The real estate market enjoyed a great boom in post-pandemic Singapore. With 2022 seeing prices go higher on almost every front, it has kept buyers, sellers, agents, and regulators alike all on their seats. The property market is heating up to the point where some market participants speculate a housing bubble forming in Singapore.

However, Singapore’s property market has sported strong fundamentals accompanied by solid demand in the past year. As the supply-slide slowly catches up in what might be a slower 2023, market participants should still keep a close eye on how different parts of the property market move this year.

With so many moving parts when it comes to the whole real estate market, some might find it hard to follow what has happened in 2022. In this article, we will cover the key statistics and trends for 4 market segments in Singapore’s property market. This includes Singapore’s Rental, Resale HDB, New Launch Condo, and Resale Condo segments.

*A caveat on the statistics is that 2022 December data is not included as they will only be completely released on 28 January 2023. The data used were drawn on 10 January 2023. When we use the term “condo” in this article, we refer to condominiums and apartments collectively.*

1. Soaring Rental Growth Across the Island

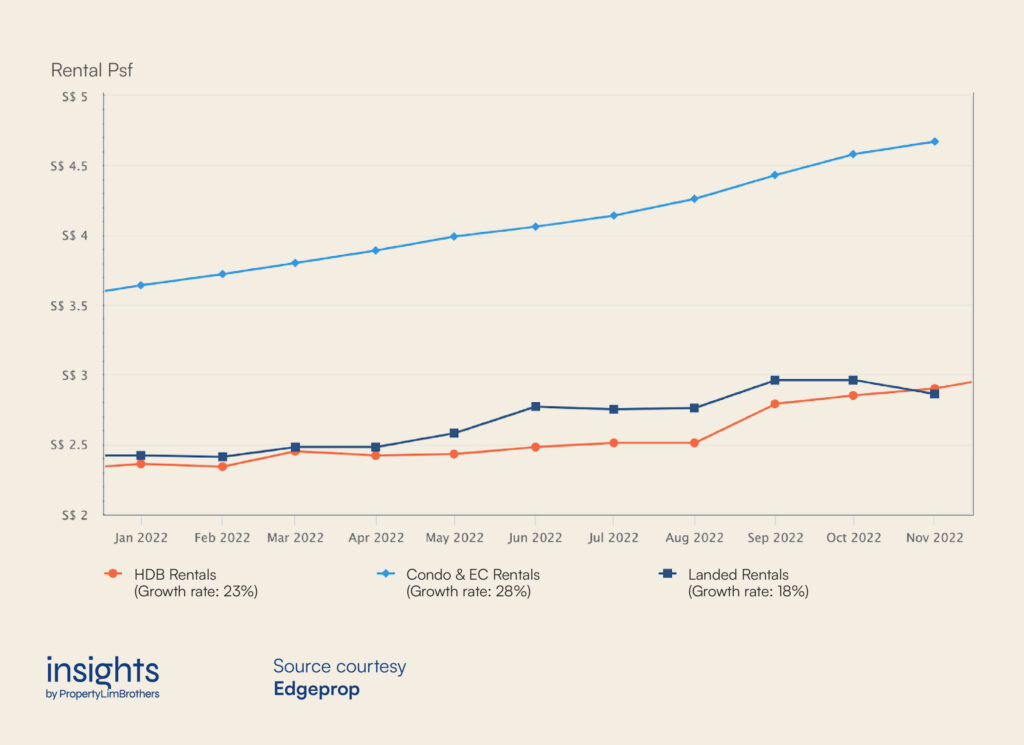

On aggregate, HDB Rentals rose by 23%, Condo & EC Rentals rose by 28%, and Landed Rentals rose 18% from January 2022 to November 2022. Compared to the news headlines of unbelievable rental increases (ranging from 50% to over 70%), the aggregate rental inflation for the year is around 23-28%. This tells us that the rental hikes across the island vary dramatically depending on the location.

