In Singapore, the only legitimate way for a single Singapore Citizen (SC) to own public housing is to wait till you celebrate your 35th birthday; less widowed or orphaned, you can then buy an HDB flat at 21-year old. As of June 2019, according to the Department of Statistics – Population Trends 2019 publication, there are about 225,000 single SCs within the age range of 35-39 years old who are eligible for public housing. Increasingly, people are putting marriage on hold as reported. Marriages and divorces are on the decline. Many prefer to remain single. HDB flats are home to over 80% of Singapore’s resident population; making it the most generally desired housing amongst Singapore Citizens (SC) and Permanent Residents (PR).

Is public housing your only option at 35 years old? Do you wait till you find a spouse/partner before you start to think about property ownership? Let’s look at the various types of housing options you can possibly consider and realistically own when you are 35 and single. Using broad categories – Public Housing and Private Housing, you can see the various factors in every property type. Hence, depending on your income (affordability), current situation, future plans (mid- to long-term plan), lifestyle, objective – there is no right and fast solution.

For the purpose of illustration, Tim is a single Singapore Citizen (SC). He is 35 years old, drawing a salary of $10,000 on a monthly basis. Currently, he works in a financial institution. After a recent school reunion, he realised most of his friends, both singles and married, are owners of at least one property. He was never pressured into buying a property since he was still living with his parents. However, he is intrigued to find out if he can afford to own one himself and what should be his first property purchase.

There are many ways to property ownership;

