Needed (Excl. Stamp Duty & Misc. Fees): $249,418

2020

Median Household Income: $7,744

With the same assumption of both Husband and Wife at age 35.

Max Loan Amount: $1,034,740

Max Property Price: $1,397,640

Total Cash/CPF Needed (Excl. Stamp Duty & Misc. Fees): $344,910

Although in their respective time periods, the max loan amount could have allowed for purchase of a satisfactory unit to each liking. The rise in Median Household income has allowed residents to leverage on a larger amount to fuel their property purchases. It will be safe to say that the gradual increase of purchasing power has been one of the contributing factors to the increase in Property Prices over the years. We all know that when it comes to that one unit that catches our eye, no amount of money can stop what the heart wants. But of course, please do not over-leverage your funds. Do contact us at Property Lim Brothers for a consult if needed.

Cash/CPF Cow

Courtesy of Singapore Department of Statistics

Taking the time machine back to 2010, at that time there was only the CPF Housing Grant (Resale), the Additional CPF Housing Grant (AHG) and the Special CPF Housing Grant (SHG). Which totals to about up to $130,000 subjected to the respective eligibility. Fast forward to 2020, the AHG and SHG has been combined to form the Enhanced Housing Grant in 2019 along with the introduction of the Proximity Housing Grant (PHG) in 2015, the grant amount you may be eligible for is up to $160,000 now.

Additionally, it is pretty common these days to see a potential paper gain of $200,000 from patient homeowners who decide to try for the lottery pick of balloting for a BTO flat. Some projects even yielded record breaking prices benefitting the owners with an eye-popping $600,000 gain, figures that are unheard of during the 2010 time period. Given the right selection, you may end up with a healthy gain after investing 8-10 years from application to completion of the Minimum Occupancy Period (MOP). These transactions, while inspiring to the eager future homeowner, are a potential issue that might invite new regulations that prevent HDB flats from being resold at $1 Million in the future according to Minister for National Development Desmond Lee. But that’s not what we want to talk about today.

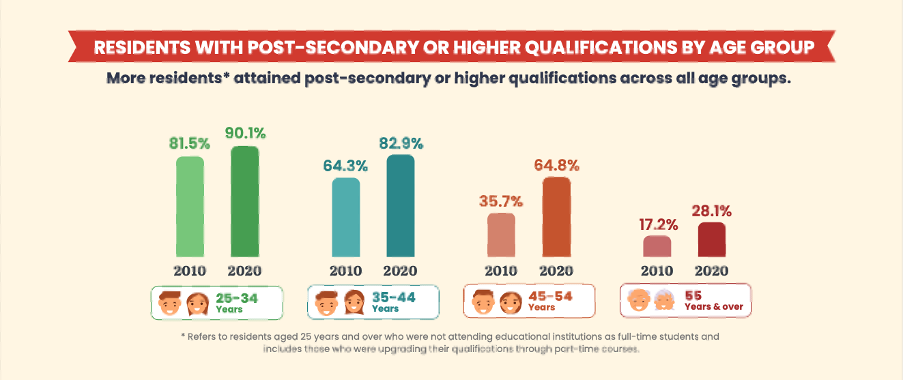

What we want to talk about today is the increasing ease that residents are having to find the Cash/CPF to fund their Property Goals. While securing the loan quantum was not an issue in 2010, the ease of having liquidity in terms of Cash/CPF is definitely not as “standard” in the year 2020. This should not come as a surprise because the increase in Median Household income is a deliberate effect of a better educated population. With higher education, employees are able to command a higher salary at the same time being more educated means smarter consumers. Giving more care on where to park & grow their money in order to hedge nasty things like inflation instead of being traditional and leave it sitting in the bank. All these factors combined; it should now give clarity to a portion of the driving factors behind Singapore’s Property Market.

But wait, what if you have the luxury of earning more than the half of Singapore’s residents?

The Average Household income has grown at a similar rate of 3.1% from $7,812 in 2010 to $10,608 in 2020. This is a whole different ball game. Assuming you have moved into your BTO 5 years ago, nicely renovated and you love the location. You and your spouse have done well in your respective careers, and you decided to purchase an additional property for investment.

Question is, Can you afford a 2nd Property?

Adopting the same TDSR calculation above with 1 Property count and an ongoing home loan of about $2,500/month.