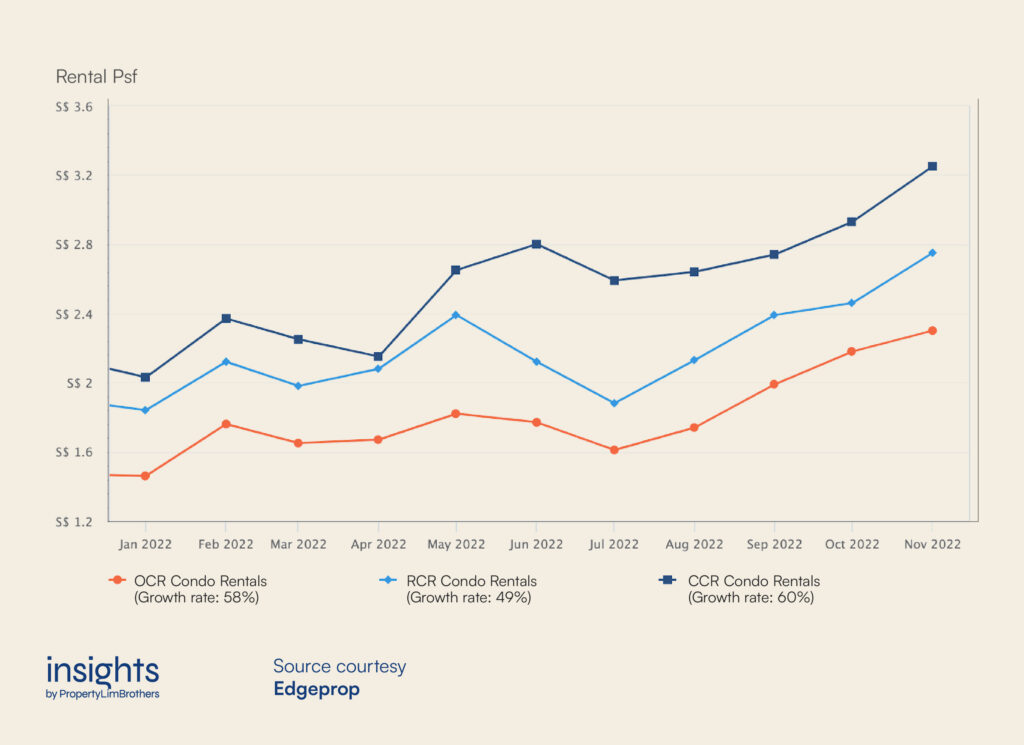

Taking a closer look at the rentals for condominiums and apartment rentals only (excluding Executive Condominiums), we start to see a more drastic increase in rentals. OCR Condo Rentals rose by 58%, RCR Condo Rentals rose by 49%, CCR Condo Rentals rose by 60%, all from January 2022 to November 2022.

