If you’re on this page, you probably already know there are certain taxes when a property is purchased, be it a brand new EC or a resale HDB. So long as you agree on a property transaction (includes Trust and Settlement agreements), one or more of these stamp duties will occur. Cooling measures were revised back in 2018, and we did an article earlier this year covering some speculation on future cooling measures.

As a side note, we recently covered 5 ways to avoid ABSD too. Do check that out if you’re purchasing a second property.

History

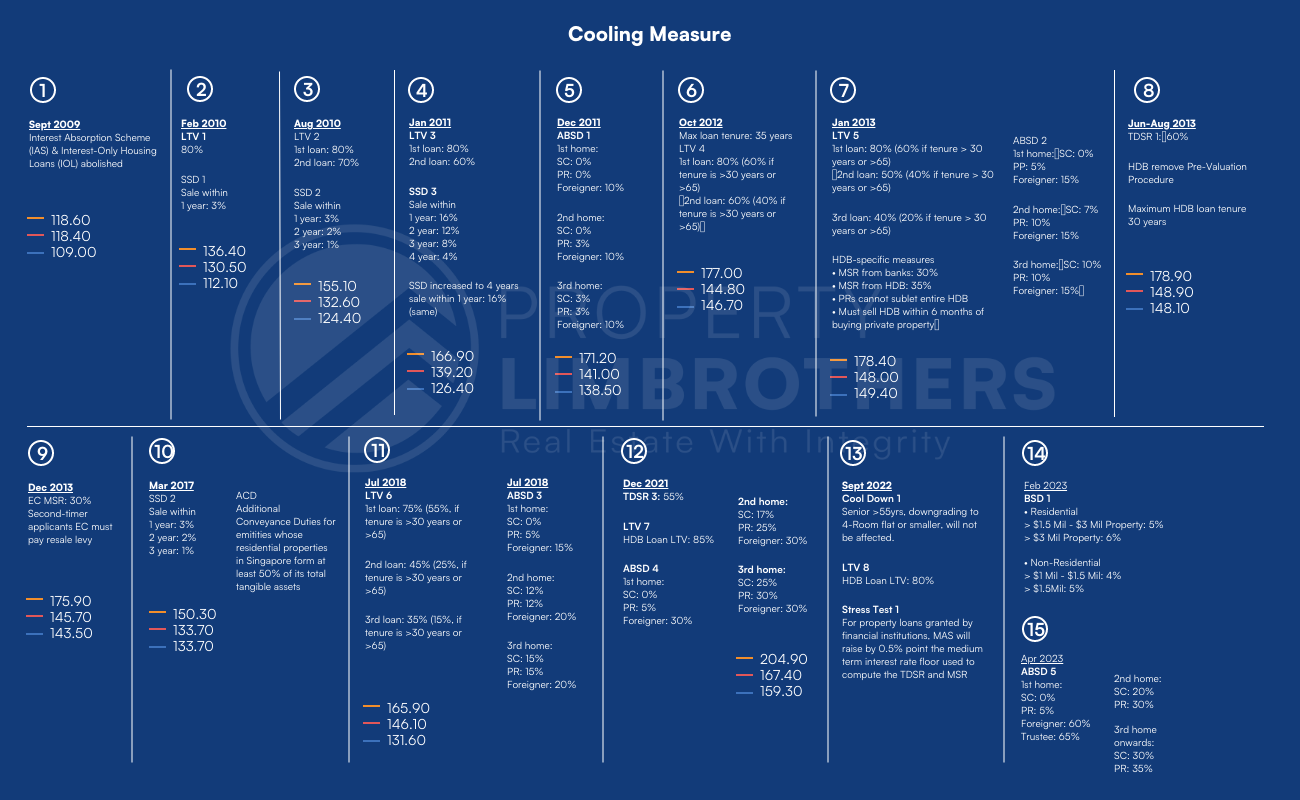

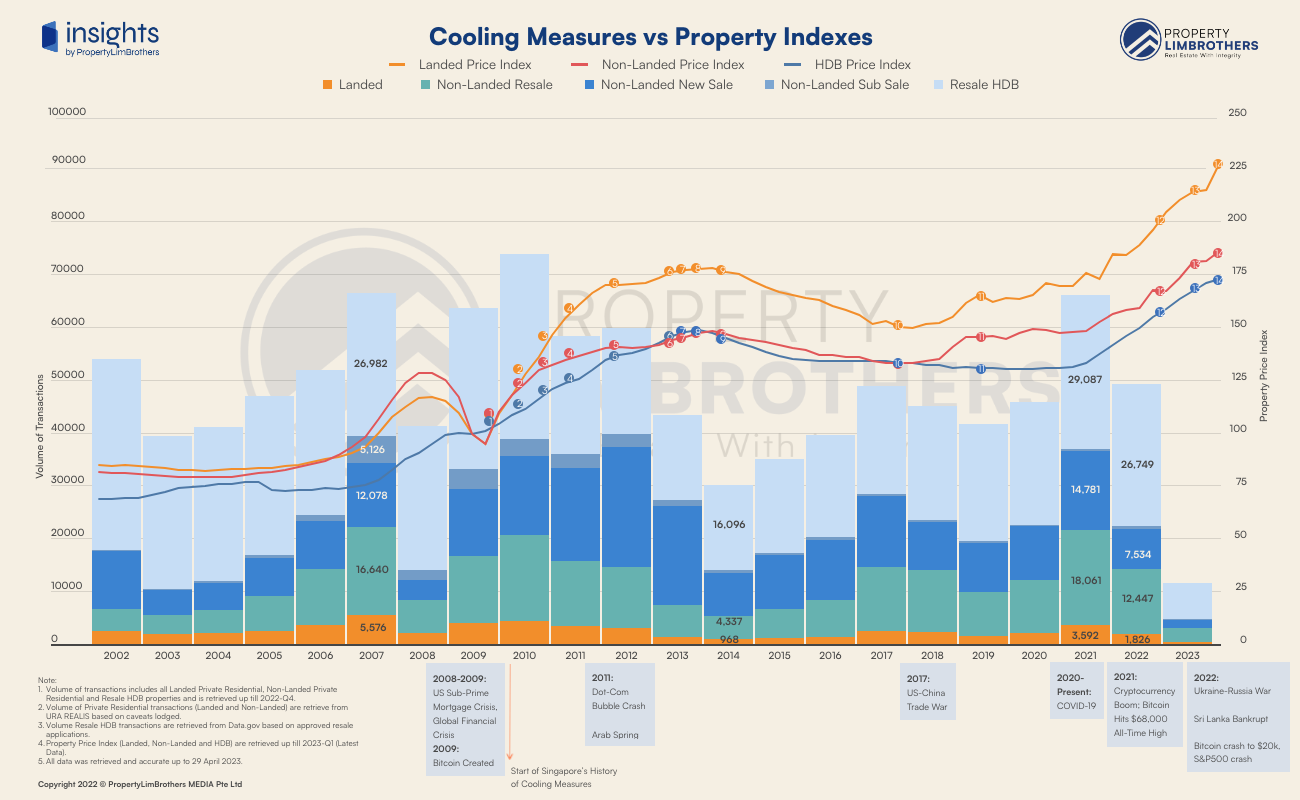

Here’s what happened since the introduction of the cooling measures.

Let’s check out which one applies to you for your next transaction.

Buyer’s Stamp Duty (BSD)

A stamp duty for every property. It is calculated based on the purchase price/ market value of the property (whichever is higher). BSD applies to every Build-to-Order (BTO) flat, resale HDB, EC, Condo or Landed property. By the way, it exists in other countries too, so you can withhold that sigh a little bit.

