What Does A Low Interest Rate Mean for Homebuyers?

Introduction

Singapore’s property market recovered steadily and rebounded after a slow first half of 2020, with home prices reaching new highs into the Q1 2021. This strong uplift observed in 2021 may be attributed to these factors: surplus liquidity, soaring demand for buying a home buoyed by an improving job market and low interest rates.

Still, home ownership and mortgage servicing remain a concern among young Singaporeans. Many worried about not being able to afford a house. It is reported that 4 out of 10 in the age group (aged 21-39) has expressed concerns who already have mortgages have difficulties paying their loans promptly.

In 2021, Singapore’s economy is projected to grow between 4% – 6%, after shrinking 5.4 % in 2020 due to the Covid-19 pandemic. We see that new residential sales grew 0.7% y-o-y in 2020, even as GDP dipped 5.8% y-o-y. Singapore private property prices grew at a rapid pace in first quarter adding to speculation that the government could join other countries to introduce another round of curbs to stabilise the market. Private property values rose 2.9% in the first quarter of 2021, the most since the second quarter of 2018. In July 2018, Singapore last imposed cooling measures.

It is imperative to own a home in the midst of uncertainties. The prospective home owners should consider their needs, affordability and risk appetite. Those concerned with rising rates and who want peace of mind should consider fixed rate packages, which offer a flat interest rate, typically for the first few years. In a recovering economy, interest rates tend to rise, so opting a fixed interest rate will allow consumers to hedge against the risk of rising rates.

What Affects the Mortgage Interest rate in Singapore

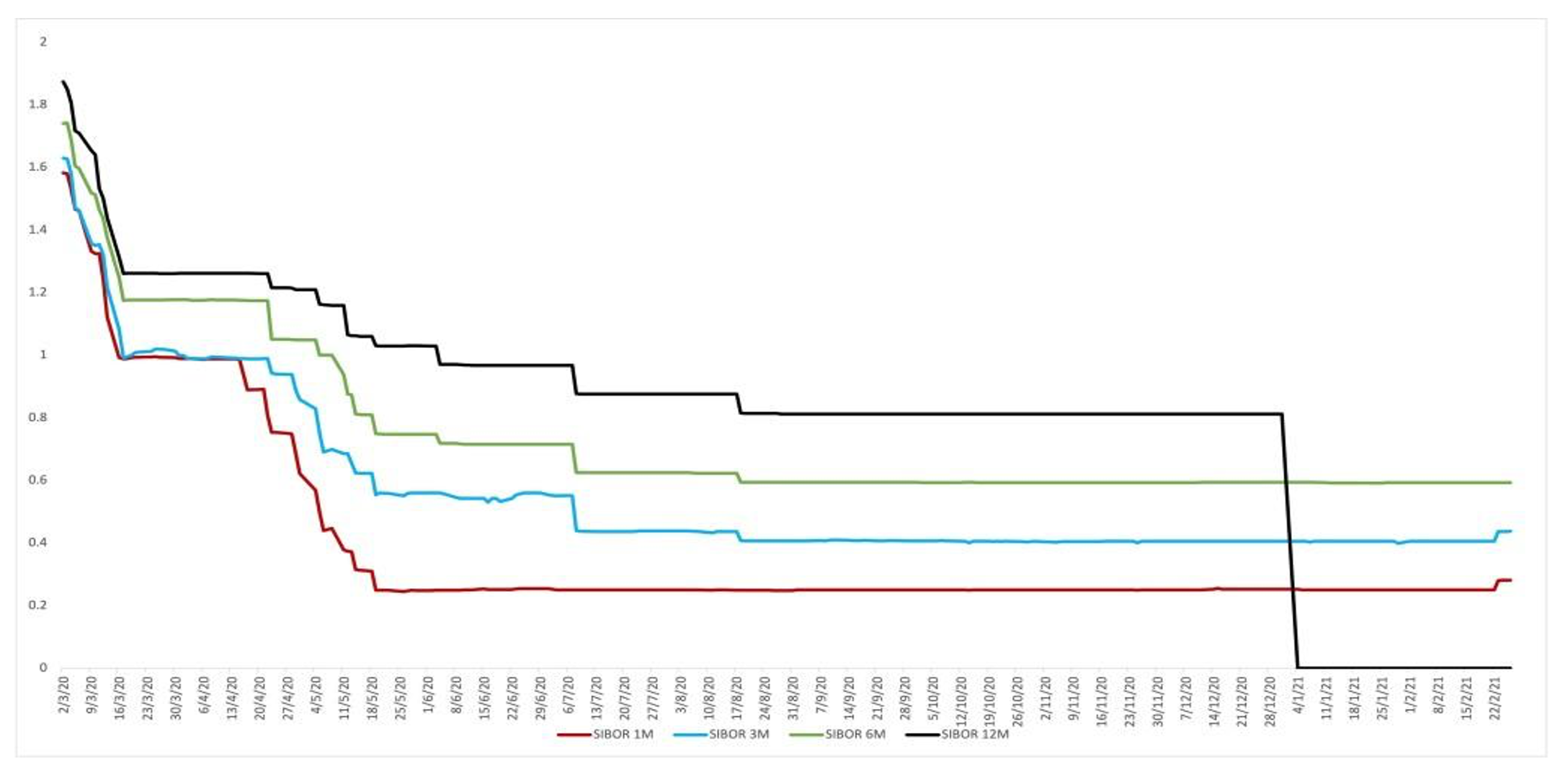

Interest rate looks to remain low, given that the US Federal Reserve, which sets interest rates that affect SIBOR, is expected to remain near zero-rate till 2023. Federal Reserve as expected kept its monetary policy in place despite the fact the economy is accelerating. Short term interest rates are set near zero as it buys at least $120 billion of bonds each month to support an economy that grew strongly to start off 2021.

With inflation rising, the Fed hold the interest rate at near zero to and show no indications that things will change anytime soon. The inflation is forecasted to remain around the Fed’s target at least through 2024. We noted that the economy is dependent on the course of the pandemic as the risks to the economic outlook remain.