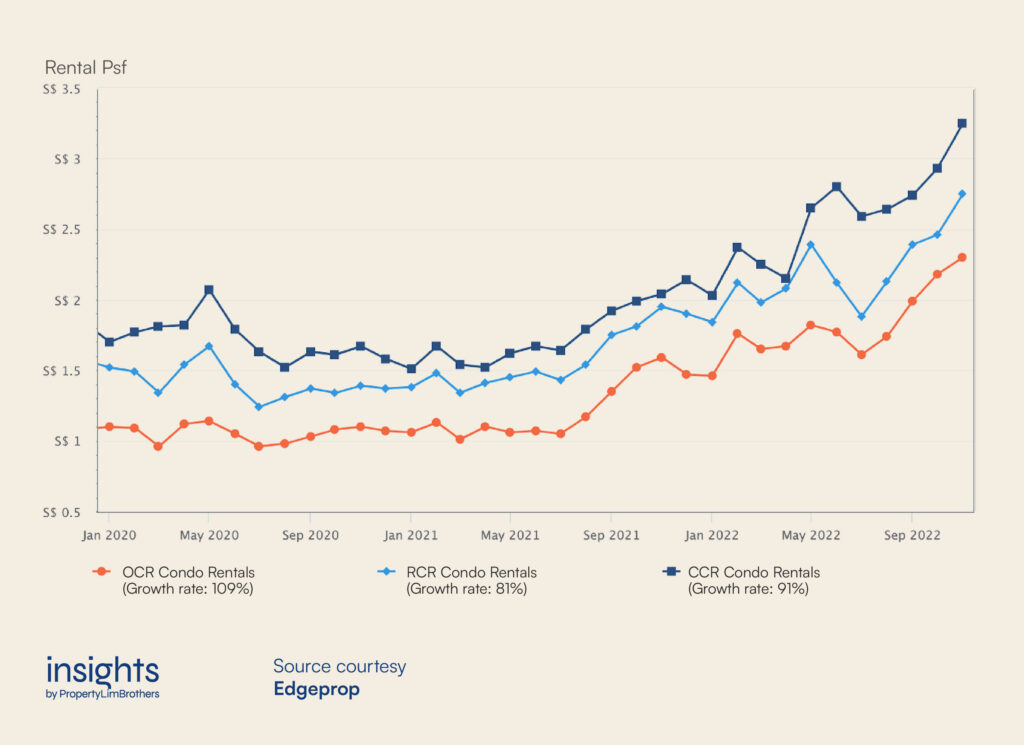

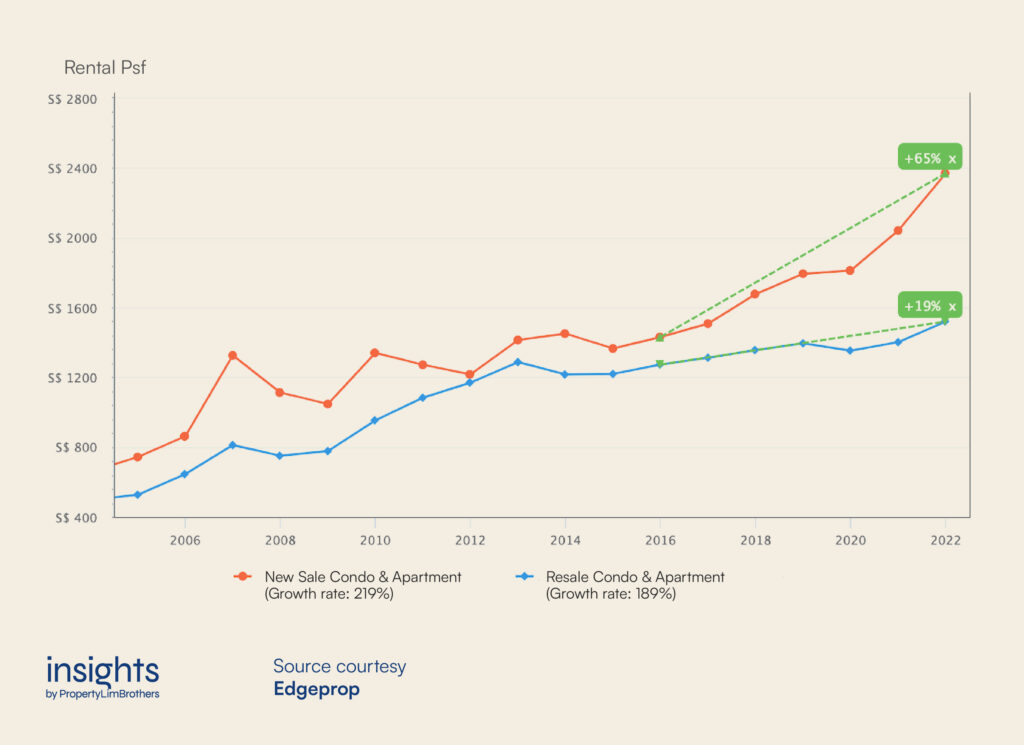

Putting the story together for people who have truly experienced massive rental hikes from their landlords, these people are likely to have their previous rental deal inked on or before July 2021. Ever since then, the rental market has been on a mission to set new highs. Looking at only condominiums and apartment rentals again but on a longer horizon, we see that rental prices could possibly double for some people renewing their contracts.

Since January 2020, people who have renewed their rental contracts on aggregate will face a 109% rise for OCR Condo Rentals, 81% rise for RCR Condo Rentals, and a 91% rise for CCR Condo Rentals. While almost every renter got hit pretty badly these two years from rental inflation, those renting in the OCR have faced the steepest rise in rental prices. Even then, the OCR rental price psf is still considered lower than that of the RCR and CCR.

This is an example of the disparity effect playing out even in the rental market. As the rentals get pricier, more renters from the RCR and CCR might seek lower prices in the form of OCR rentals, thus pushing up the rental prices there. On the other hand, we also observe that the CCR rental growth is higher than that of the RCR. We speculate that this could be due to the influx of more affluent renters competing for a more limited number of central properties.