FYI,

Purchase price is the amount signed in the agreement.

Market Value is the valuation report of the property.

Discounts (except non-cash benefits, which are not applicable) for the buyer may be deducted from the purchase price, but must be stated in the document.

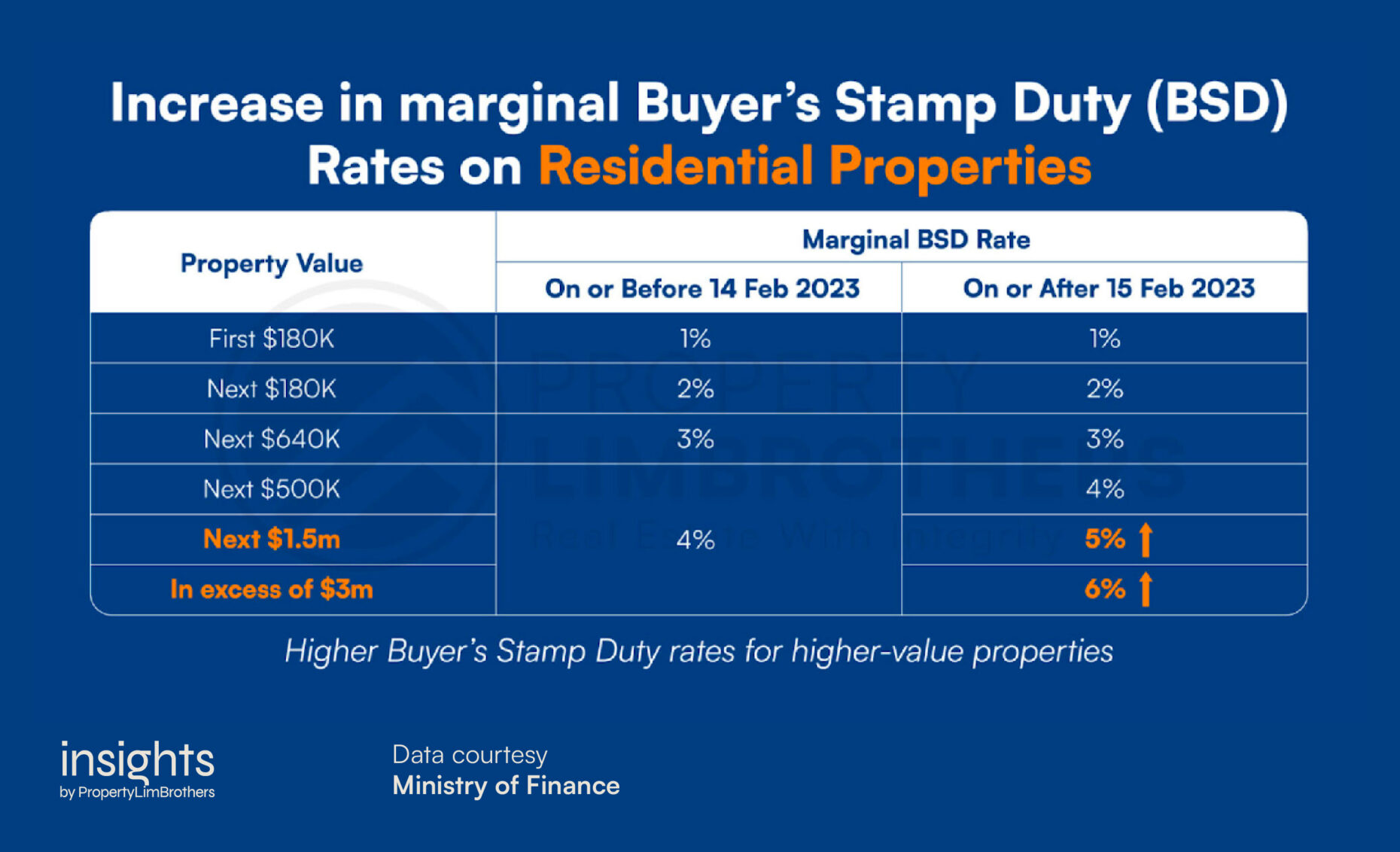

Since the cooling measures in 2023, BSD for residential properties (HDB, EC, Condo, Landed, etc) are as follows:

For example, if you property’s purchase price is $1.4 million and its valuation is $1.2 million, your BSD will be calculated based on the $1.4 million purchase price, as it is higher.