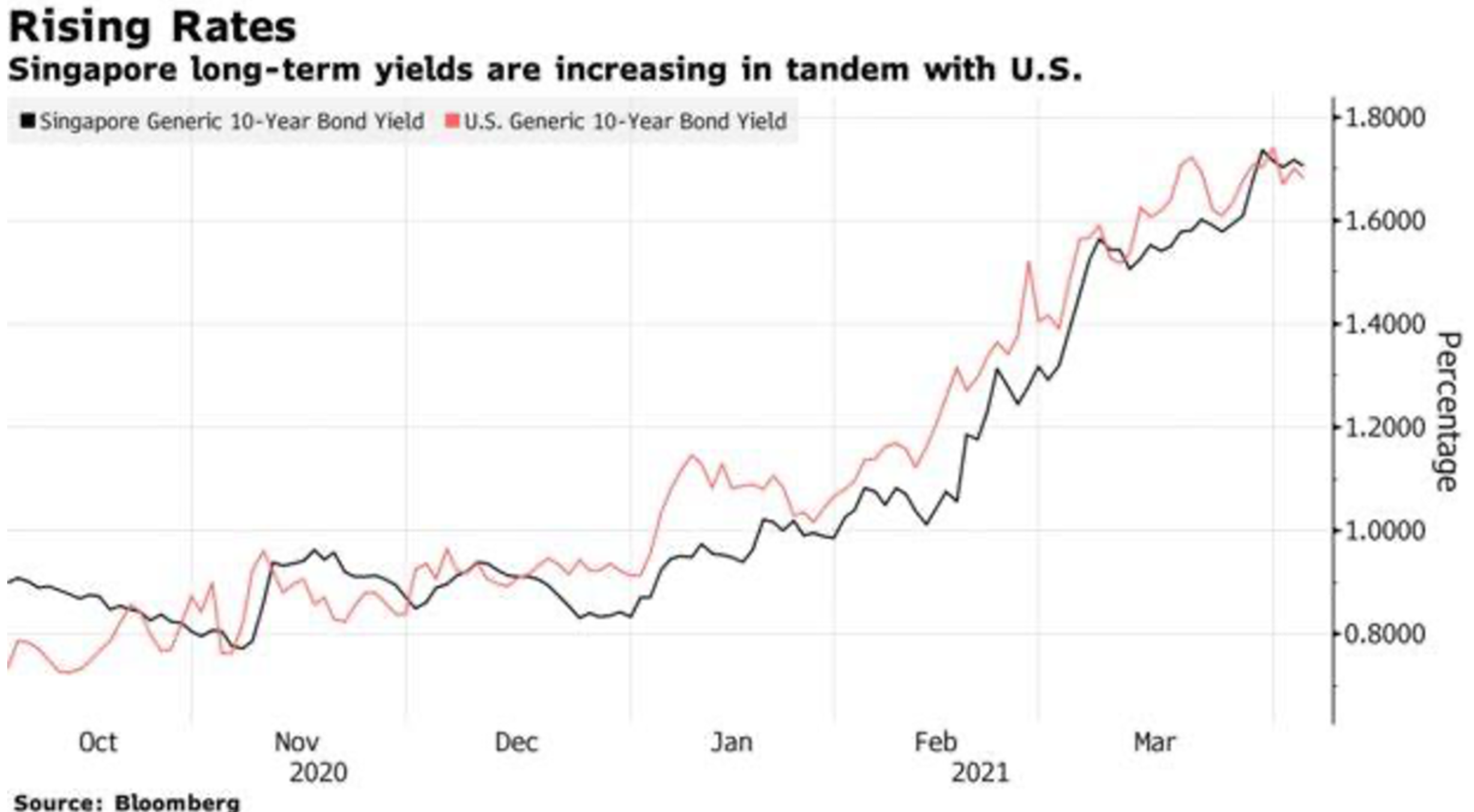

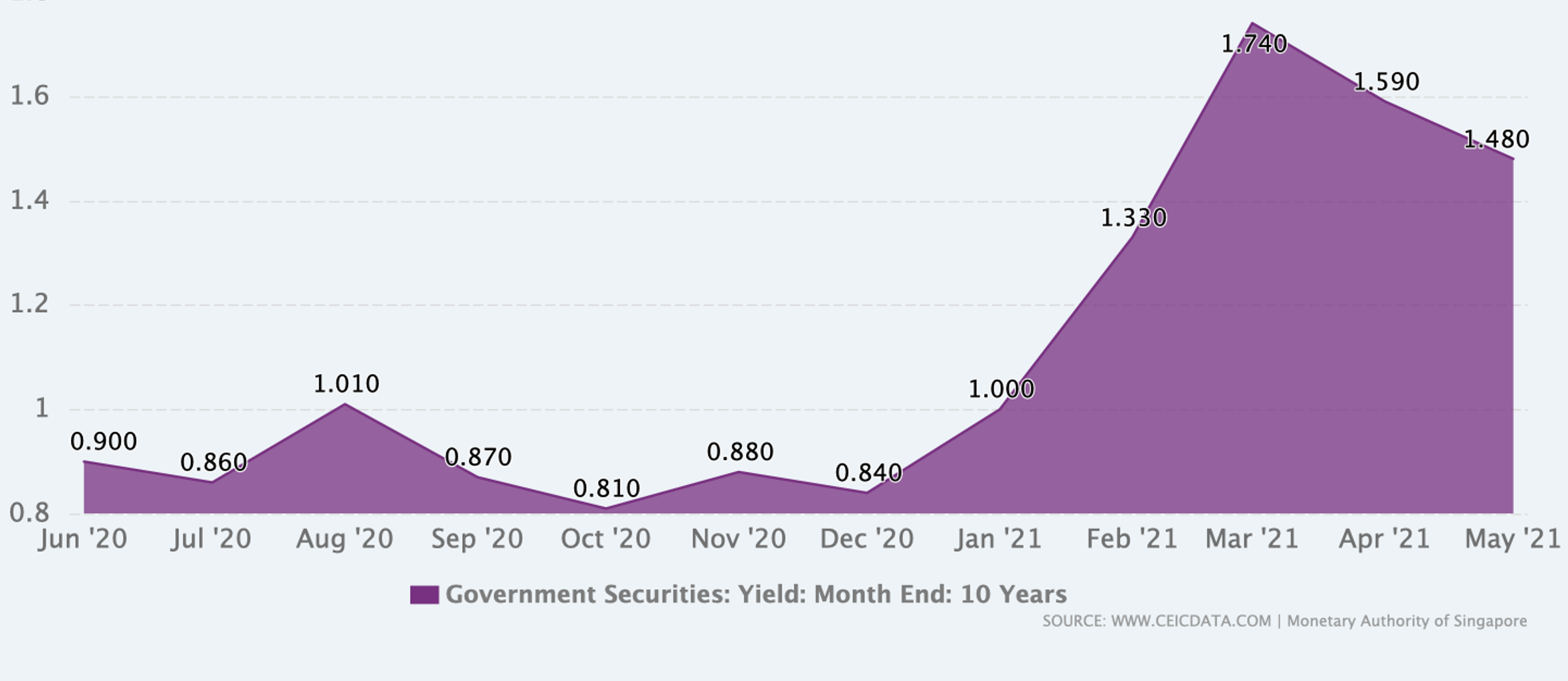

The Singapore long term yields move in tandem with the U.S, meaning that the Singapore long term yields are rising with the U.S. The 10-year range is the key to the economy, since it impacts mortgages and other consumer and business loans.

The risk of rising interest rates ahead reminds that homebuyers should continue to exercise caution in their property purchase decisions. Rising rates in the U.S. recently can be seen in a strong economic recovery there, which will gain some momentum to Singapore’s own rebound. Singapore’s economy is expected to expand between 4% and 6% in 2021, after shrinking 5.4% in 2020 due to the pandemic.

While most homebuyers should continue to be able to service their mortgage loans, a small percentage of households within the private property market could face cash flow problems. MAS analysis showed that the median household’s mortgage servicing ratio would remain manageable even under a stress scenario of a 2.5 percentage point increase in mortgage rates and a 10% drop in income. Again, buyers should take into account that interest rates will rise in the future, and be certain of their ability to service their mortgage loan before making long-term financial commitments.

Singapore is undergoing a reference rate reform currently. Home buyers choosing for a Sibor (Singapore Interbank Offered Rate) package should note that the full transition from SIBOR to SORA (Singapore Overnight Rate Average) is expected to take place in 2024.

Sibor refers to the rate at which Singapore banks can borrow money from each other via the interbank market. SORA refers to the volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore.

Sora is utilised as the new interest rate benchmark in 2024. This comes as a new adoption of the interest rate setting as the proposed extension of Libor discontinuation would mean that it will cease the use of Swap Offer rate in pricing the new derivative contracts and loans contracts as well as the SOR-linked cash market products.