You will still be entitled to loan from the bank (Taking into consideration a 45% LTV Limit for 2nd Housing Loan) :

Max Loan Amount: $860,672

Max Property Price: $1,912,604

In contrast if we were to compare to the Average Household Income from 2010:

Max Loan Amount: $487,078

Max Property Price: $1,082,397

Even with a same ongoing loan of $2500/month, “Average” Residents are now able to leverage on a larger loan for a 2nd Property (That is if you have the spare Cash lying around) of nearly twice the quantum of having an additional $2700 in Household income. Taking into account that this is before any proper structuring, of an individual/household Property portfolio. While the Cash/CPF portion may seem like a roadblock to even consider a 2nd Property, we spoke earlier of the additional paper gains that could very well be taken advantage of by homeowners, who have profited nicely from their initial Property decisions, to own their 2nd Property

Again, we believe that in the Year 2020, finding the Cash to invest has grown increasingly attainable. Be it from new record highs from certain notable Indexes that savvy investors have profited from or the returns on the growth of a certain Electric Car manufacturer or even the believer in Cryptocurrencies that flipped a 1000% gain on Dogecoin. We observe that investors of all sorts still have preferences in Real Estate as a Tangible asset class of storing their gains. Highlighting that several factors mentioned could have led to the increase in popularity for 1 and 2 Bedders for investors to receive good rental yield and yet have the lower entry quantum.

The climate of the future Property Market will definitely favor the Private Residential sectors. With the ability to earn more now and to receive potential funds from grants and/or paper gains from BTOs, it is relatively easier to fund that upgrade to Private Property. Couple that with the ability to leverage more from Mortgage Loans due to the current low interest rates and high gross income, we believe that the spotlight will continue to shine towards having a stake in Singapore’s Private Property Market for own-stay and/or investment given the already decreased percentage of HDB dwellings.

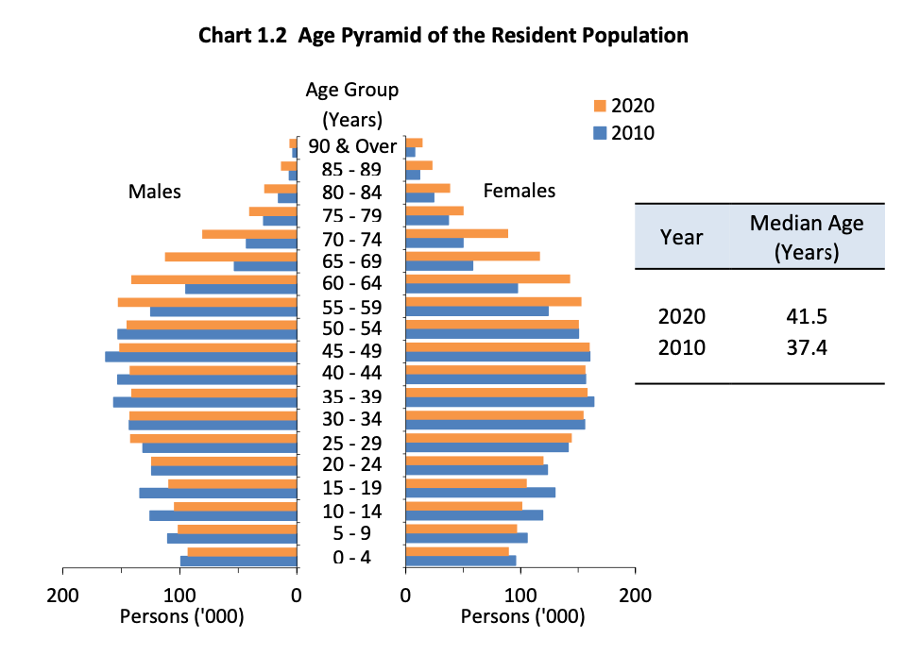

Ageing Population affecting Buying Power

Courtesy of Singapore Department of Statistics

It is no secret that Singapore is an ageing population with a declining birth rate. The charts from the Census have reflected an increase of Median Age in the Year 2020 bringing it up to 41.5 years. While a factor of 4 years may not seem like a lot, the actual implication is that half of the Residents are having to deal with a shortened loan tenure due to age limitations. Thus, not being able to max out their loan tenure to 30 years and take advantage of a longer repayment period.

To put things into perspective:

Loan Tenure: 28 Years (65 years – 37 years)

Property Loan: $1,000,000

Mortgage Interest: 1.5%

Monthly Mortgage Repayment: $3,646.65

Loan Tenure 23 Years (65 years – 41 years)

Property Loan: $1,000,000

Mortgage Interest: 1.5%

Monthly Mortgage Repayment: $4,136.79

In 2010, it would have been a little easier monthly to repay that mortgage loan by about $500. But how does this shortened loan tenure affect Property decisions?

