There are four important factors that you should understand before you decide to put your money into your first and subsequent property investments:

1.The current property market scene in Singapore

2. Your Loan eligibility

3. Factors that might affect your investment decision

4. Factors to note to maintain this mid- to long-term property investment

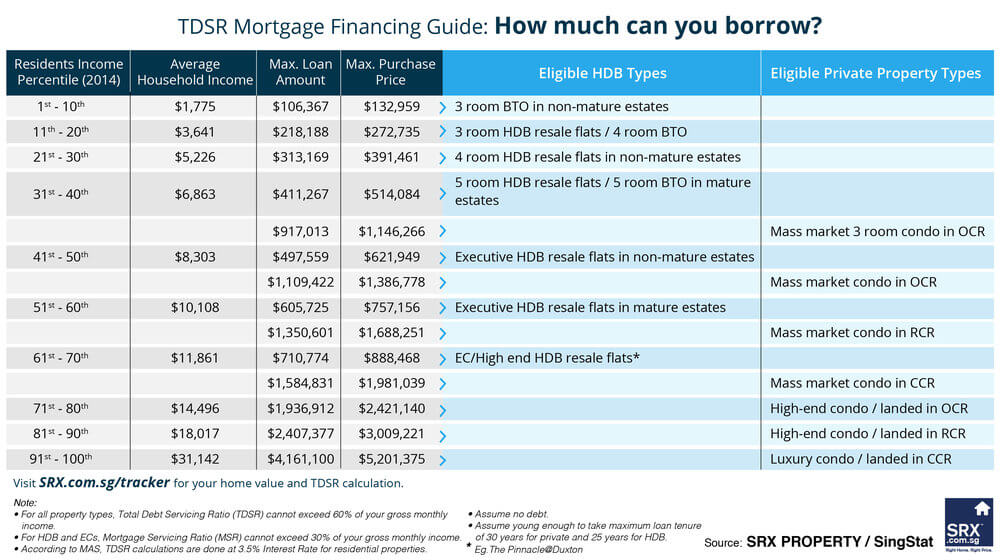

Let’s focus on the second factor: your loan eligibility, and how to prepare for it. The government has set in place the Total Debt Servicing Ratio (TDSR) policy a couple of years back, to ensure people do not over-leverage and over-commit into a property investment. The TDSR measure takes into consideration your eligibility to take on a Mortgage Loan for a property investment, after taking into account your income, age and debt obligations.

There are three things to note in making a property investment:

-

Down payment + Buyer stamp duties

-

If this is your first property, you can loan a maximum of 75% Loan to Value, and pay the rest of the 25% as down payment yourself.

-

If > $1m, buyer stamp duties =4%Price -15,400

-

If < $1m, buyer stamp duties =3%Price -5,400

-

-

Proof of income for mortgage loan

-

Clear financial ability and plan to hold the property, in the mid- to long-term, should the market turn unfavourable to you or in the event of loss of income by owner(s)

(Source : www.srx.com.sg)