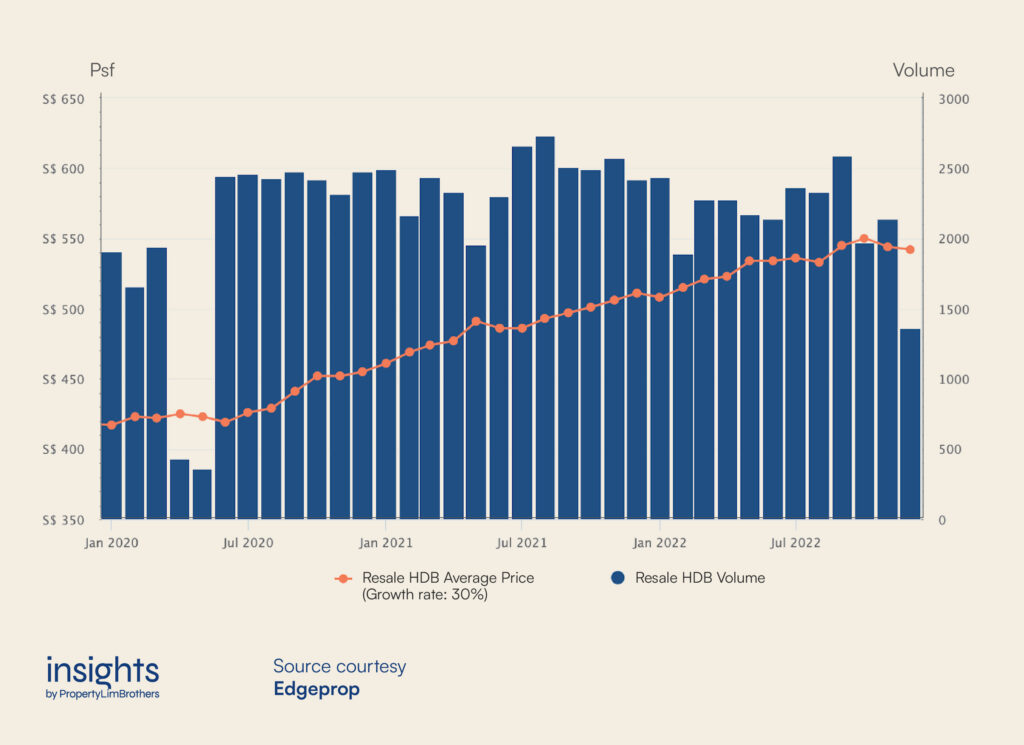

2. Resale HDB Market Heating Up

Resale HDB buyers aren’t the only ones worried about the rising prices. In fact, regulators have taken recent action to help cool the Resale HDB market and keep the housing inflation under control. You can read more about some of the cooling measures in 2022 here. The specific cooling measure that concerns the Resale HDB market in particular is the 15-month wait-out period for Private Property Owners (PPO) and ex-PPO who are looking to purchase non-subsidised HDB resale flats. This is with the exception of seniors aged 55 and above who want to downgrade to a 4-room or smaller flat for retirement.

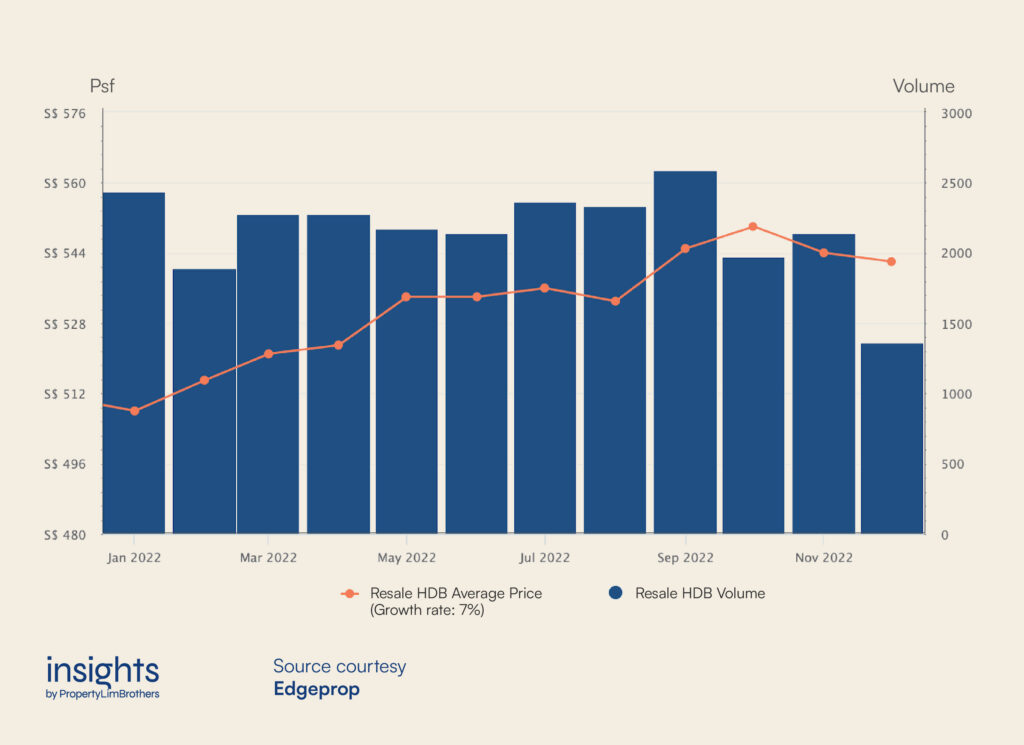

When we look at Resale HDB in 2022, aggregate prices have risen around 7%. While this might not seem as extreme as rental price increases, it is well beyond the healthy inflation rate for housing. In fact, if such rising prices are left unchecked, it is very likely that housing prices will enter a bubble and hit the rocky road of unaffordable housing. Some effects of the end-September cooling measures can be seen as the fourth quarter (October to December) sees prices starting to stabilise and transaction volume cooling down. Time will tell how much effect this particular policy will have on the market prices and volume in the coming quarters.