1. To own a HDB property first and buy a private property later as a second property.

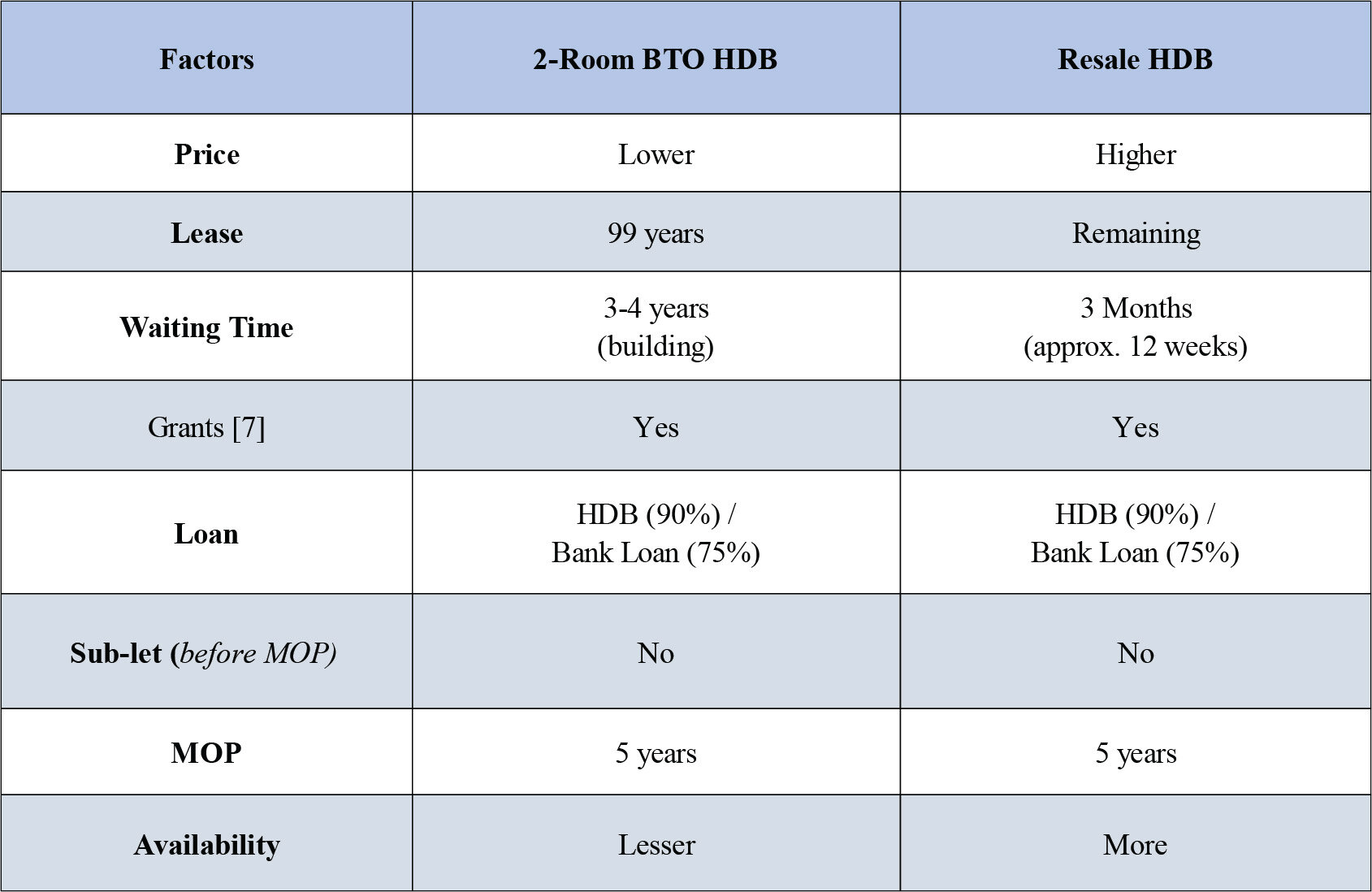

For this method, you can consider kick-starting your property portfolio with either a new 2-room BTO flat in non-mature estates (since 2013 policy ruling change) or a bigger HDB resale flat. Either way, you are entitled to utilise the government grants which is subjected to eligibility and income ceiling.

In Tim’s case whereby he had exceeded the income ceiling of $7,000 with his monthly income of $10,000, he is only eligible for the Proximity Housing Grant (PHG), provided that his parents are to be occupiers in his property or that he buys a property within 4 km proximity to his parents’ current residence.

You are required to occupy the house until it reaches its minimum occupation period (MOP) of 5 years before you can decide to proceed to either rent out or sell off the property. There are some who buy a low-cost flat which will be fully paid for by the time it reaches its MOP. This will then enable you to own a second property – private property with 75% loan (if you have fully paid for your HDB) or 45% loan (if you have a running mortgage loan for the HDB).

In Tim’s case, he will be 40 years old when he can purchase a second property. However, this method is only possible if you have enough cash to pay for the additional buyer stamp duty (ABSD) of 20% for a second property on top of the buyer stamp duty (BSD).