Singapore long-term interest rate increased from an average of 0.8% in 2020 to 1.5% in May 2021.

Floating rates tend to be lower as compared to fixed rate packages, which means paying a lower monthly instalment especially in this low interest rate environment. Essentially, in floating-rate packages, banks add a spread to the floating-rate used as a reference, to make the final interest rate charged to the borrowers. Floating rates are set to reference rates (e.g. SIBOR, bank’s board rate) that constantly change over time. Floating rate mortgages is deemed attractive when market rates are high and expected to decline in the next few years.

Let us now look at the two main home loans financing types on the market: Singapore Interbank Offered Rate (SIBOR) loan and Fixed Home Rate (FHR) loan.

Sibor Loan

Simply, Sibor is the median rate at which Singapore banks lend money. The rate is government regulated and therefore, it is a publicly available information.

A SIBOR home loan has an interest rate that consists of the bank’s spread which is how much the bank wants to charge, plus the prevailing SIBOR rate. So if the SIBOR rate is 0.5 per cent, and the bank’s spread is 1 per cent, then your interest rate would be 1.5 per cent.

Banks commonly express this with an “M” in the mortgage rate. It is referring to the three-month SIBOR rate, they would indicate 3M SIBOR. The interest rate period determines how often your bank loan interest changes. So if you have a 1M SIBOR loan, then your home loan rate changes every month. If you have a 3M SIBOR loan, then your rate changes every three months.

FHR Loan

An FHR loan is a form of Board Rate (BR) loan. This means the interest rate is not set by the market, but the bank gets to set the rate.

This form of loan was initially unpopular as the banks entice homebuyers in with low interest rates only to raise the rates afterwards. That has changed when the FHR loan was introduced. The interest rate of this loan is pegged to a specific tranche of fixed deposits. This introduction certainly reassures the borrowers in a certain degree as when the bank raises its mortgage loan rates, the bank would also effectively be paying out its fixed deposit holders more.

Today, FHR loans are more common than the traditional SIBOR loans. SIBOR and FHR rates move in tandem. SIBOR rates tends to be more volatile meaning that SIBOR goes up, it usually moves up more than FHR.

Another difference is how often the rate changes: SIBOR rates change every month or every quarter of the year, on the other hand banks change their fixed deposits rates less frequently, which typically change only once a year.

History of Mortgage Interest Rate Movement in Singapore

Source: ABS.org.sg

Looking at the Sibor rates in June 2019, the 1M SIBOR rate was 1.886 per cent, and the 3M SIBOR rate was 2.005 per cent. In June 2021, however, the 1M SIBOR rate was 0.265 per cent, while the 3M SIBOR rate was 0.436 per cent.

It is noteworthy, however, that bank spreads also fluctuate. Often cases, the bank will raise its spread in the fourth year and thereafter. In addition, the bank will often adjust its spread when the interest rate falls to record lows.

Generally, interest rates in 2018 averaged approximately two per cent per annum, whereas they average just 1.3 per cent today. In relation to the SIBOR home loans, this segment of borrowers enjoy rates as low as under 1%. The banks adjust the spreads for the market but overall, the offering rates are considerably affordable at 1.40% to 1.44% range in 2021 as compared to 1.8% – 2.3% range in the past years.

How to Invest in Singapore Property

Aside from the cooling measures and restrictions imposed, there are other important factors to consider: Additional Buyers’ Stamp Duties, Total Debt Servicing Ratio. For example, Singaporeans purchasing a second property have to pay an ABSD of 12%, and an ABSD of 15% for their third and subsequent property.

As to how much buffer property investors should set aside to ensure that they are not overleveraged, the Total Debt Servicing Ratio (TDSR) framework, which warrants that the portion of a borrower’s gross monthly income that goes into repaying monthly debt obligations (housing loans, credit card debt etc) should be capped at 60 per cent.

Financial institutions and banks use an internal stress-test rate of 3.5%, which means borrowers must maintain a TDSR of 60%, even if interest rates were to rise to 3.5%.

For fixed rates loans, the lowest available in the market is 1.2% for the first 2 years, the lowest rates as at June 2021.In addition to interest rates, property owners and investors should also take into account the lock-in period. This refers to the time period when a penalty would apply if one wishes to terminate the loan earlier than agreed. That can mean prepay the loan in full, refinancing, or even selling the property.

Other factors to consider include the option to prepay during the lock-in period, whether you are looking for capital gains, and whether you are looking to extend the tenures to improve on cash flow management and leverage on lower rates.

Those with existing mortgages should also review their loans to explore refinancing. Another important point to take note is that the investor should base their calculations on projected increases on the mortgage instalments, should the rates rise in the future. Also, looking at how potential savings from lower interest rates accumulate against fees related to refinancing. These include legal and valuation fees, and penalty charges for early prepayment, which may add up to a hefty sum.

Currently, rates are at 1.18% for Sora-pegged mortgages. The preference for certain mortgage types has changed over the past five years. From 2016 to 2017, the market more inclined towards fixed-deposit pegged rates, which are set to the banks’ fixed deposit accounts. These are priced more competitively than fixed rates. Savers may invest their money elsewhere, in the volatile stock market, mutual funds when interest rates for fixed deposits remain this low.

However, in 2018, fixed-deposit rates rose, people are more inclinedto take up fixed interest rates. In 1Q2019, more consumers moved towards Sibor-pegged rates, which were lower than fixed rate.

Which is Better: SIBOR or FHR?

SIBOR is more volatile than Fixed Deposit Home Rate. In addition, banks have more control over fixed deposit rates as compared to SIBOR which are essentially derived from at least 12 banks. To sum it up, borrowers who value predictability in mortgage repayments would prefer to opt for FHR or fixed rate loans.

A FHR loan is suitable for individuals servicing the home loan with cash instead of CPF and a SIBOR loan, will work well for individuals who are financially savvy looking to reset at cheaper refinance rates.

Fixed rate packages offer you with a fixed interest rate for a specific period of time, typically between 1 to 5 years. For example, there are 2-year, 3-year and 5-year fixed rate packages available in the market. There is usually a penalty incurred for early prepayment of the loan during this period.

Floating rate packages vary in terms of the interest rate (typically ranges between 1.2% to 3%), lock-in period and minimum loan quantum.

How Low Interest Rates Benefit Property Owners?

-

Lower Monthly Mortgage Repayment

Borrowing the same amount on a lower interest rate would translate lower monthly mortgage repayment as the cost of borrowing is lower.