Looking at the longer timeframe, 2022 had a 10.7% decrease in volume of transactions compared to 2021 for the Resale HDB segment. From the chart above, you can see that rental prices started its dramatic rise ever since the end of the pandemic circuit breaker period (June 2022 onwards). For buyers interested in a Resale HDB, it would be important to keep a close eye on how this market segment reacted to the Cooling Measure in September 2022. Coupled with more frigid macro conditions, it is possible to see both price and volume decline for this segment in 2023.

*There is some data available for December 2022 for Resale HDB deals but the data may be incomplete. Nonetheless, the data is still used to give us a more complete picture of 2022.*

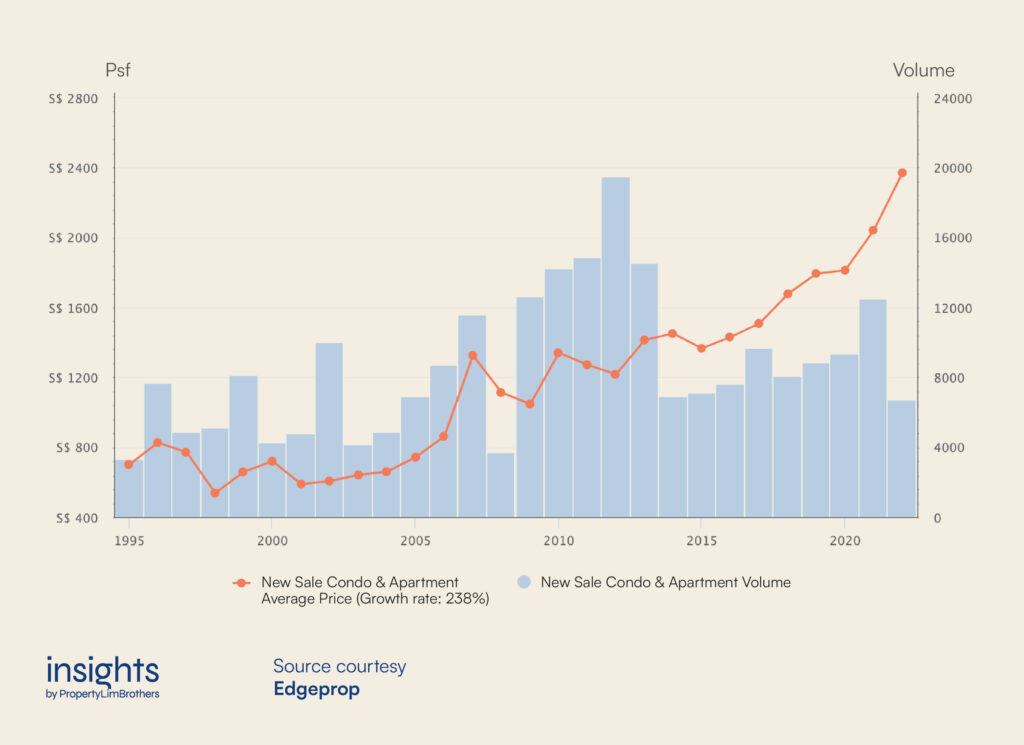

3. Condominium & Apartment New Launches make new All-Time-Highs

The new launch market making new all-time-highs is not a rare occasion, especially in recent years. For the 6 consecutive years from 2017 to 2022, the new launch condominium and apartment segment have made new all-time-highs every year. This is an extraordinary performance, but not one without worries.

Conventionally, the New Launch segment is thought of as one in which people “can surely make money”. These climbing prices reflect the contrary. With higher new launch sale prices, end-consumers are left paying more than previously before. Over the past 7 years, the price of new launches has increased significantly and might erode some potential for appreciation for more recent buyers.

From the chart above, New Launches clocked $2,370 psf in 2022 as the new all-time-high for the aggregate price of this segment. However, the volume has dropped significantly. Compared to the year before, the volume of transactions in 2022 has dipped 46%. This might be partially due to incomplete data in December 2022, but this only represents a small portion of the decline. The volume will contract significantly even with a hypothetically higher December volume.