Answer: The amount that the bank will loan to you.

With an average income of $10,000 and a difference in tenure of 5 years, that translates into being able to loan about $150,000 lesser. For some popular developments (i.e. near popular schools or MRT), that could be the difference between owning a unit on the 3rd storey versus having a nice unblocked view on the 12th storey. In terms of popularity of choice units when it comes to exiting the market, the unit on the 12th storey will have priority over many buyers who are looking to buy into that particular development.

Gradually, in the perspective of sellers, when it comes to meeting the selling price of the house, some buyers may have difficulty of meeting the valuation against the amount that they might be able to loan. This might be a potential challenge for sellers who are looking to sell quickly and at their target price. In order to resolve this challenge and help homeowners achieve their objectives, exploring aggressive and creative marketing targeted at the right audience would be the right fix 😉

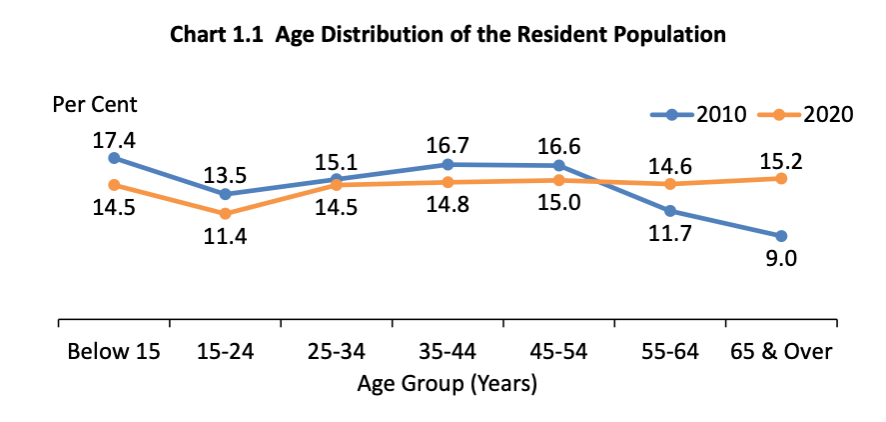

Mommy & Daddy old already

Courtesy of Singapore Department of Statistics

In the last 10 years the number of residents aged 55-65 and 65 & Over have risen the most drastically by 2.9% and 6.2% respectively. These are perhaps the most worrying numbers that the Singapore Government would be observing from the Census. Residents at such an age would already be well established in their career paths and the next consideration they might have is Estate Planning, restructuring their property portfolio to leave their legacy for their children. So, what are the Property trends that could have been resultant?

Courtesy of Squarefoot

Between the year 2011 to 2012 there was a good amount of transaction volume due to the lower prices in the landed property market across all districts. Prices then began to surge and caused transactional volume to stagnate over a good number of years. Fast forward to 2017, demand started picking up again once prices dipped. But what is most interesting is the time period between 2019 till date. Even as prices hit new peaks the demand is not fading. Transactional volume continues to pick up even as prices are at a high. More and more residents are wanting a stake to own a piece of land in Singapore so they do not have to worry about whether their property would depreciate from newer developments. In the Landed Market where supply is limited and ever dwindling, the future expected price movement would continue northwards.

Serviced Apartments for the Elderly

Courtesy of HDB

Of course, Landed housing is not affordable housing. HDB has recently launched a new breed of flats targeted at the Elderly called Community Care Apartments in Feb 2021. The pilot project at Bukit Batok integrates senior-friendly housing with care services that can be scaled according to care needs and social activities to support seniors to age independently in their silver years. The flats have Lease Tenures of 15-35 years with 5-year increments and you will have the choices of a full upfront payment or a partial payment upfront + $50/month for the duration of your lease for the Basic Service Package.

It seems that this type of flats has a certain demand since they were oversubscribed within a day of the BTO exercise. There is also standing indication from the Census that there is an increase in households of 1- & 2- Room Flats from 4.6% in 2010 to 6.5% in 2020. Citing this popularity, would housing developers consider offering up this type of apartments for the mass market? Since the seniors who are currently in the phase of right sizing their private flats are already looking towards 1 and 2 Bedder as their primary options and then reinvesting the remaining funds into a 2nd Property to have that monthly passive income via rental.