2. Relatively High Returns

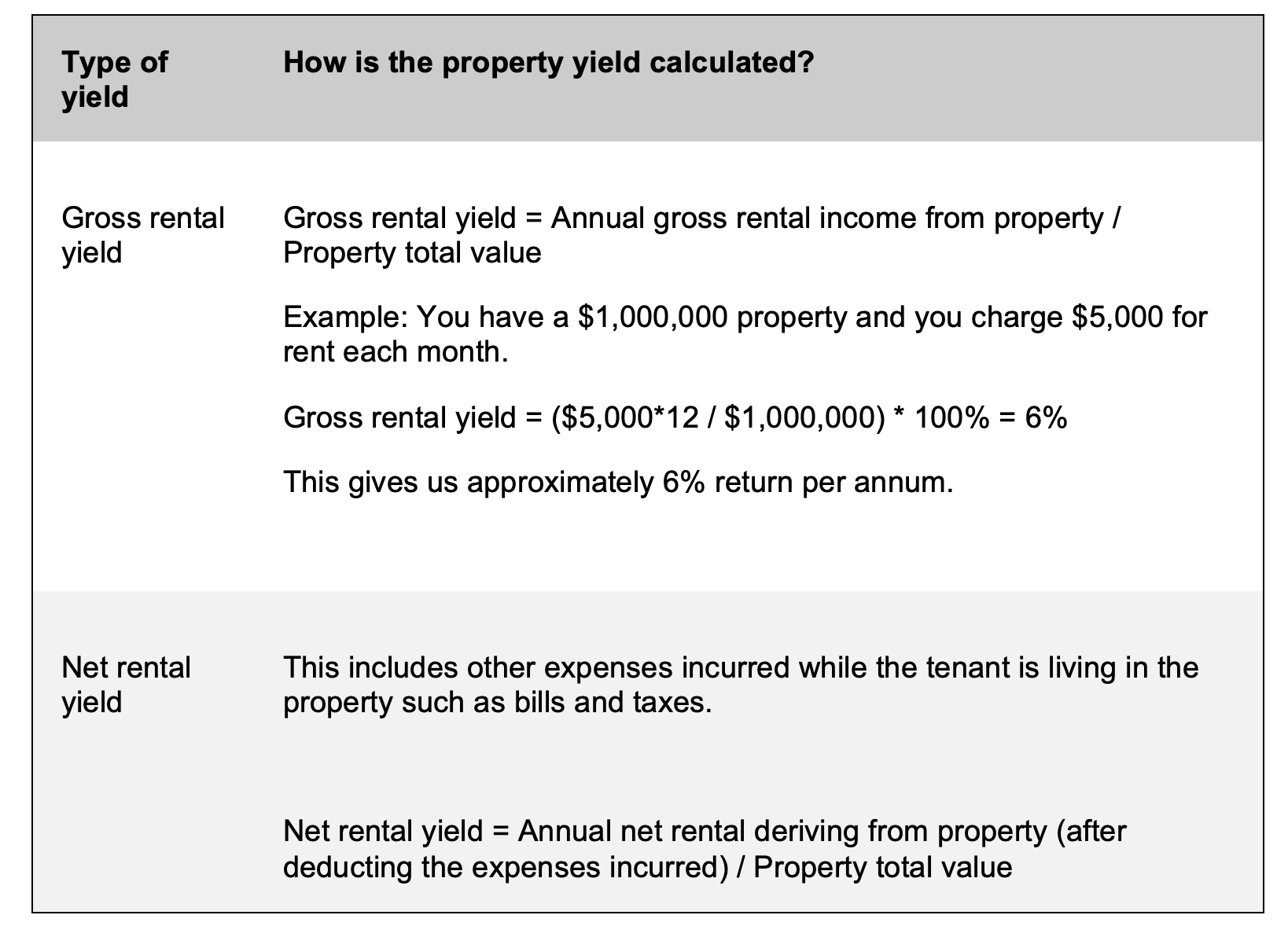

Assuming the rental market to recover and remain firm, low interest rate would mean rental returns will be higher for investors. In Singapore, a high rental yield can translate a decent sum of passive income through rents alone.

For Example: You have a $1,000,000 property and you charge $5,000 for rent each month.

Gross Rental yield = ($5,000*12 / $1,000,000) * 100% = 6%

This give us approximately 6% return per annum. If the investor is paying say, 1% in interest rate on their mortgage, their return each month would be higher than if they had to pay a higher interest rate on their home loan in this case.

How to Calculate Property Rental Yield

There are two predominant forms of rental yield: Gross rental yield and net rental yield.

3. Ability to afford and meet MAS-regulated TDSR of 60%.

The Total Debt servicing ratio restricts the amount the individuals can pay off towards their monthly mortgage debt repayments based on a % of their gross monthly income for prudency.

If you are planning to buy a property in Singapore, you have to meet the Total Debt Servicing Ratio (TDSR), which states that only 60% of a borrower’s gross monthly income may be considered for your debt obligations taking into account your current credit standing, outstanding credit card debts and other loan obligations.

For example, you earn a fixed income of $10,000 per month. The sum of your credit card, personal loan and car loan repayments is $3,500 per month.

-

TDSR = (Total monthly debt obligations)/(Gross monthly income) = $3,500/$10,000 = 35%

-

Your TDSR threshold is $6,000 (60% of $10,000).

-

If you want to apply for a property loan, the maximum monthly repayment you can make will be $2,500 ($6,000 – $3,500) under the regulated TDSR rules.

Hence, if you’re paying at a higher interest rate, this means that the monthly mortgage repayment will increase further and you might not be able to meet the TDSR. As such, you will need to pay off your outstanding debts first to fulfil the MAS-regulated TDSR of 60%.

Apart from the TDSR, there is the Mortgage Servicing Ratio you need to factor in if you are buying HDB flats and ECs bought from the developer. The MSR caps the amount that may be spent on mortgage repayments to 30% of a borrower’s gross monthly income.

For example, if you earn $5,000 per month, your monthly home loan instalments cannot exceed 30% of that, which is $1,500.