The decline in the transaction volume might not be due to a low take-up rate. We see that unsold inventories for private property have been on the decline. Instead, this lower volume could be due to fewer new launches hitting the market compared to 2021.

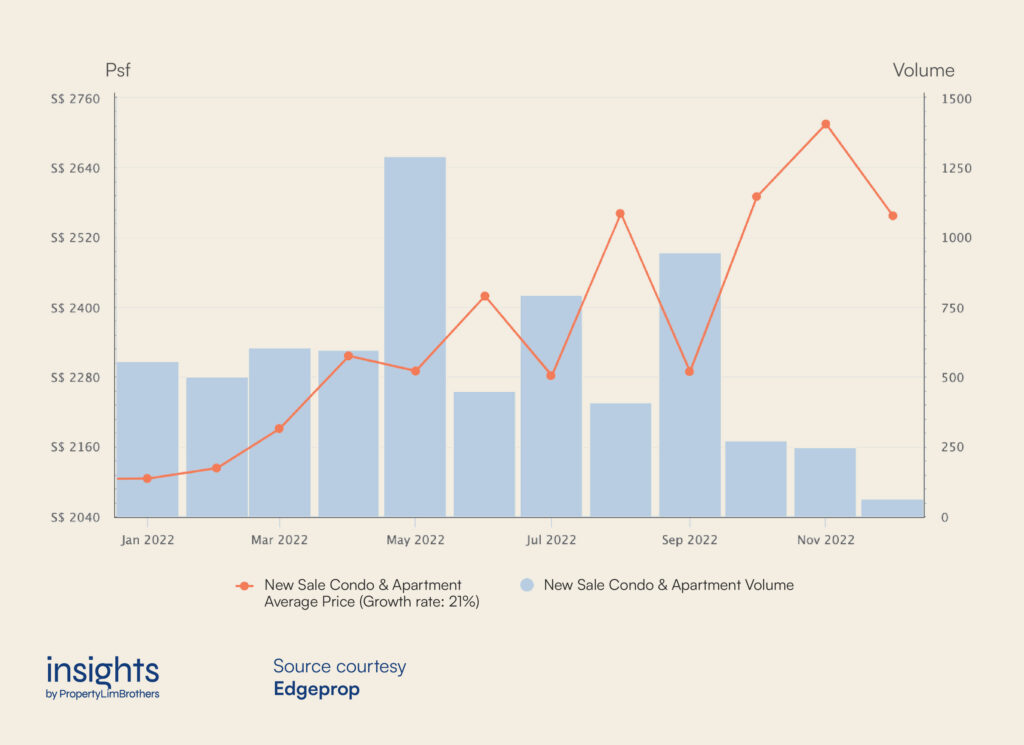

Compared to New Sales of Condominiums and Apartments made in January 2022, New Sales made in December 2022 are priced 21% higher. This may be due to a difference in the project being sold due to the difference in launch timings in the year. As a result, we cannot infer much from the monthly breakdown of prices for the generic new launch market.