One of the main concerns with the HDB’s Community Care Apartments is that you will not be able to resell the flat in open market. Instead, it has to be returned to HDB in which you will receive a reimbursement of the remaining lease, should you choose to no longer live in it. Which means the money you put down for the flats will be an expenditure as it loses the opportunity to appreciate and “work” for you. Furthermore, in terms of leaving the flat behind, even with a standard 99 year leasehold HDB, if their children owns a private property, they will not be able to retain the flat but will have to sell it off right after the execution of the Will. It will seem inevitable that parents who will want to leave behind assets for their children will definitely choose a 99-Year private development with potential for appreciation or Freehold projects that will provide a good hold of value.

As the years pass and the population continue to age with a declining birth rate. We believe that landed housing will still be a prime choice in a property portfolio when it involve Estate Planning. On the flip side, for people who may not want to put down a large amount for a piece of land, they will definitely look towards projects with good appreciation potential and/or a firm store of value. Smaller units with lesser bedrooms could very likely see an uptake with more senior buyers for ease of living, especially so in districts which are more integrated and has better amenities like the CCR or RCR areas.

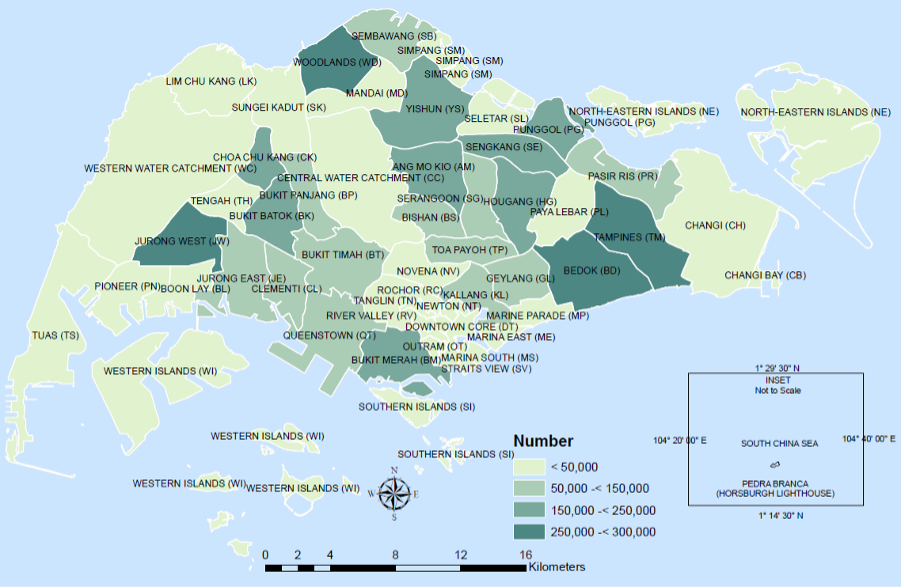

The Heat Map of Singapore

Courtesy of Singapore Department of Statistics

The current heat map of residential location should come as no surprise, the expected areas of denser population is as per the squeeze you experience from the morning crowd of the respective towns. However, the interesting places to take note of are Tengah, Pioneer, Boon Lay, Paya Lebar and the CCR region. For different reasons of course.