At this point, you might wondering about certain residential properties that are considered half residential, half commercial, such as shophouses and HDB shophouses. BSD for such properties is split into ratios, and calculated accordingly based on residential and non-residential percentages.

BSD was revised in 2023’s cooling measure, with higher marginal BSD rates for higher-value residential properties.

When to pay BSD

BSD is payable within 14 days from purchase/acquisition, and you can use CPF to pay for it.

For more, check out this IRAS PDF on how to pay BSD.

Seller’s Stamp Duty (SSD)

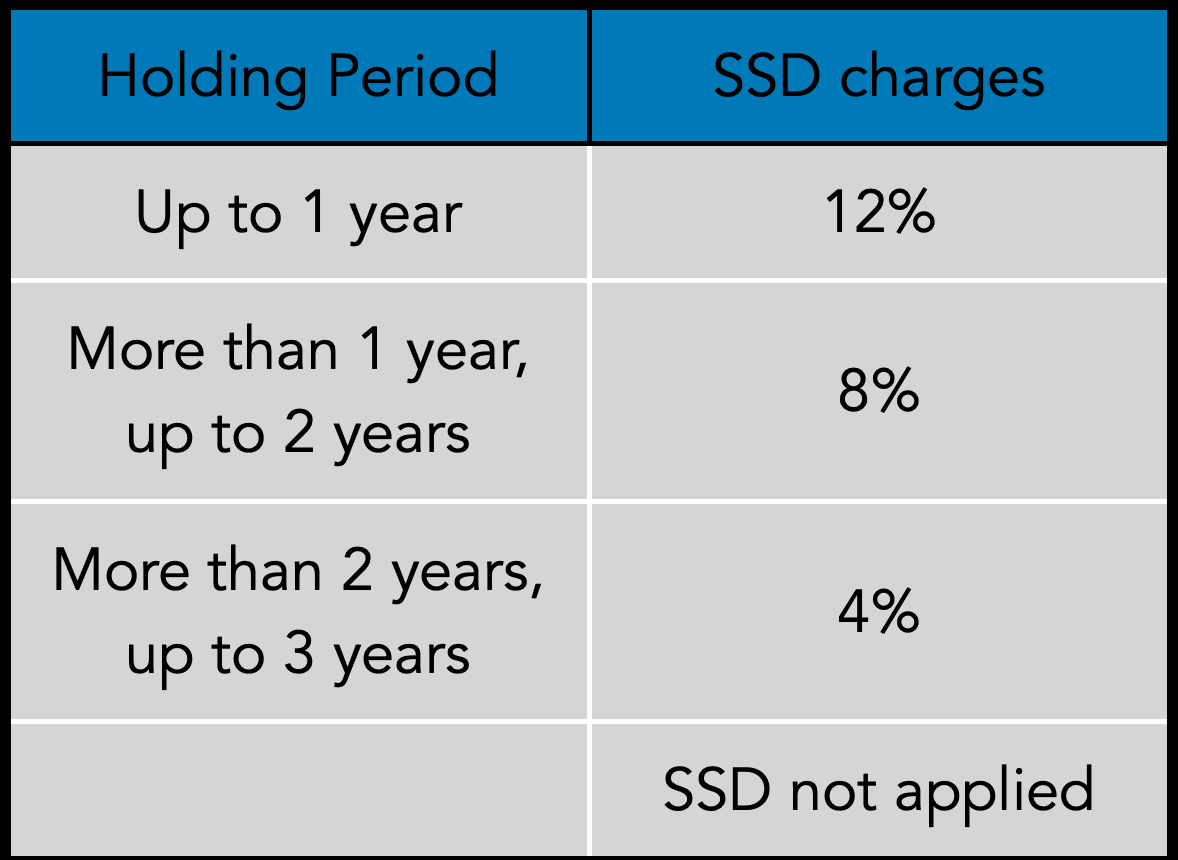

Basically, this is an additional hindrance for property investors besides ABSD (which we’ll cover below). Seller’s Stamp Duty (SSD) is a tax imposed for properties if you sell within the 3-year holding period, to curb property flipping.

Typically, SSD does not apply to HDBs as you will need to fulfil the Minimum Occupancy Period (MOP) of 5 years (to prevent HDB flipping), before selling the unit.

SSD applies to all other residential properties.

SSD rates are based on the actual price or market value, whichever is higher.

SSD rates.

When to pay SSD

Like BSD, SSD must be paid within 14 days from the executed sale contract date. Otherwise, a hefty 5% per annum, daily, will be imposed. You can pay SSD in CPF as well. That’s uh, pretty crazy.

Note: SSD also applies if the property is acquired through divorce, inheritance or transfers within the family.

Additional Buyer’s Stamp Duty (ABSD)