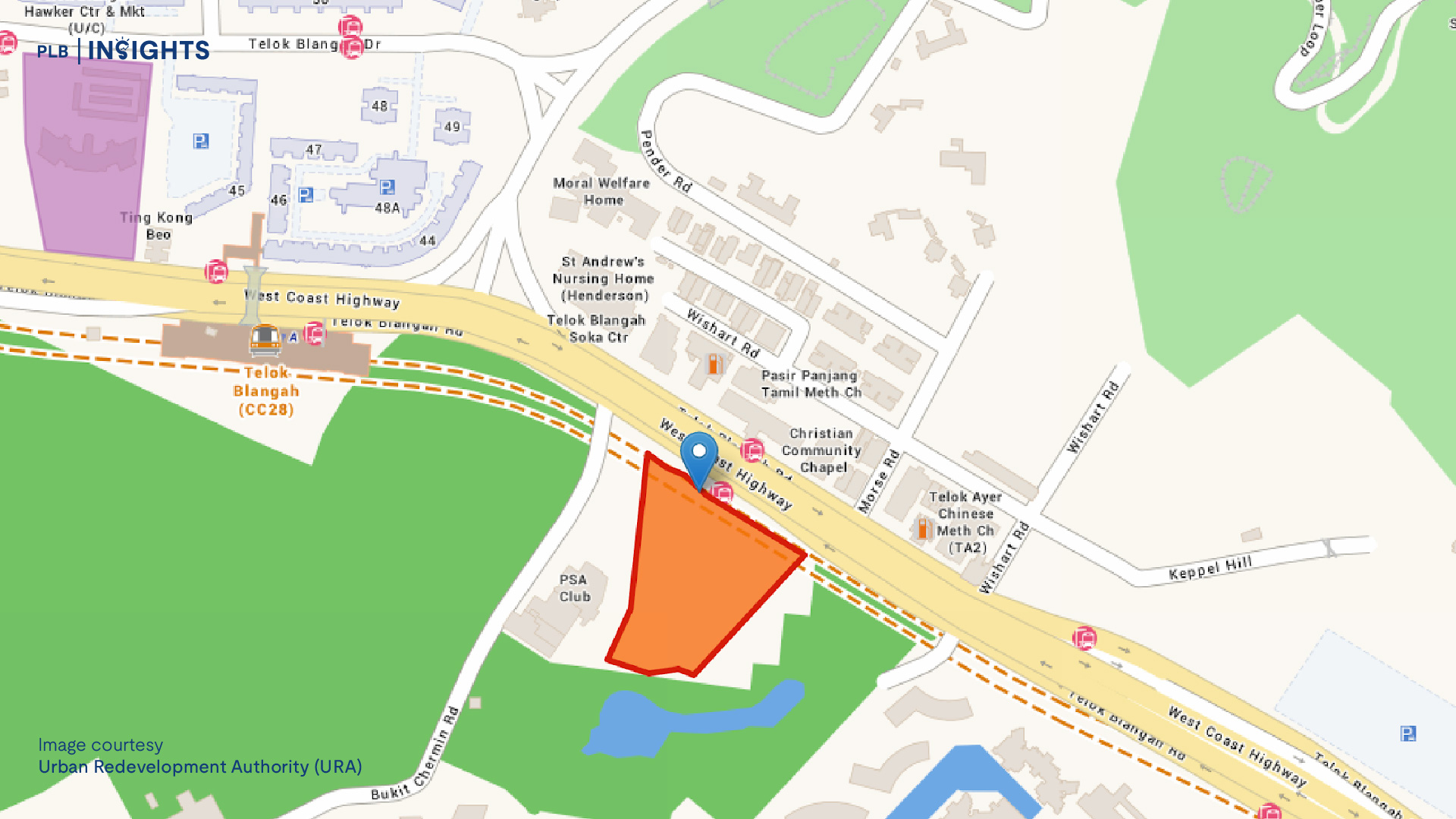

2. To own a private property first – new launch

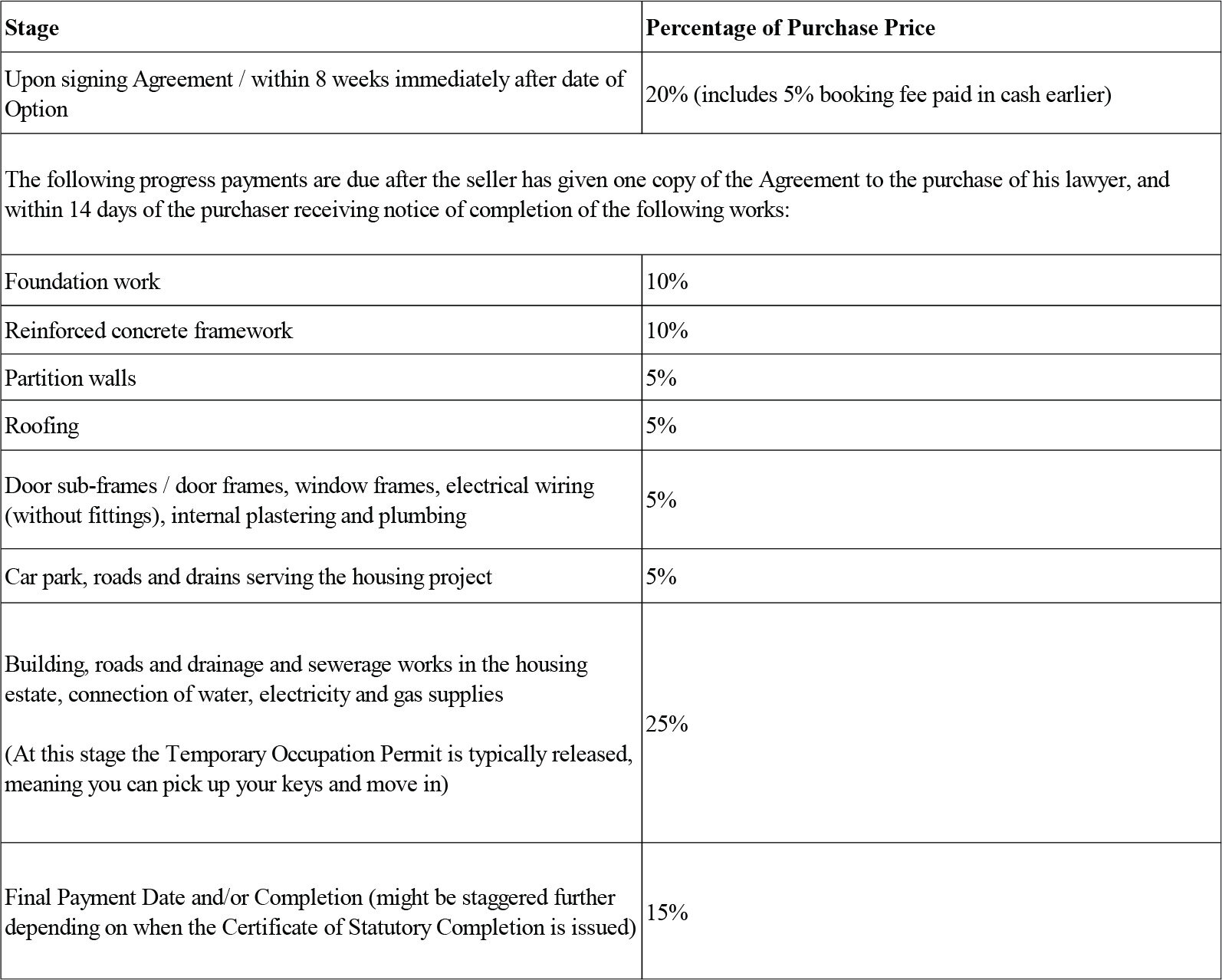

For new launches, although the waiting period is long at approximately three to four years, it allows you to do progressive payment – to pay according to the stage of construction (refer to the table below) it is at. Monthly repayments will be less taxing. This method is only good if you have an alternative place to stay like your parents’ home. Hence, this can be an investment property. You can choose to occupy after the project has obtained its Temporary Occupation Period (TOP), or even sell before its TOP, or when you have fulfilled your Seller’s Stamp Duty (SSD) period of 3 years.

This method gives you the flexibility to rent, sell or stay depending on the market situation after fulfilling the SSD period and also your needs. New launch private property typically has great potential upside in terms of its capital