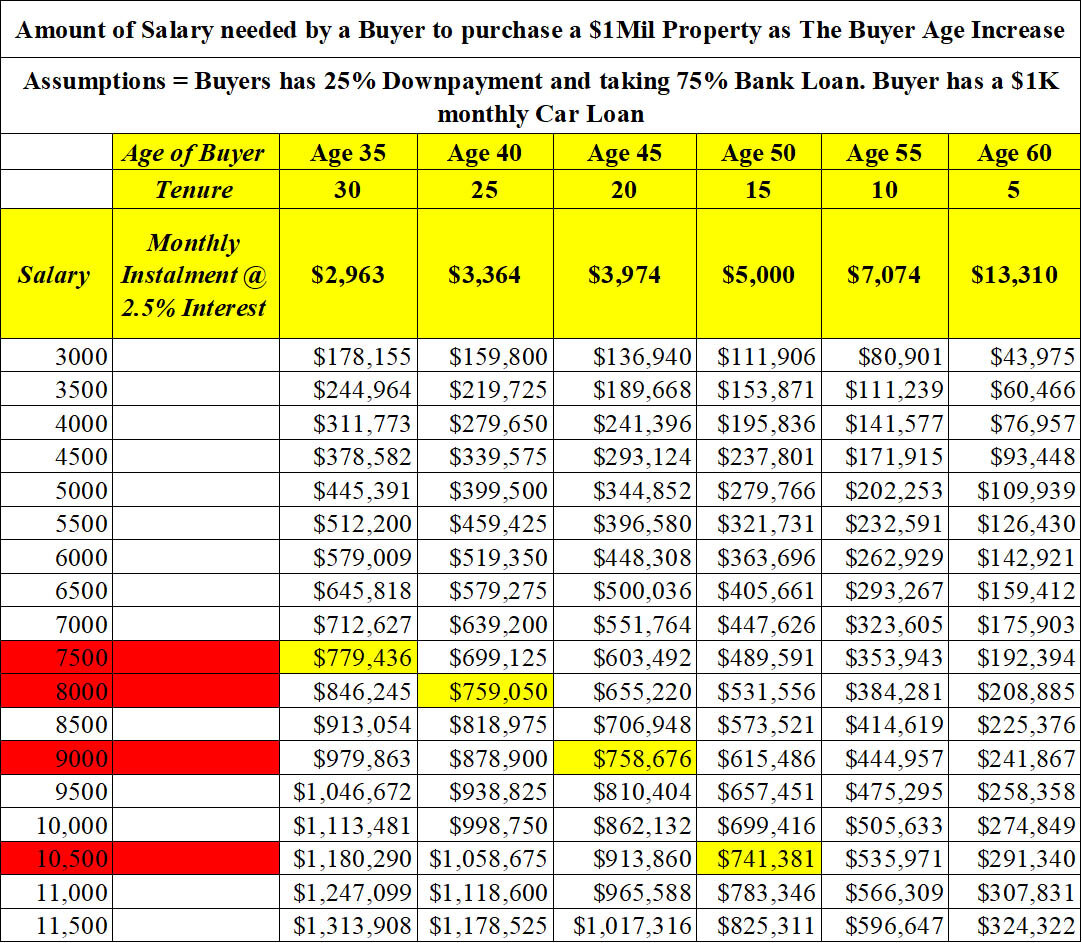

Attached above is a rough estimated breakdown of what one can afford in the different household income brackets based on a loan tenure of 30 years for Private properties and 25 years for HDB. Next we’ll factor in if a family has a car monthly instalment of $1000. Let’s take a look at how this affects the loan eligibility while taking into account one’s age as you get older.

In the chart above, the necessary down payment of 25% to buy a $1million property is $250,000. The buyer stamp duty is applicable as well.

If you are in the age category of 35, the maximum loan tenure that the bank will allow for your mortgage loan =65-your age. This maximum loan tenure is generally capped at 30 years assuming a 75% loan to value(LTV).

Let’s say, currently the interest rate is at an average of 2.5% across various banks. You invest at age 35, and pay approximately $2963 in monthly instalments. Assuming you have a car loan installment of about a thousand dollars ($1000) a month, you will have to be earning a monthly income of approximately $7500 gross monthly income to be able to qualify for a loan close to the 75% LTV mark.

The Perfect Timing Effect

However, as you age, there will be some effect on your loan eligibility. The older you are, the shorter the tenure that you can loan for, the higher the monthly instalment payable, and the higher the required monthly income – assuming all other factors are kept constant.

So as a buyer, what does this mean for you?

Everyone aims to enter the property market at the “perfect” right timing.

However, time is something we cannot buy back.

Some interested investors keep waiting for the right opportunity to come, and end up never making a choice.

Henceforth, it is important to find the right balance of what makes sense for you & your family financially to meet your current lifestyle needs or wants. This could vary from person to person depending on individual factors such as your current age, current income ability, your duration of stay till you exit, sustainability in the event of income loss and various other factors.

If you’ve been sitting on the fence about your property plans ahead, drop our team a message and we will be happy to assist you.