Let’s face it, Singaporeans are jaded about discussions on socioeconomic status (SES). We are tired of being compared with distant social groups which we don’t relate to. Sentiments on the ground reflect this view, disenchanted with “upgrading” to a condo for the sake of “upgrading”. Upgrading in today’s world doesn’t mean moving up the social ladder in the conventional sense. It means being happier, comfortable, and content with where we are in life. It means being better than you were yesterday. Mentally, emotionally, physically.

In this article, we use the notion of upgrading properties as one which better suits your current or future lifestyle and investment profile. It does not simply refer to the traditional idea of moving from HDB to Condo to Landed. Life is more than just the money chase. Here, we will discuss 5 reasons why upgrading from Condo to HDB would make sense if you relate to these scenarios.

1. More Space for Less Money

Get more for less. When you are thinking about getting the most bang for your buck, HDBs technically have the better deal in terms of PSF. You’re able to upgrade the size of your home for less money as opposed to a condominium. Location aside, HDBs are generally built with the family nucleus in mind. Each bedroom is typically bigger (well technically, the whole place is bigger).

Let’s compare the average size of your home should you have a million dollars to buy either a HDB or a Private Condominium.

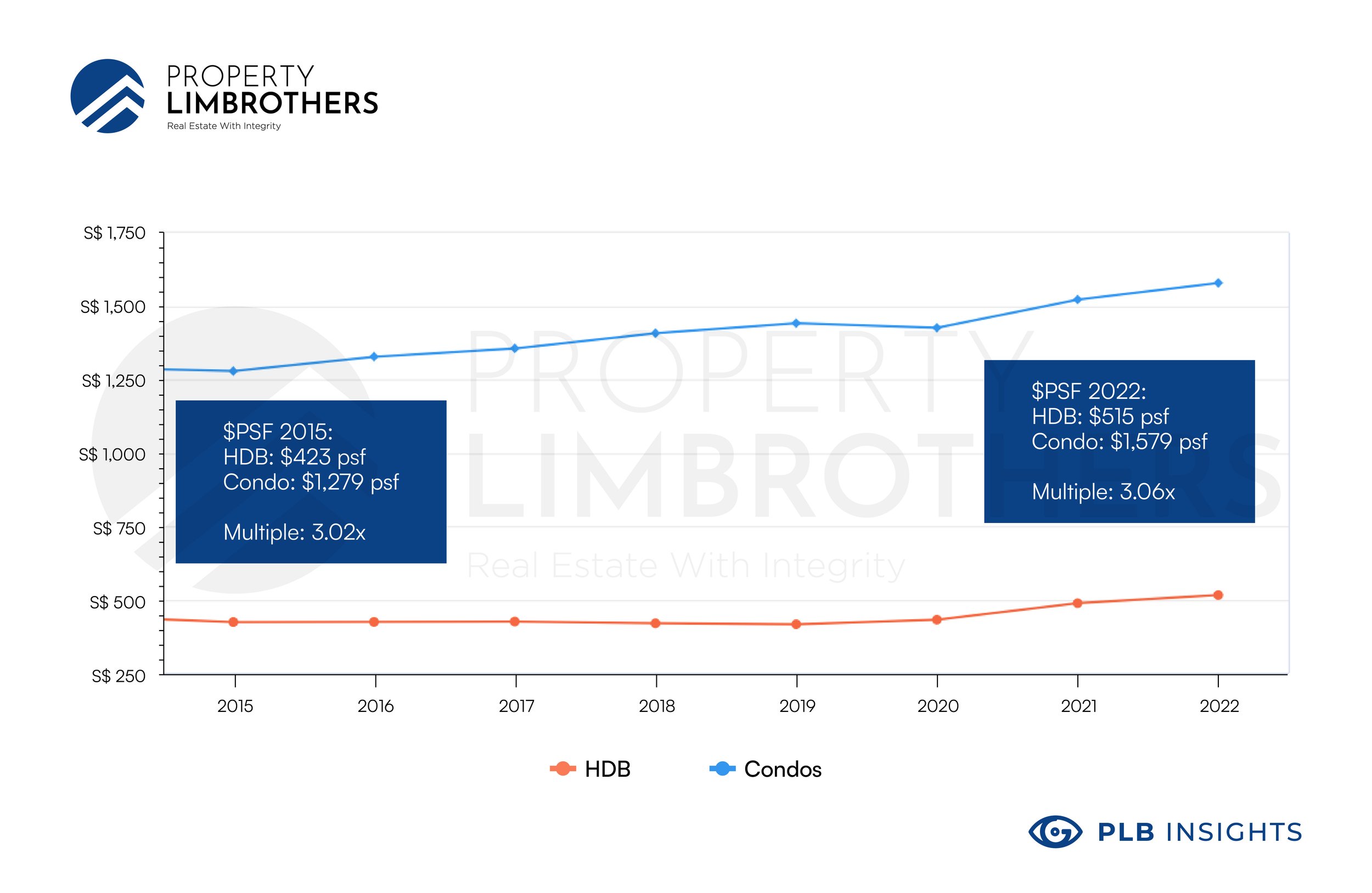

Based on the average price of HDBs and Condos over the past 7 years, we see that the price multiple is around 3x. This means that Condos are typically priced three times higher than HDBs on the PSF basis. In other words, with the same amount of money, you typically get an apartment three times smaller if you chose to buy a Condo than a HDB.