Additional Buyers’ Stamp Duty (ABSD) is a tax imposed for property buyers when purchasing their second property or more — the bane of property investors in recent years. Introduced in end-2011, it was to curb the bulk of property investors both locals and foreigners who purchased multiple properties. It is on top of the usual BSD.

ABSD is a percentage of market value/ purchase price (whichever higher), payable upon acquisition of the property. If the purchase was made by two or more parties, the rate is based on the profile with the highest ABSD rate (including spouses).

Take note that this is on top of the Buyer’s Stamp Duty (BSD) that all properties have to pay for.

ABSD aims to curb the bulk of property investors both locals and foreigners who purchased multiple properties.

ABSD charges.

The upside for ABSD, is there are workarounds, depending on circumstance. We’ve written an article covering avoiding ABSD, so check it out!

And if you’re wondering, no, Additional Buyers’ Stamp Duty (ABSD) applied does not mean you don’t have to pay BSD. BSD applies to all properties, and ABSD is paid on top of that.

For more info, you can vet through the IRAS fact sheet PDF here.

Rental Stamp Duty

The final stamp duty is Rental Stamp Duty. Basically, there are three types of lease: Fixed rent, Premium rent and Variable rent. It is a lot cheaper than the other types we mentioned above, and affects properties as well. However, commercial properties may undergo additional rental components, which are subject to a percentage of gross sales turnover (GTO). We’ll cover some of that below.