appreciation versus HDB resale flat or BTO flat. The time period required for you to make your next move is shorter too – 3 years SSD for private property, 5 years MOP for resale HDB flat, and 8 to 9 years for BTO flat (inclusive of its construction).

Typical payment schedule for a building under construction (BUC) condo unit

3. To own a private property as the first property – resale condominium.

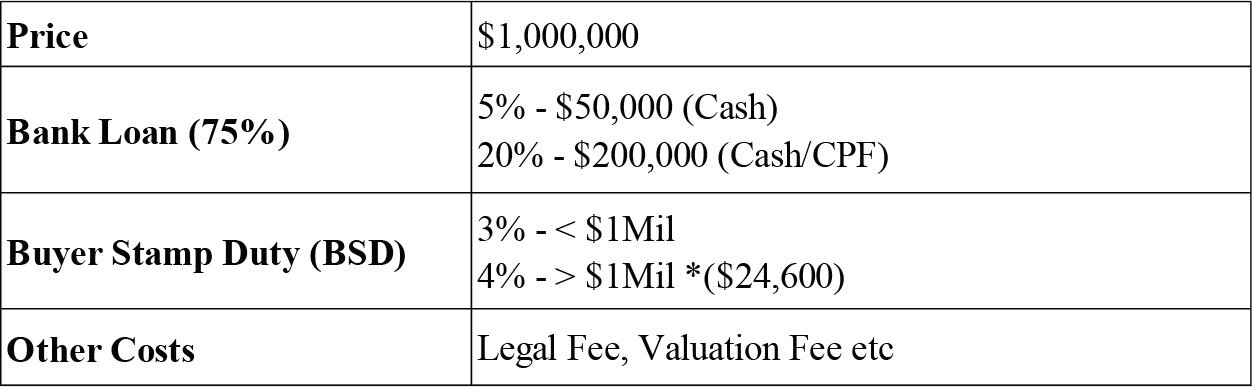

Assuming Tim would like to purchase a $1 mil resale condominium, what are the initial costs involved for Tim? Before embarking on any home search, Tim will need to have the first 9% in cash (5% down payment and 4% BSD, the remaining 20% can be paid via CPF if sufficient; otherwise to top up in cash). Depending on his objective, affordability and his future plan, he can buy either a resale Executive condominium (EC) / condominium, provided he is able to loan up to 75% and he has $274,600 (cash and CPF).