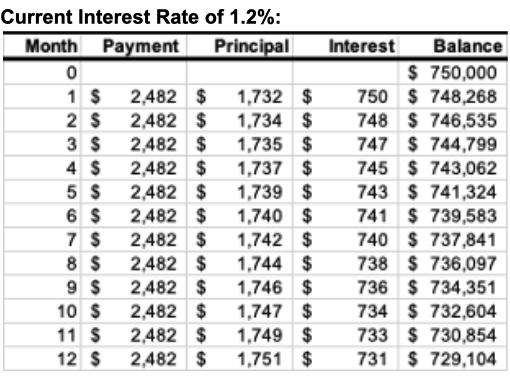

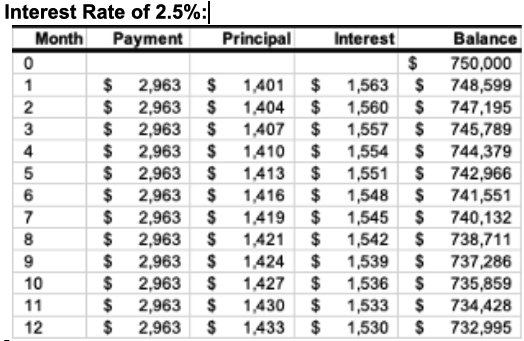

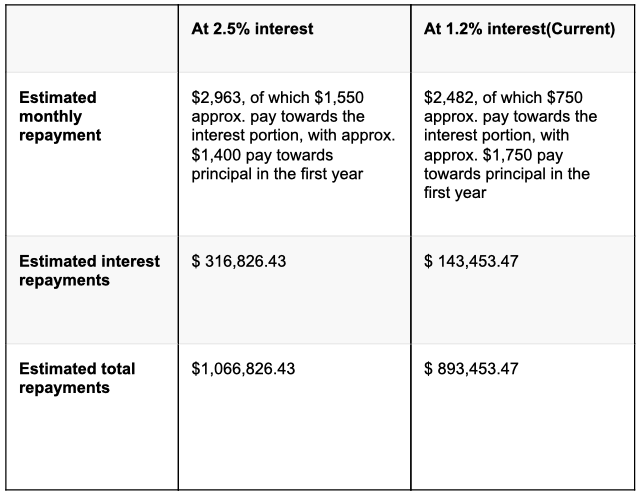

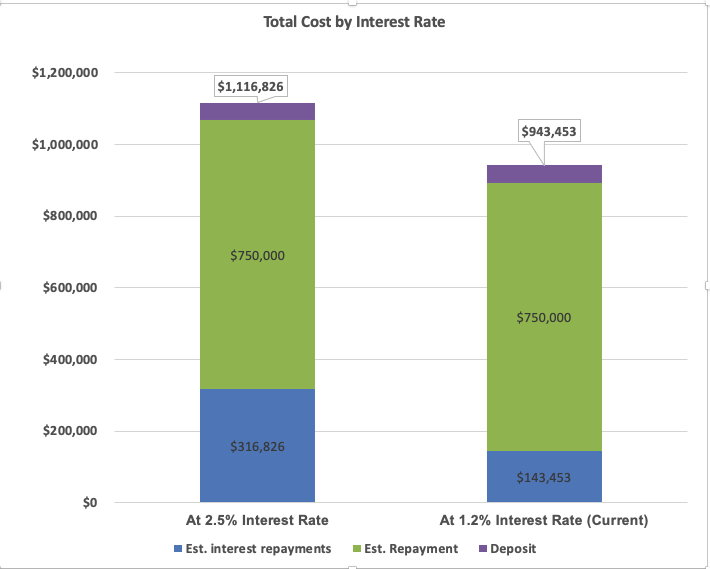

Total Property Costs based on Current interest rate of 1.2% vs 2.5% bank loan

What will be the impact and differences between buying a property with a mortgage at 1.2% versus say buying a property when mortgage rates are at 2.5%? If you look at your mortgage repayment schedule over time, the principal portion of the payment will consistently increase and the interest portion will decrease significantly. Even so if you pay at a lower interest rate, the effect is magnified over time, reducing your interest expenses every month until your mortgage is fully paid off. Now, let us illustrate an example on this.

Assuming bank loans have been priced at Sibor rate (3 months) + bank’s spread, this means the indicative interest rate is the Three Month (3M) SIBOR rate, plus the bank’s spread is equivalent to 1.2% currently. Assume the interest rate will continue to rise and reach 2.5% next year; this is used as the second illustrated example.

Using the example of the following cases:

Say you purchase a condominium unit for $1 million for the maximum loan tenure of 30 years. The maximum allowable loan quantum is $750,000 from the banks. LTV: 75%. Initially, your mortgage payment will primarily go towards the interest portion, with a small amount of principal included. As mentioned, interest payments are based on the outstanding balance of the loan at any given time, and the balance decreases as more principal portion is repaid. Essentially, the smaller the loan principal, the less interest you’ll be paying.

Here’s what your payment schedule might look like for the first 12 months. Notice that the interest portion of the payment reduces steadily as time goes by:

Using the current interest rate of 1.2%, a total amount of $893,453 is paid, of which $143,453 is paid toward the interest portions over 30 years. At 2.5% interest rate, a total of $316,826.43 is paid towards the interest components over 30 years and total repayments is $1,066,826.43.

Effectively, at 2.5% interest rate, only 47% of your monthly payments go towards paying off the principal amount in the first year, while at the current 1.2% rate, 70% goes towards repaying the principal portion initially. Hence, it is advisable to lock in with a current lower rate and prepay early if possible, should your financial situation allow you.

It is important to point out the illustrated numbers above that how the interest rates can affect your property purchase. Low interest rates won’t remain low as it is subjected to the market conditions.

The interest rates will rise against inflation. Also, it is expected that the SIBOR is set to rise after the pandemic. If you are taking a floating-rate loan during this period, please bear in mind that your repayments will rise in the future when the interest rates go up. You may want to consider all factors and whether you can afford the monthly repayments when it does rise in the future.