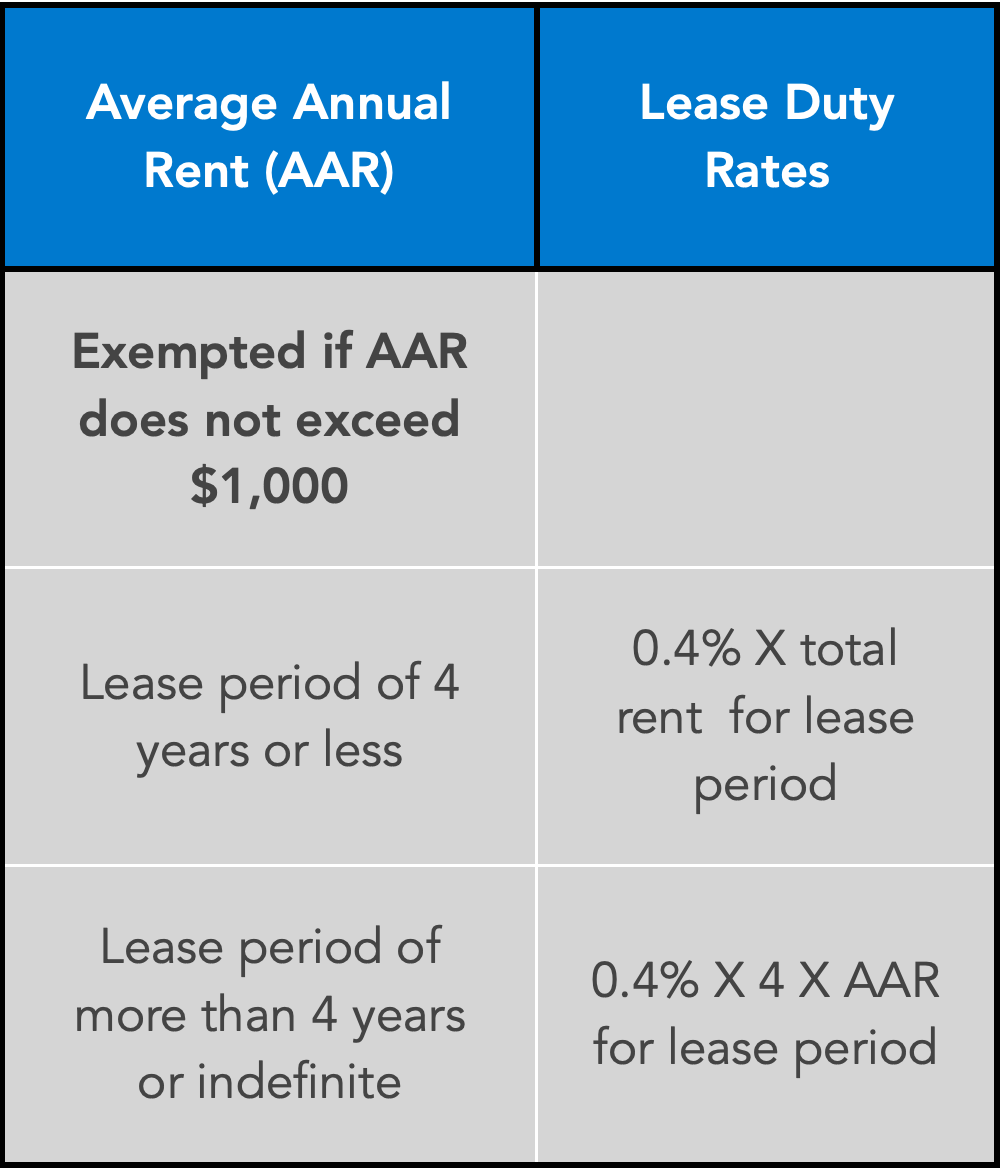

Rental Stamp Duty charges.

It’s quite easy to calculate it as well. Here’s an example.