Let’s put the maths to work with our hypothetical million dollars. Using the 2022 price averages, HDBs cost $515 psf and Condos cost $1,579. Assuming you can spend the entire million dollars (how we wish this was real), your HDB will have the size of 1,941 sqft and your Condo will be sized at 633 sqft. This is a huge difference. That’s a large jumbo HDB flat versus a small 2-room Condo.

Image courtesy Mothership

We hope that the difference is clear with this visual and numeric example. Though the images don’t represent the apartments of the exact size we demonstrated in our maths example, the above jumbo HDB flat is for sure a huge contrast to the 2-bedder Condo below. The space is a serious plus and an important consideration of an investment of this size.

Why not give yourself more literal breathing space? Perhaps this might suit your family’s needs better.

Image courtesy AsiaOne

2. Affordable Route to CBD

Another reason you should upgrade to a HDB from a Condo is that it might help you get closer to the CBD. As mentioned earlier, HDBs on average cost lower on a psf basis when compared to Condos. Building on this idea, it is possible to get an upgrade in terms of location. Sure, you might be spending a huge amount of money on a HDB but a location closer to the CBD is ideal for you, then it might just be worth it.

In this section, let’s look at more solid examples. We take a look at 12 Cantonment Close as our HDB example in the Outram neighbourhood. We compare this HDB with its neighbour, The Beacon. We know that Pinnacle@Duxton might be the first Outram HDB on your mind. But that case is an exception and might skew the prices upwards. Some may speculate that more of such exceptions are on the way with PLH flats being pioneered with the Rochor project.