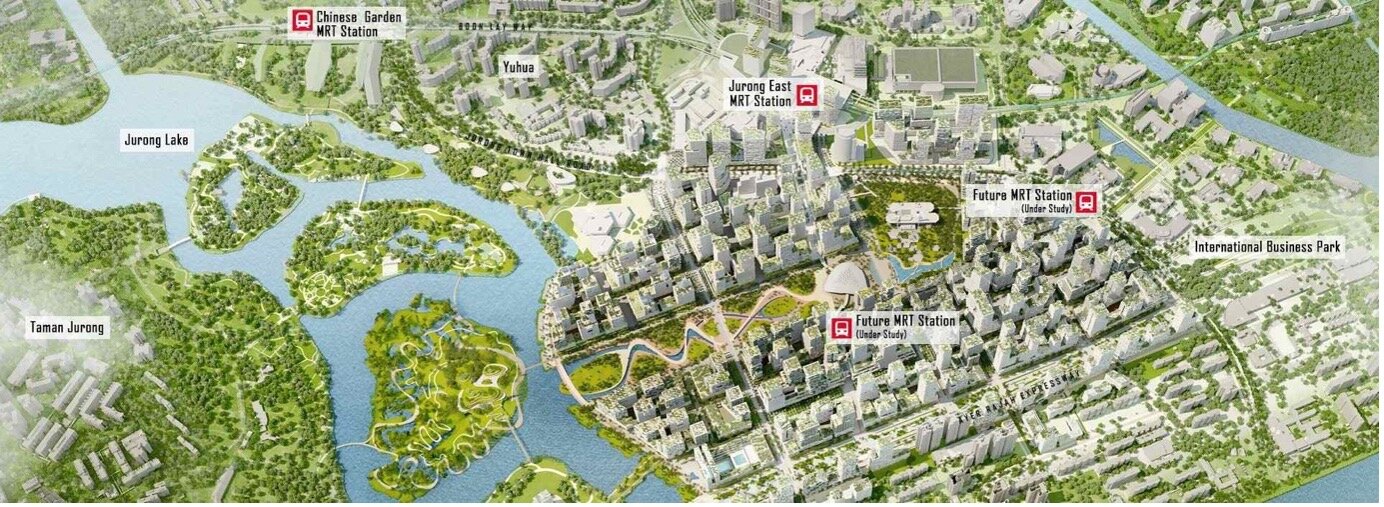

Jurong Lake District

Courtesy of URA

While Jurong West is currently one of the denser towns in Singapore, the direct vicinity has yet to catch up. We believe that, in the near future, once the Jurong Lake District is fully developed along with the completion of the Jurong Region Line, the decentralization of the CBD and the movement of PSA towards Tuas Port, the population around the direct vicinity of Jurong West will likely see an increase. Likely to be a choice of residence by own-stayers and tenants for the proximity to business establishments, the Ports, Jurong Island and for the increased connectivity that the Jurong Region Line will bring about. With recent headlines on the First EC site in Tengah awarded for $400.32 million and JLD being touted as the next CBD, exciting things will be coming to the west. 西游记 (Journey to the West) for those in the other areas of Singapore.

Relocation of Paya Lebar Airbase

Courtesy of URA

Currently Paya Lebar might seem like an odd ball with a low amount of population in despite being surrounded by well populated towns. Rightfully so, since Paya Lebar has a number of commercial developments and a large chunk of it being Military ground, home to the Airforce (Our Home, Above All). But the relocation of Paya Lebar Airbase will bring about major changes given the sheer size, equal to 5 times of Toa Payoh Town. Likely to have better connectivity between the North-East and East Coastal area, additional commercial hubs and community spaces for everyone to enjoy.

It would seem that there is no definite plan set in stone for the development of the area considering that URA released a public invitation for ideas to transform and redevelop the site. However, one thing is for certain, where Green initiatives and more efficient use of space are over-mentioned topics in the current climate, we will expect to see a trend setting town that boasts developments unlike its surrounding.

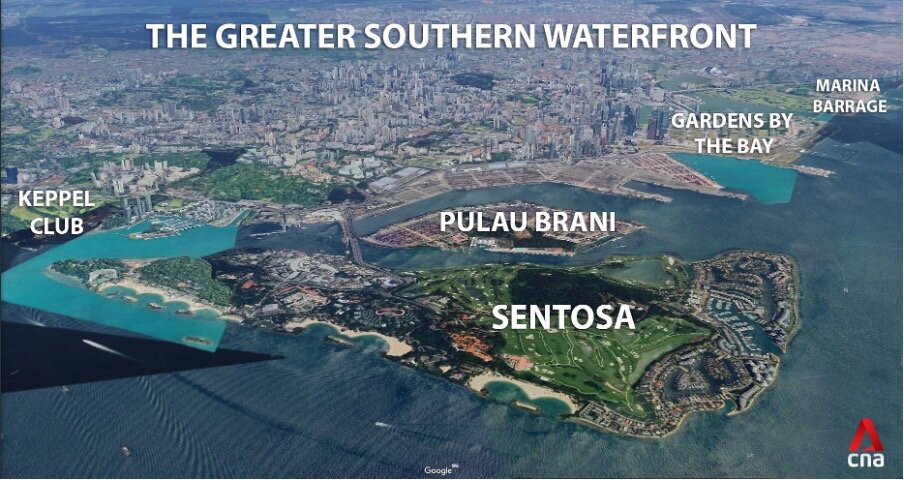

Core Central Region

Courtesy of CNA

In one of our earlier articles we spoke about how the Core Central Region is approaching its prime purely based on technical and price factors. Supporting this analysis is also the developments that will continue to make the CCR, the cream of the crop. Such as, the CBD Incentive Scheme in 2019, the rejuvenation of Orchard Shopping district the Greater Southern Waterfront developments and the redevelopment of Pulau Brani into a Resort facility. These developments will no doubt continue to allow the CCR region to thrive as the prime area of Singapore even with the ongoing developments in other parts.