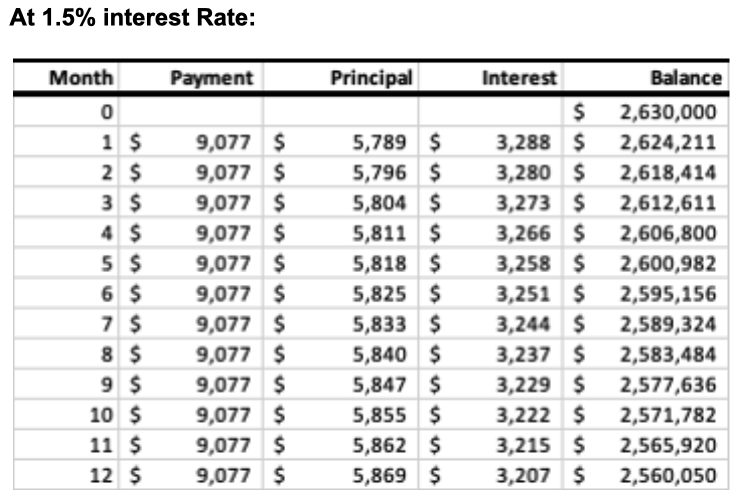

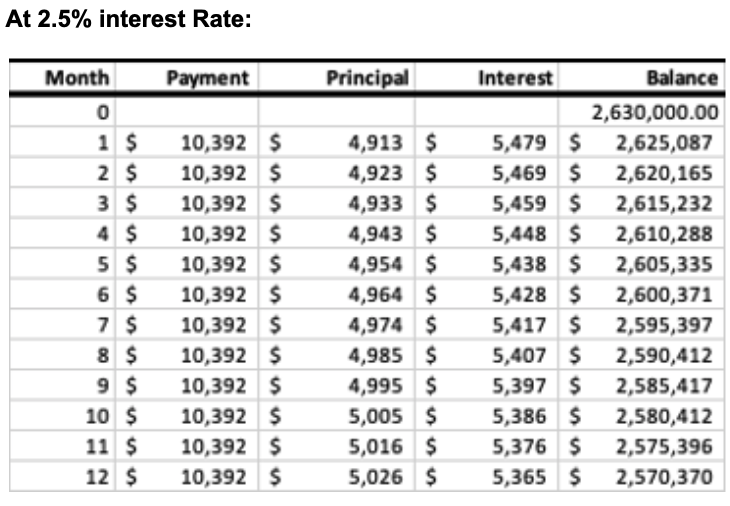

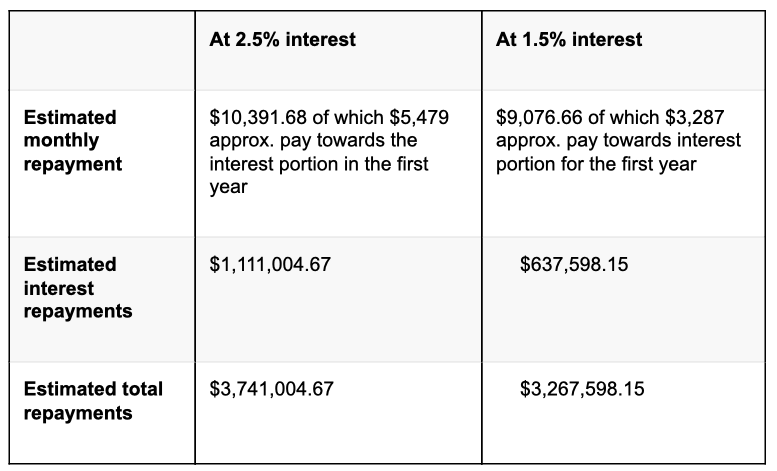

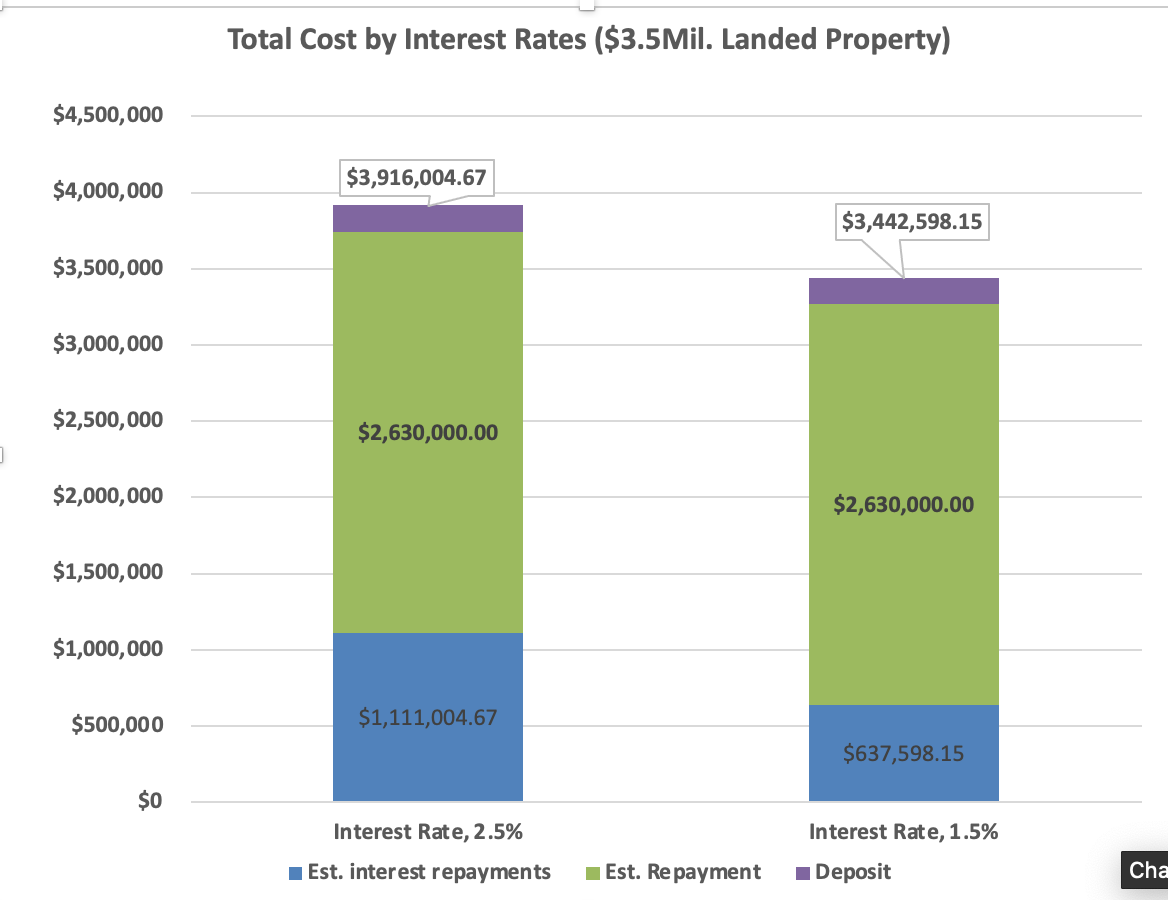

Another example on a $3,500,000 Landed Property Purchase

Say you purchase a strata cluster landed property unit for $3,500,000 for the maximum loan tenure of 30 years. The maximum allowable loan quantum is $2,630,000 from the banks based on LTV 75%, 30-year tenure. Here’s what your payment schedule might look like for the first 12 months. Notice that the interest portion of the payment reduces steadily as time goes by:

Essentially, at 2.5% interest rate, only 47% of your monthly payments go towards repaying the principal amount in the first year, while at the 1.5% rate, 64% goes towards repaying the principal portion initially.

For a $3.5 million Strata Cluster Landed Home purchase in this case, there is a significant savings of more than 74% in the total interest repayment when you lock in with lower mortgage rate of 1.5% as compared to the interest rate of 2.5%. In terms of absolute interest payments, the amount of interest savings for Strata Cluster Landed Homes is $473,406.52 in this case.

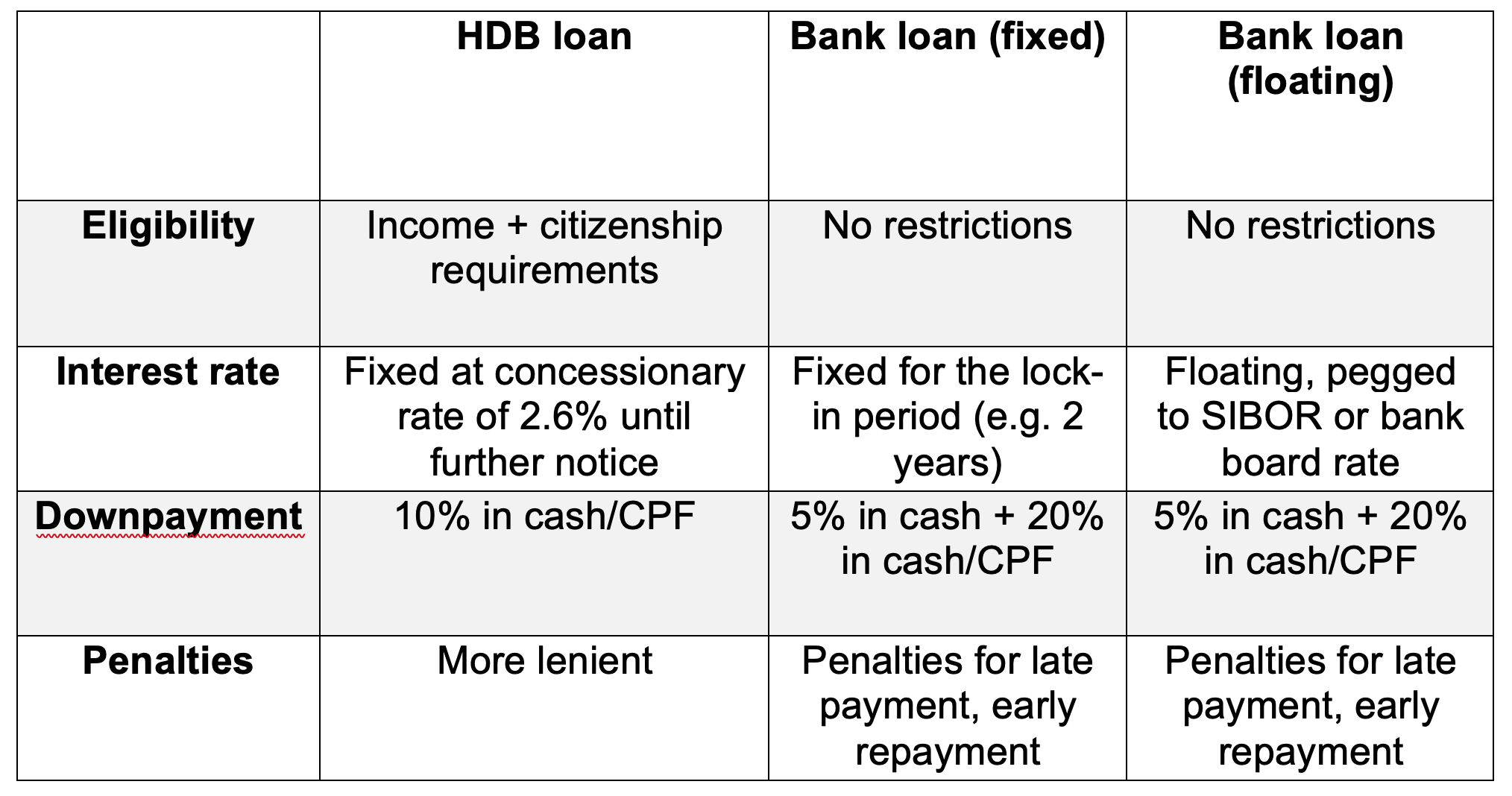

Another illustrated case for Mortgage loans for HDB purchase— HDB loan vs bank loan

The interest rate will affect your resale gains and rental returns.