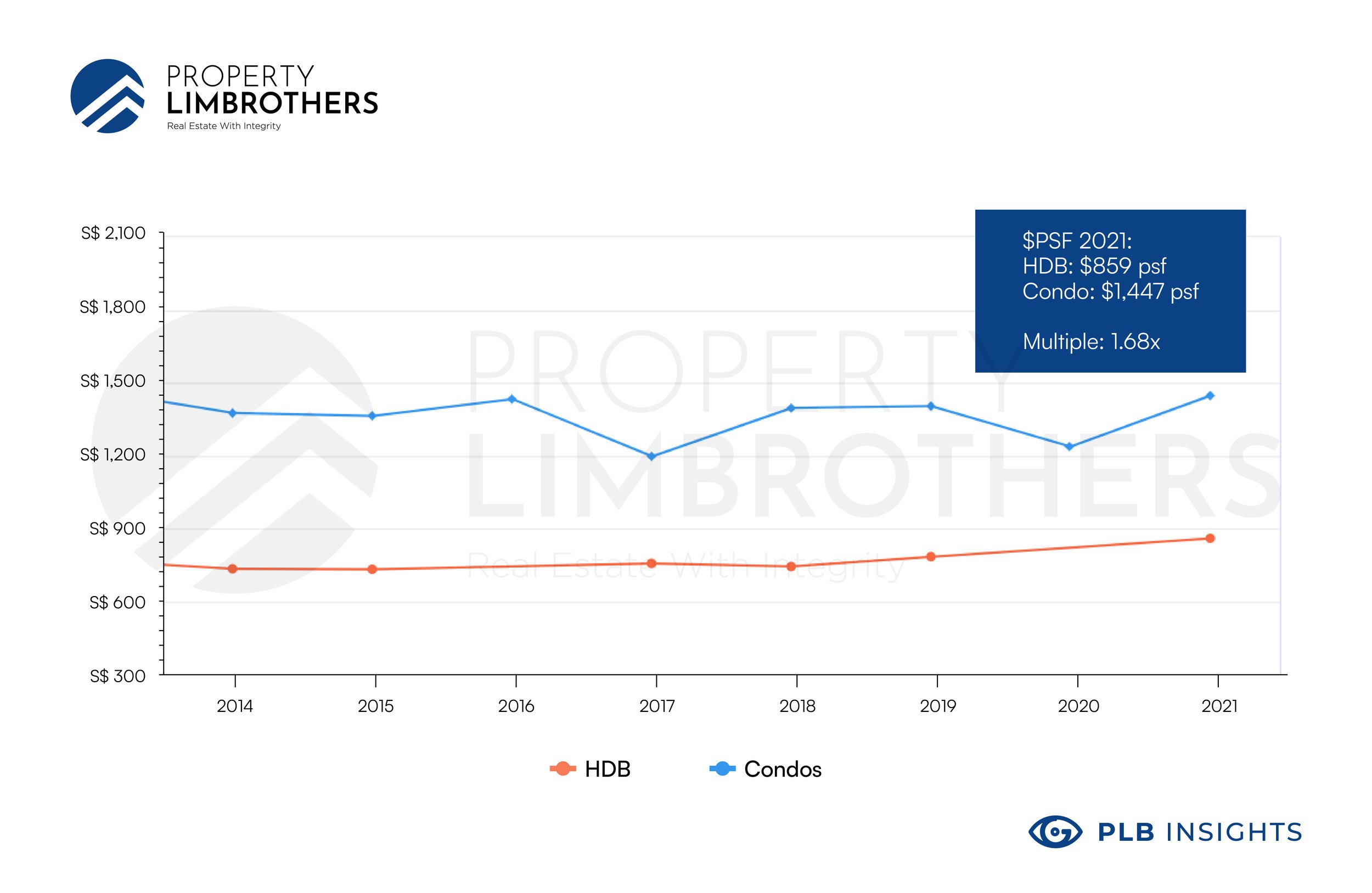

For 12 Cantonment Close, the first thing we notice here is the difference in the multiple. While on average the HDB space multiple is 3x, here closer to the CBD area the multiple is 1.68x. This makes sense because as we get closer to the city, demand is high and the disparity effect pushes buyers to go for the HDB option more often, slightly closing the gap between HDB and Condo psf.

Another point you might notice is the better growth rate for HDBs nearer to the city. At 17% over the course of 7 years, 12 Cantonment Close outperformed The Beacon by a margin of 12%. We attribute this appreciation to the disparity effect, which we cover in our videos and other articles.

Image courtesy SRX

But that is not the key point. The main idea is that it is more affordable to stay closer to the city if you pick a HDB option. With our imaginary million dollars yet again, we could buy a HDB around the size of 1164 square feet or a Condo the size of 691 square feet. The difference is either a large 3 room HDB or a large 2-bedder Condo. This makes staying near the city more family and wallet friendly.

With the government’s plans in the Greater Southern Waterfront, we can expect to see more affordable public housing closer to central areas. However, these options would have a MOP of 10 years, which will slow down the transaction volume of HDBs and keep public housing affordable (hopefully this pans out well when PLH flats hit the resale market).

To be clear, it is difficult to have your cake and eat it. Typically, the trade-off between size and location is not trivial. We can see that the difference in psf between HDB and Condo narrows as we get closer to the CBD, but what does this mean for the actual size of the home? Assuming that we are buying a SGD$ 1 Million HDB, that would mean that the average size of 1941 square feet would be reduced to 1164 square feet. That is approximately the size of a big 3 room or a small 4 room flat when you decide to go for a closer-to-city option.