Even with the various developments across the island, it is pretty obvious that the future developments in the CCR area are still skewed towards expats, tourist and the upper-class residents. Ultimately, it will be quite difficult to dethrone the CCR of its vibrant lifestyle façade. We foresee that the CCR will continue to thrive, even as the decentralization of the CBD takes place, with government incentive to enhance the CCR into a space where people want to live and spend their leisure time.

How will Connectivity affect the Property Market?

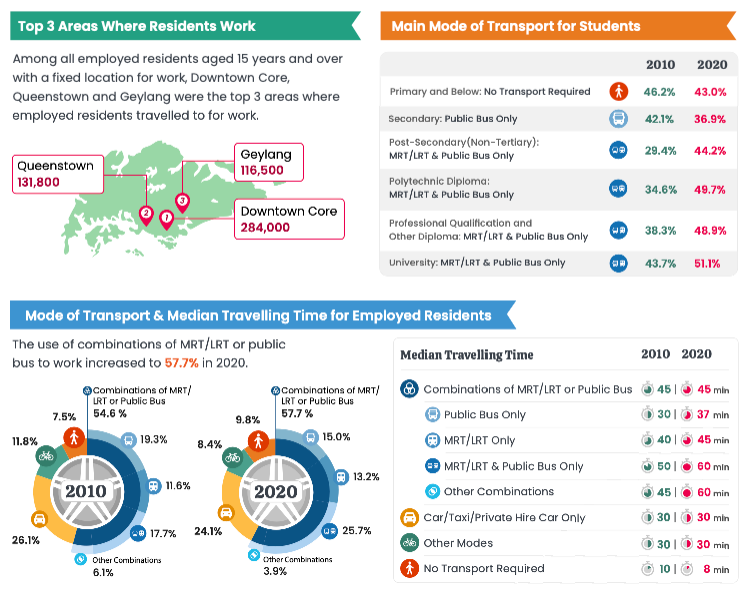

Courtesy of Singapore Department of Statistics

Increasing connectivity within an already small country is a blessing we all welcome. A quick look at the study, shows that there is an increase in usage of a combination of MRT/LRT or Public bus and walking from 54.6% in 2010 to 57.7% in 2020. With more connectivity via underground links, sheltered walkways that come with the increasing number of MRT stations and integrated transport hubs, more residents have taken preference over Cars/Taxi/Private Hire Cars and Other Modes (Motorcycles, etc). With the high cost of owning a vehicle and the expenses that come with, it is no surprise that residents prefer the more cost-efficient method of public transport.

However, not everyone wants to pay a premium in enjoying the connectivity. It is relatively common to see residential buildings atop a commercial building that houses the integrated transport hub. To enjoy the luxury of catching the MRT or the Bus just right at your doorstep comes at a cost. The pop up of these developments has also allowed surrounding developments to appreciate in value. For those that do not want to pay the premium, their only choice is a longer travelling time, which is prominent in the increase of the respective Median Travelling Time on Public Transport between 2010 and 2020.

While we believe that these developments rightfully command a premium in the current climate with our increasing dependability on having amenities nearby, we foresee that in the future, having a MRT station right at your doorstep will not be uncommon sight, with the upcoming Thomson-East Coast Line, Cross Island Line and Jurong Region Line. Developments will need more than just a MRT station to justify to the buyers for paying a premium price.

Our Take

As population grows while our land area doesn’t’, space will start to become a luxury commodity. With an increasingly educated population and growing income ability, most will probably be able to own the ideal house that they toiled hard for with some being able to consider additional Property for investment.

Ageing population might prove to be a challenge for buyers and sellers alike with issues on eligibility of loan quantum and/or tenures. However, these can be solved with a safety deposit or a larger cash down payment. For those who look to enjoy their silver years, Landed/Freehold Properties offer a store of value while some might look to Private Leasehold Properties with potential for capital gain. We have highlighted areas to keep watch and spoke about how increasing connectivity in Singapore could affect your property decision. While there may seem like a lot to consider for current and future Property opportunities, an in-depth analysis and proper planning will help with making the right choice. If you have any questions on your considerations, you may wish to speak to our new launch consultants. Otherwise stay tuned for more Insights and we’ll catch you on our next Signature Home Tours.

P.S. Stay tuned for an extension of our analysis and how it will affect each micro segment of Singapore’s Property Market.