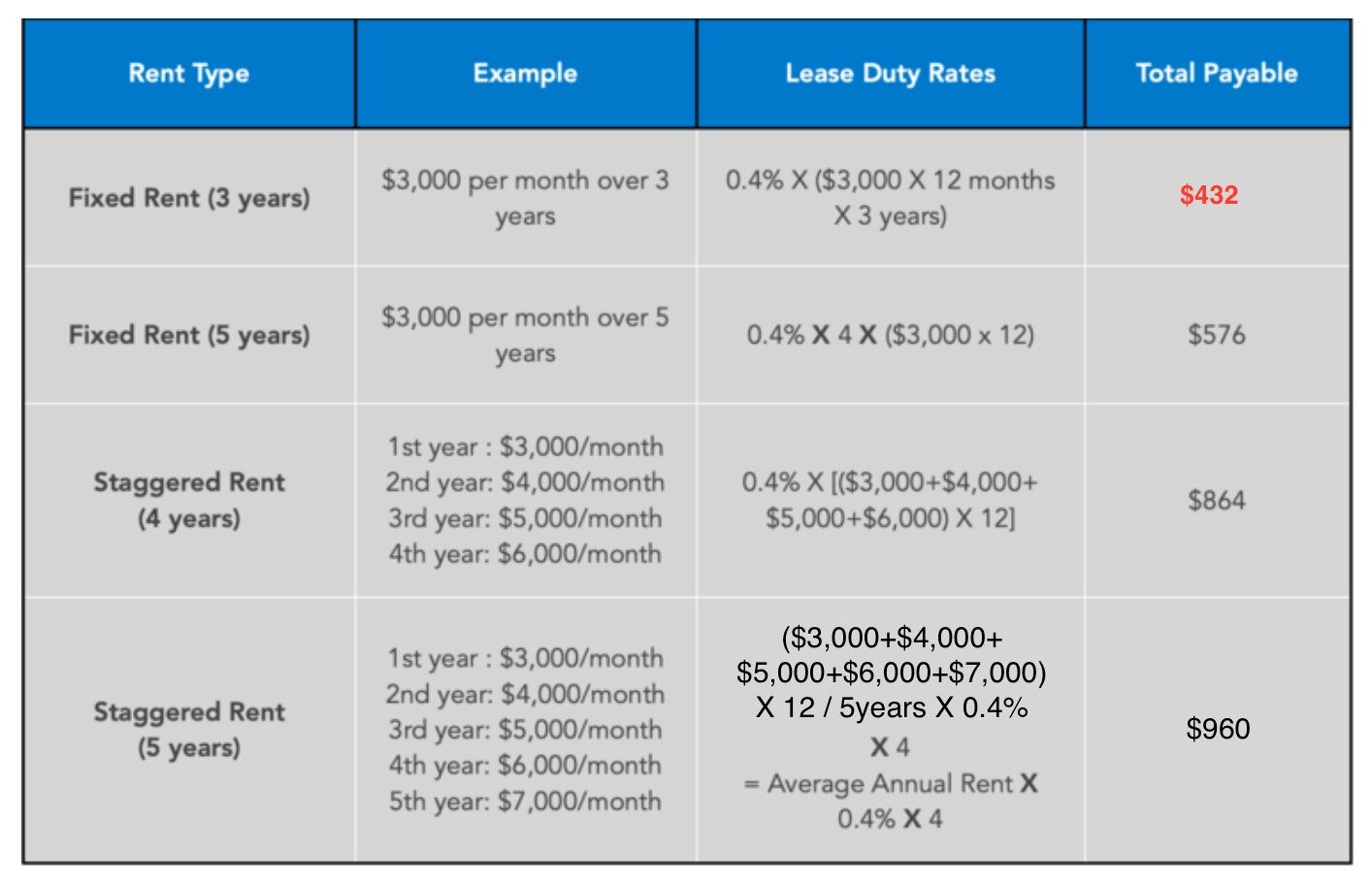

Rental Stamp Duty charges examples.

Observantly, you will realise how the 4 year mark is where there’s the least rental, where after the 4 year mark, it makes a small jump.

Now the part where it gets more complicated, arises when variable rent is in effect for commercial tenants. This usually happens to retail or F&B tenants, where the gross sales turnover (GTO) is calculated on top of rental (sometimes with a minimum or maximum secured sum), and the usual 0.4% against the total rent.

While we don’t mind giving you examples on it, there are talks to revise the code of conduct for fair tenancy practices for both landlords and tenants, introducing a single computation for rent. Other topics covered will ensure further transparency during agreements, and undoubtedly clean up some misunderstandings for commercial tenants.

Summary

When it comes to Stamp Duties, or any property tax for that matter, buyers and sellers alike will only be well-versed in it when the need arises. Unless you’re a property agent of course. Most of these stamp duties are unavoidable, but if you are looking for some help, do approach our PropertyLimBrothers team. We hope you have found this article insightful. See you in the next one.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.