In a previous article, we took a look at the macro trends of the real estate market, post pandemic. Seeing 11-year highs in volume of transactions, a five-fold figure compared to April year ago, we posited how strong price and volume increase was a predicate for motivated buyers looking to buy and enter the real estate market as soon as possible.

Yet, May, along with the Phase 2 Heightened Alert measures, brought along a considerable slow in developer sales, with many developers pushing unlaunched projects further down the timeline. Is May 2021 symptomatic of the slur we will face in the upcoming months? Or is it simply an understandable dip considering our tightened restrictions? Analysts argue for the latter.

First, a look at May 2021

In May 2021, Singapore entered Heightened Alert, where a limit was placed on group sizes in social gatherings, and consequently home visits. Developers of new launches were also affected, as these restrictions limited show flat and property viewings as well as new launch activities. Despite potential mitigations such as virtual tours and zoom meetings, this culminated in a 30 per cent drop in private home sales compared to the previous month.

Understanding the statistics

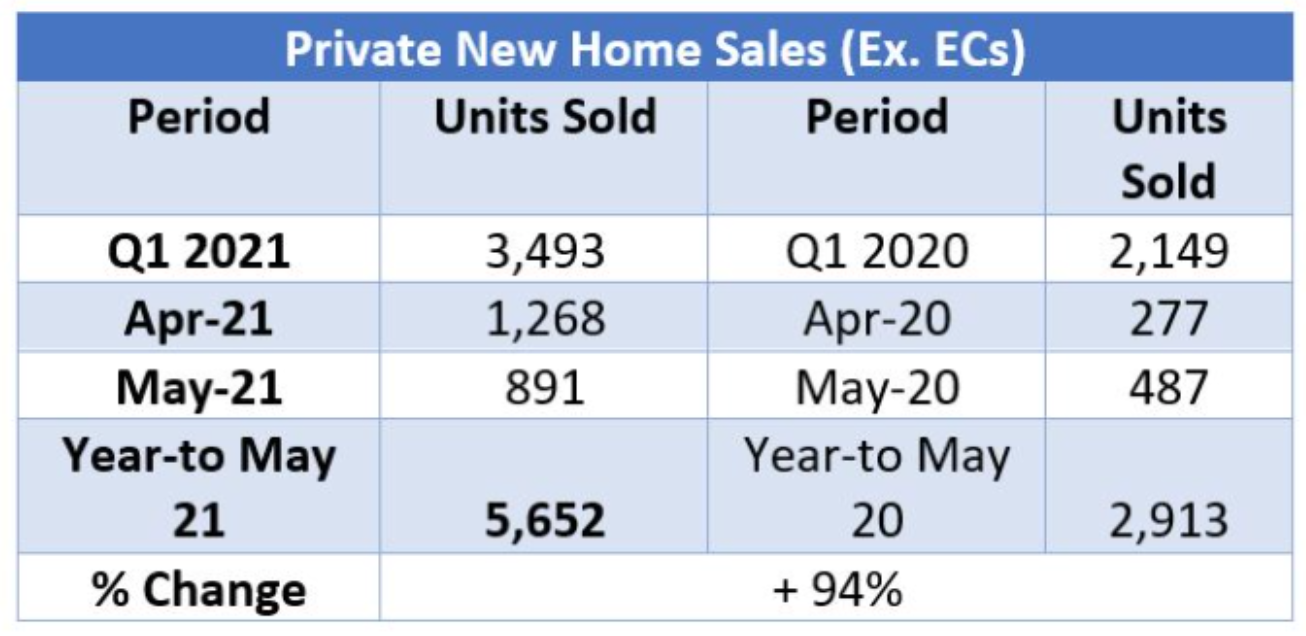

However, this is not the time to panic. Here, it is important to note that this figure excludes statistics from sales of executive condominium (EC) units. Accounting for ECs, the home sales curve becomes much less volatile – only a 8.8 per cent down from April and still, double of the 510 units sold in May (during circuit breaker) last year. Widening the timeline, we see a strong rebound in the market this time round compared to when similar measures were introduced last year in April 2020, where sales in new launches plunged by more than 60 per cent. Optimistically, we also find year on year bookings up by 83 per cent from May last year, proving market resilience and an increasing appetite for real estate in Singaporeans.

Source: Propnex from URA

Executive Condominiums paving the way

While May presents a dip in sales for new launches, sales of EC units have more than quadrupled — 339 new units from 80 in the previous month. Again, the preference towards larger units remains a post pandemic trend, where buyers are looking for homes to accommodate a new work from home trend and lifestyle.

Looking forward

While the dearth in major launches could predict a rather muted month ahead, new home sales in July remain a strong predictor of a rebound in new home sales. With several new launches located within the Outside Central Region (OCR) such as the Pasir Ris 8 and The Watergardens at Canberra, “pent-up-demand” from HDB upgraders for cheaper mass market units could push buying interests up. Other projects such as the Klimt Cairnhill and Perfect Ten in Core Central Region (CCR) as well as the Parc Greenwich EC are all projects that we predict will garner interest from buyers.

So, as Phase 2 Heightened Alert measures ease, we remain on a heightened alert for attractive new launches that cater to buyer demands. Have an interest in these new launches? Contact us today.