This is one of the key factors that property investors need to consider, in addition to appreciation rates and the rental market.

Some property investors even try to set their rental rates to their mortgage rate.You also have various fees for example, maintenance fees, property tax that add up to about $700 a month. You then know your rental income must be at least enough to offset the mortgage and recurring fee. Lower monthly costs translate to a higher net rental return; hence making properties more appealing in a low interest rate environment.

Why are Interest Rates So Low Now and How Does This Impact The Homeowners?

As you are aware of the fact that Singapore property market has been quite buoyant as the pace of increase in private housing prices has gathered momentum since the Q2 of 2020 and it’s a piece of good news for property investors. We see prices of properties continue to rise and the buyers would still snap them up.

We also need to recognise that the rising prices would also mean that Singaporeans could no longer find their desired housing for themselves without breaking the bank. This would mean that they were have to relocate or hope that they could find a cheaper mortgage rate in the market. In view of the uncertain economic outlook and expected rise in interest rate, households should need to exercise caution in their property purchase decisions. Even so, MAS analysis revealed that the median household’s mortgage servicing ratio would be manageable even under a stress scenario of a 2.5 percentage point increase in mortgage rates and a 10 per cent decline in income.

The Singapore government is monitoring the developments in the property market closely and will adjust policies in due course so as to stabilise sales cycle and sustain the property market for Singaporeans. Over the past years, the government has put in place several measures to ensure the housing market is in line with economic fundamentals. Despite the fact that several laws and countermeasures against property investors developed to halt the soaring prices of homes in Singapore, foreign property investors are still turning to Singapore for their property investments.

Will Coronavirus Impact Ability To Pay More For Homes?

According to the CBRE, Singapore is the 3rd most expensive residential property market in the world. Buying a home in Singapore in fact, is expensive.

In contrast to most other economic crises, overall property market in Singapore did not show some signs of weakness. The government’s spending on $100 billion stimulus packages in 2020 help businesses and households manage the economic impact of Covid19. The measures such as deferring mortgages repayments allowed people to continue owning their homes for the time being.

If the situation worsens, as it has already been, and the government does not provide support measures, home prices may then come under pressure.

Homebuyers may want to consider bank loans instead

You can buy an HDB flat with a bank loan, or otherwise refinance from your HDB loan to a bank loan.

Homeowners who are in the last few years of their loan tenure could save money by choosing the cheaper bank rates for the remaining years.

The US Federal Reserve, which sets interest rates that affect SIBOR, is currently at 0.25%, projected near-zero rates till 2023. Even thereafter, the rate will take years to normalise as the world recovers from Coronavirus.

You may want to focus on the Net Rental Yields to realise the Effective Returns.

The net rental yield, which accounts for recurring costs such as mortgage repayments, bills etc should be examined. This lower interest rate may not be sufficient, but it is a bonus. Also, if you’re currently paying higher rates, you can switch to cheaper loan packages on the market. This can be done in two ways by repricing or refinancing.

If you can find a cheaper loan package with the same bank, you may reprice it at the lower rate. This typically incurs a fee. However, some home loan packages offer “free repricing” options at no cost essentially. If the cheapest loan package is with another bank, you will have to refinance instead. This incurs conveyancing fees that costs up to thousands.

In addition, it is noteworthy that you will have to go through the loan application process all over again. Your property has to be revalued and you need to provide documents like proof of income.If your financial situation has deteriorated, there’s a chance you may not even qualify for the new loan.

You should ensure there is no additional penalties for refinancing. Some home-loans come with lock-in clauses, that can charge penalties of up to 1.5 per cent of the undisbursed loan amount.

What Might Happen to Home Prices, Should Interest Rates Increase

We observed that in the past, when the increase in mortgage interest rates was sufficient enough to bring down the refinances and overall demand.