3. Economising on Lifestyle Choices

Moving on, there are a group of you who are affected by the Work-From-Home (WFH) trend. There are some of you who are so busy with work and family that you aren’t able to fully utilise the facilities and amenities that your condominium provides. Trust us, that is a very common complaint that we hear. Parenting isn’t easy and much less so in a dual income household. Nonetheless, it is a valiant effort to give the best to your child.

Noting these important points on lifestyle, it might be in the interest of some to better economise their choice of home. If space is your definition of luxury then improve your lifestyle by upgrading to a larger HDB. If living near the CBD is your definition of luxury then moving to a more centrally located HDB is a reasonably affordable option. Sure, spending money on status symbols is not necessarily a bad thing. But if it is at the expense of a better lifestyle which you (and your family) desire, then perhaps it is high time to reconsider your decisions.

Image courtesy JobStreet

That being said, Condos are not without their benefits. To be fair, they do offer a lot of amenities. Most Condos would have car parks and swimming pools. Some would have more elaborate tennis, badminton, squash courts, and gyms. If you do find yourself frequently using these facilities, you might find the convenience of having it right there amazing (without having to travel and compete with the public to book). Privacy is also another key perk. So do consider whether you value these aspects of your Condo before deciding to switch over to public housing.

Lifestyle is a difficult point to cover because it might vary so much. WFH and the nature of your job also factors in on how you spend your time at home or in the office. The bottom line is that if your family-work lifestyle is that which hardly makes use of, or enjoy the condo facilities then maybe the maintenance fees you pay every month is not being fully utilised as a resource. Maybe it could do good as an enrichment class for your children, or for a much deserved spa treatment for yourself (every month). The WFH scenario might also see you needing more space than your Condo can afford you, putting HDBs into the consideration set if you’re looking out for a bigger space.

4. Your Kids have Grown (literally)

This short point is a little bit more of a personal one. As you see your children grow up (literally), you might notice them needing more personal space. They would like decorating their own rooms, have more space to chill, and might not enjoy sharing rooms with their siblings as much. This might trigger some to look for a bigger home in the interest of their adolescent or young adult children.

Seeing your children fight is definitely not a scene you would like to come home to after a long day of work. What brings warmth to the heart is when you know every member of your family is enjoying and appreciating the space that is home.

5. The Golden Years — Retirement

Retirement is cited as one of the most prominent reasons for “downgrading” to a HDB. As you can tell, we really dislike the status labelling. Retirement is the golden years. You’re not “downgrading” to a HDB because you have to. You’re upgrading to a HDB because it gives you the benefits that you are looking for in your retirement.

Moving to a HDB gives you government benefits (GST Vouchers and the like). If your children are at the age where they are applying for BTO, they might be able to get more subsidies and grants if they were to buy a flat near you.

Image courtesy Straits Times

Upgrading to a HDB also means that you free up capital from your previous real estate investment. You can use this however you wish in your retirement years. Some use it for their grandchildren’s university education. Others might want to use it to bless their children and help subsidise their wedding expenses. Cash is king. And you should have plenty of cash when you free up that capital.

Efficient space, less chores. Perhaps, less chores for your robot vacuum cleaner, but less chores nonetheless. If you envision yourself not needing or enjoying that much space when you are in your retirement phase, then why not cut yourself some slack and have a smaller space which needs less maintenance.

Closing Thoughts

To sum up this article, we do not hold a bias for or against any properties. HDBs and Condos have their own perks and are designed to suit the needs of different demographics. We appreciate options and variety. This article hopes to demonstrate an angle that favours HDBs in some scenarios. Of course, the assumption in this article is that you are married and are Singaporean so that HDBs options are still open to you.

We think that upgrading from Condo to HDB makes sense if you want:

-

More space for a lower price

-

A more affordable residence near the CBD

-

To re-adjust your lifestyle

-

More space for your children at an affordable price

-

Re-optimise your property portfolio for your retirement

If you want some expert opinion on your own individual situation, our consultants would love to get in touch with you to see how we can help you. Contact us here.