Similar to method 2., Tim can choose to sell once he has fulfilled the SSD period or rent immediately after his purchase to earn rental income. The only downside, depending on the project, size, and other factors, the capital appreciation may not be as significant. But, if you just need a place immediately for your own stay, then this may be an option. You can refer to our past blog if you are in a dilemma between a new launch and a resale condo.

Illustration: Cash/CPF needed for a private property purchase

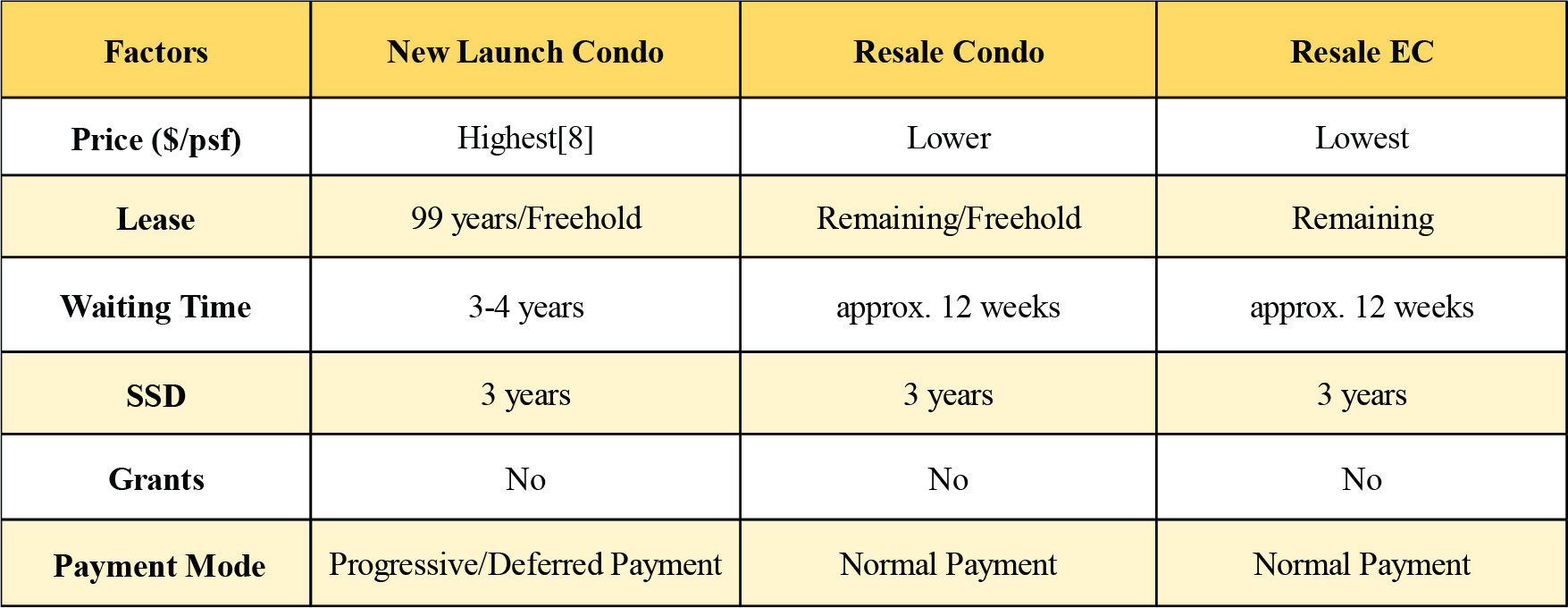

To sum up the factors on the different types of housing, refer to the tables below. At the end of the day, it really depends on your preference, needs, lifestyle, salary, disposable income, expenses – hence you will need to weigh the factors and options based on your current situation and your future plans. Property is a big-ticket investment that requires mid to long-term planning in order not to over-commit or over-leverage to a point that it causes stress if you need to liquidate your property.

If you are 35 years old and still waiting for the “perfect timing”, do note that there are many other factors for consideration – one of them is age on loan eligibility. Do read up more about this on our previous blog and if you find all of this overwhelming, or contact our PropertyLimBrothers team and we will be happy to assist you in your portfolio planning.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.