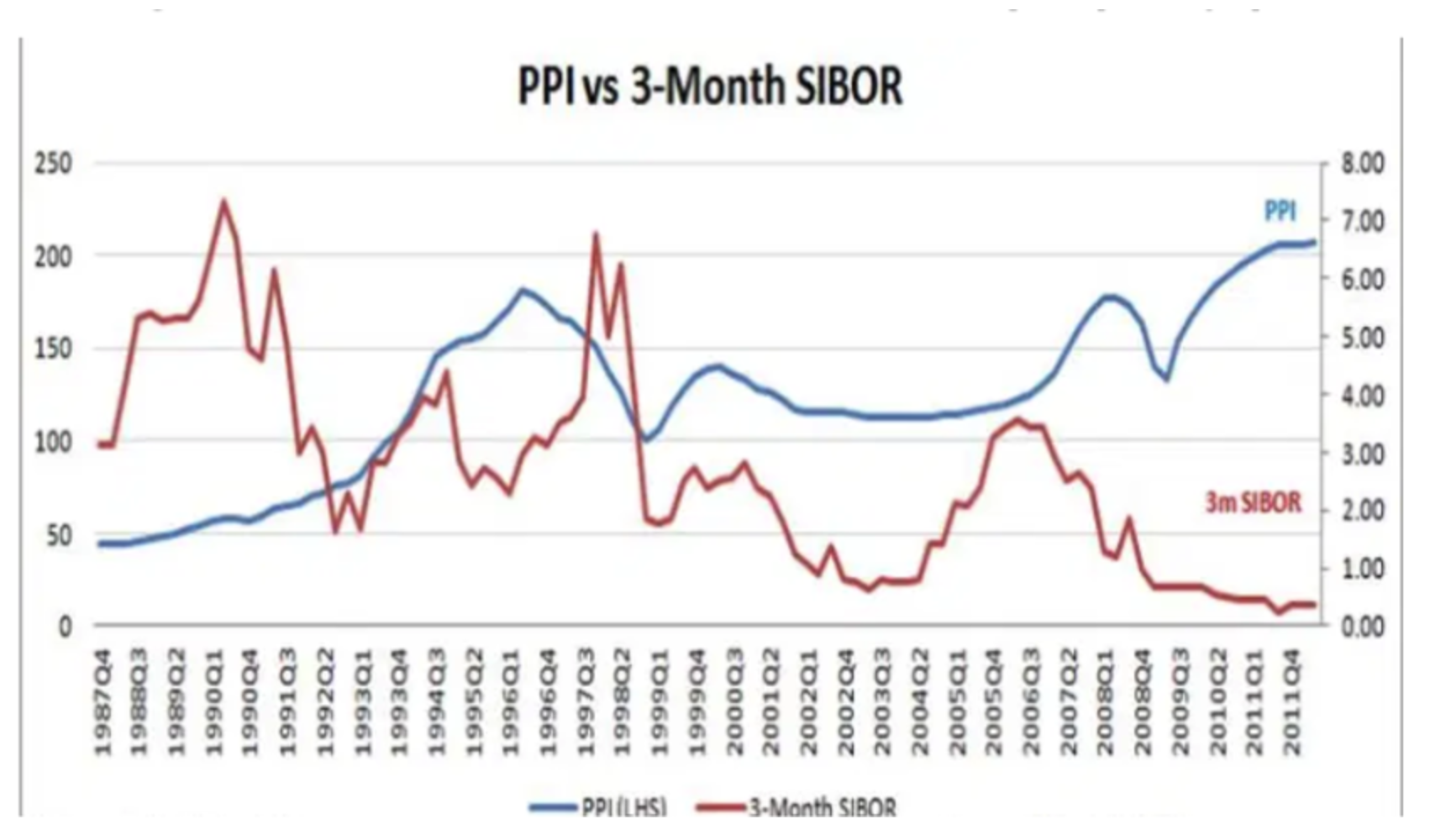

Source:Business Times

The housing prices are at their high. If interest rates increase, we’ll see home prices go down.In terms of valuing the property, a higher cost would lead to a fall in property prices. It is less likely that the mortgage rates is rising in the next few years.

For investors, they have to compare the rental yields for residential property with the prevailing mortgage rate. As such, investors will have to question whether it still makes for a worthwhile investment.

Higher interest repayments compound the fact that property investors already pay higher taxes on rental properties, and the Additional Buyers Stamp Duty.

The rising interest rates could cause some investors to take their money elsewhere as the investor will have to bear the brunt of the rate hike in the future.

Source: URA

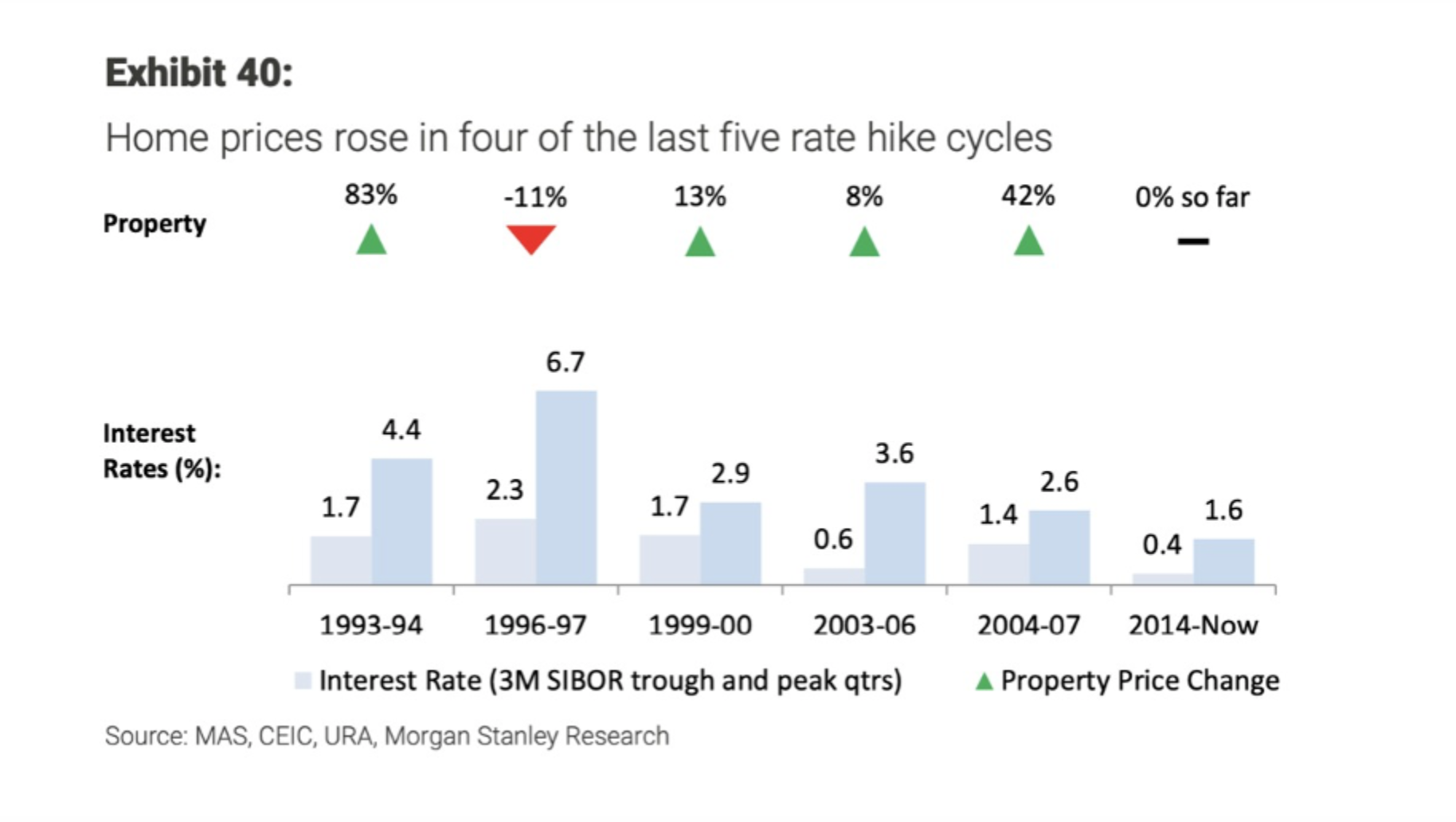

As shown on the chart, there have been several periods of rising interest rates that have also corresponded with rising property prices.

Conclusion

In the past, we observed that home prices rose in four of the five previous rate hikes. Theoretically, rising mortgage rates could put a downward pressure on home prices. It happened during the 1997 Asian Financial Crisis, when the three-month SIBOR increased from 2.3% in 1st Quarter of 1993 to 6.7% in 4th Quarter of 1997, and home prices dropped by 11%.

However, the other rate hike seen in 1993 were marginal, and home prices in fact rose. This could be explained by the fact that in these cycles, the rising rates coincide with a recovering economy and improving growth outlook. This in turn, more than offset the resulting pre-default fire sales effect and mortgage defaults or delinquencies stemming from the rising cost. We think that the home prices will continue to rise for another year even with a potential rate hike or a policy restrictions.

We believe interest rates, while it is a key factor affecting the property market, are only one of several attributes that impact it. Different speeds of economic recovery and underlying regional growth drivers will continue to impact markets around the world. Asia will continue to experience a faster macroeconomy recovery due to effective and stronger government intervention during these periods and soaring demand for exports as global economy recovers. Also, growing market confidence, low mortgage rates, ample liquidity and the risk of additional curbs may spur buyers to rush to purchase.

With increasingly more luxury and city-fringe projects scheduled to be launched, growing sales of such homes may further lift the prices of private homes and overall residential price index in the next few quarters. Having said that, we hope you find this article useful. Stay tuned for the next PLB insights article! For those who are interested in finding out more or would like to start planning for your property portfolio, you may contact our PropertyLimBrothers team!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.