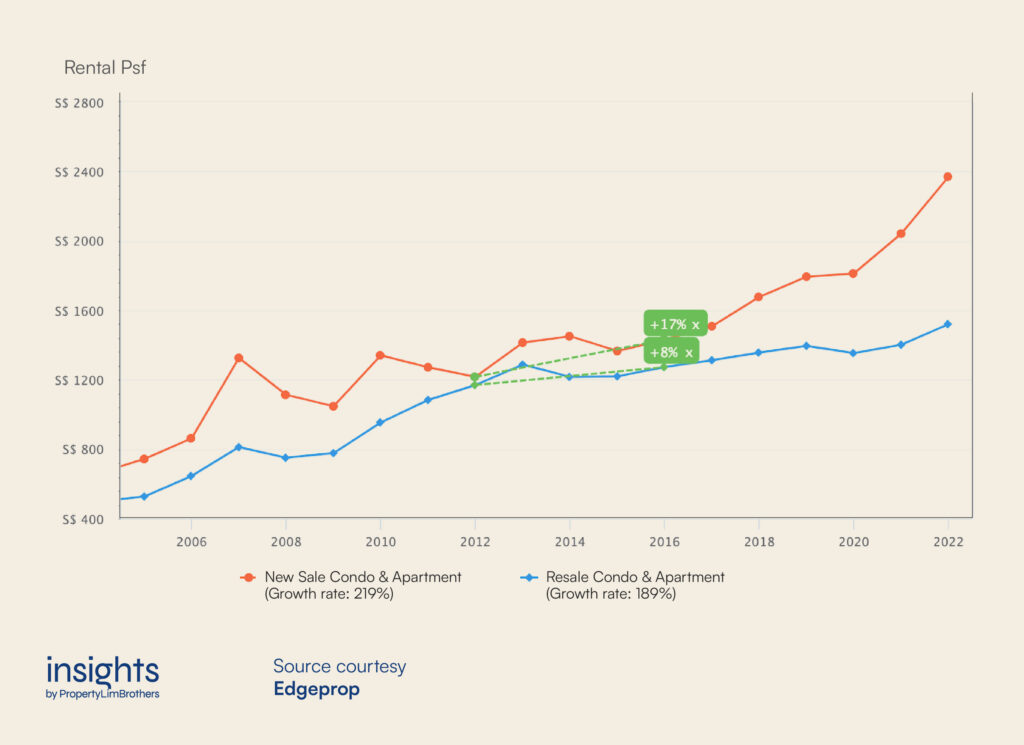

Regardless, the New Launch market has made a considerable climb up. To the point where spectators are wondering if the market is behaving euphorically, with some launches almost selling out on its launch weekend in 2022 (such as AMO Residence). We notice a growing disparity gap between new launch and resale condo prices. In the chart below, notice that from 2016 to 2022, new launches have grown 65% whereas resale condos have only grown 19%. This is more than triple the growth. There is also an aggregate price difference of $850 psf between new launches and resale condos in 2022.

While this does not conclusively tell us that new launch prices have peaked, it does tell us that the disparity gap might push buyers towards the Resale Condo segment instead. It could be very possible that new launch prices remain high due to rising costs on almost all fronts (from land, materials, to labour).

Compared to an earlier period from 2012 to 2016, we see that the difference in growth rates is narrower. In this period, new launches grew 17% and resale condos grew 8%. The difference in aggregate price was only $158 psf in 2016. This is less than the aggregate price difference of $850 in 2022, which is more than 5 times larger. Moving into 2023, we might see strong cost-push inflation keep new launch prices high while resale condo prices start to catch up and close the disparity gap.

*There is some data available for December 2022 for New Sale Condominium & Apartments but the data may be incomplete. Nonetheless, the data is still used to give us a more complete picture of 2022.*

4. Resale Condos, the Underdog Rising

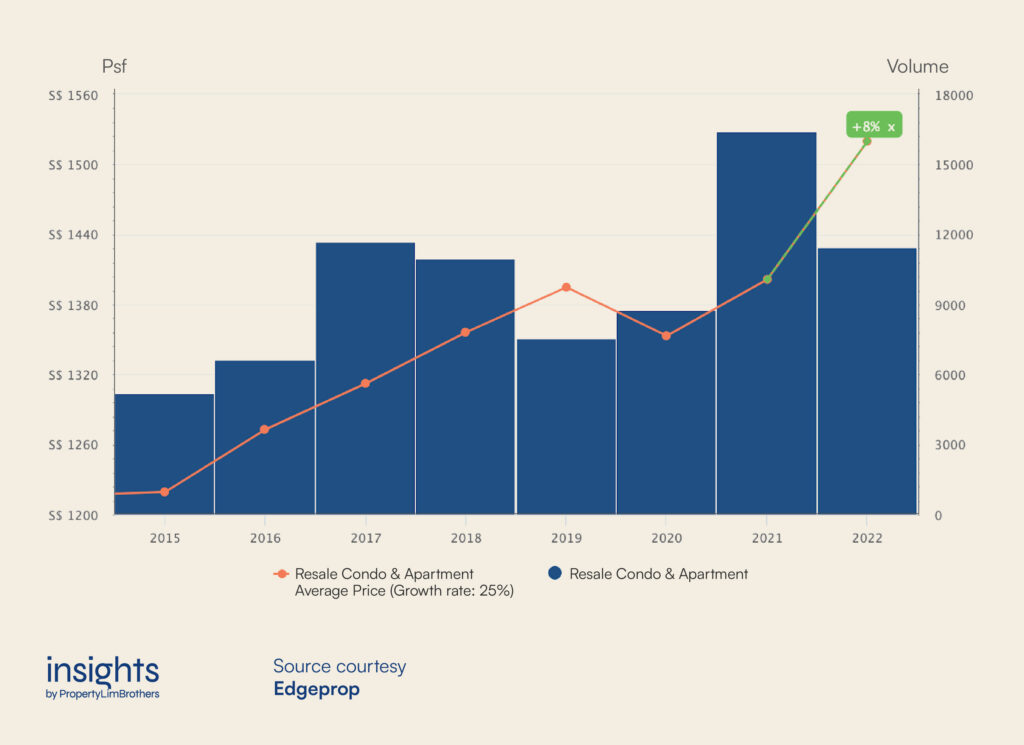

As mentioned in the previous section, there are a few reasons to be optimistic about the Resale Condo segment. Among others, the Resale Condo benefits from the existing disparity gaps in the property market. As a segment that has lagged behind the top growth segments (such as New Launches), it might be time for the underdog to shine.

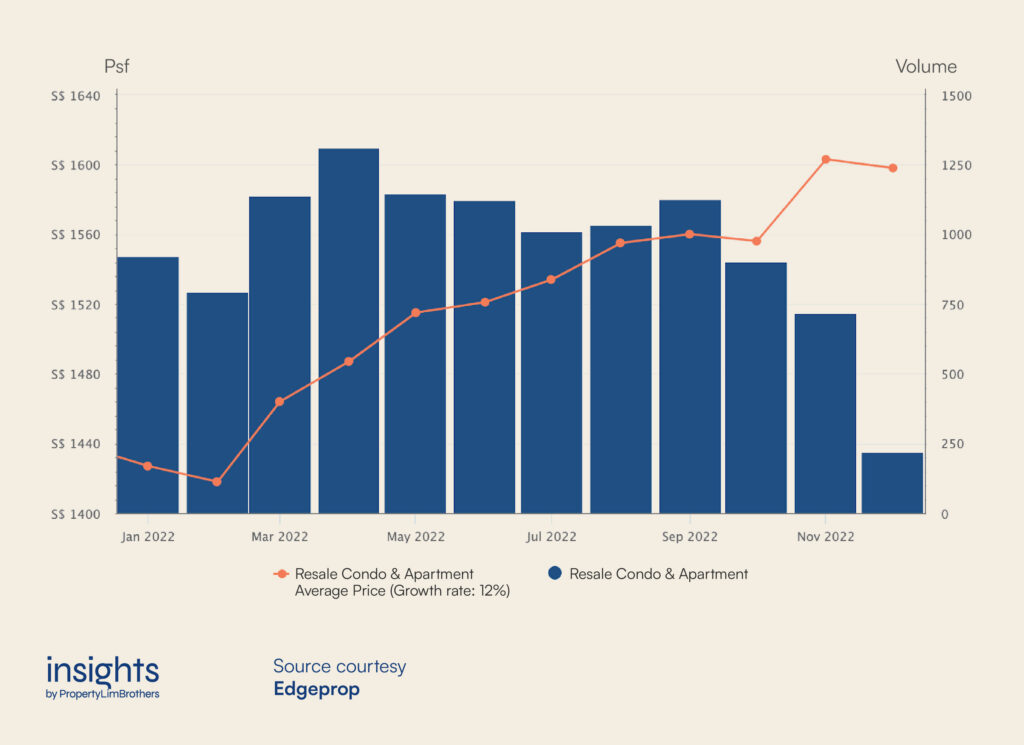

In 2022, prices of Resale Condos have increased by a decent 12% on aggregate from January to December. While the volume of transactions has tapered off strongly in the last quarter of the year, this might be due to the revenge travelling episode from Singaporeans travelling abroad amidst the holiday season and international reopening of many countries. Despite this decline in volume, we still see strong price performance in the last few months of the year, probably owing to transactions in more expensive neighbourhoods.

The Resale Condo segment clocked an aggregate price of $1,520 for the year 2022. Despite the 30% decline in transaction volume from 2021 to 2022, price still grew substantially from the previous year with an 8% increase compared to the aggregate price of 2021.

Some might interpret this as a topping-pattern, where price overextends before a price correction downwards (2019 is one such example). This is a possibility. With added anxiety over a possible recession in 2023, buyers and sellers may both hold back from transacting, with only weaker hands letting go of their property at a price lower than the present.

Still, considering the recent cooling measures preventing private property owners from purchasing Resale HDBs, Resale Condos might be a segment that buyers flock to instead when looking for affordable options for real estate purchases without a long wait. With the lower relative price compared to new launches, there is reason to be cautiously optimistic about this real estate segment.

Learn more about How these Key Statistics & Trends Affect You

Singapore’s real estate market has made incredible moves in the past year. With this article, we hope that you have gotten a quick and clear glance at the important developments in Singapore’s residential mass market.

Thank you for your support in reading this far. Stay tuned for more articles on Singapore Real Estate. Follow us on Instagram (@insights_plb) and drop by our Editorial page for more!