What is this Prime Location Public Housing Scheme?

The Ministry of National Development introduced the Prime Location Public Housing (PLH) in late October 2021. These new set of regulations that applies to selected new HDB BTO flats built in prime locations hopes to address the “lottery effect” whereby buyers who are fortunate enough to secure a BTO in a great location such as one in the Core Central Region (CCR) or Rest of Central Region (RCR) will be more than likely to strike a windfall upon selling their flat after Minimum Occupation Period (MOP).

At the current time of writing, we are anticipating the August 2022 BTO launch, which will likely have PLH Flats in the Bukit Merah region, so we thought it would be appropriate to revise what PLH flats are and their impact on the real estate market, and if you should go for them!

What are the similarities and differences between a typical BTO flat and PLH flat?

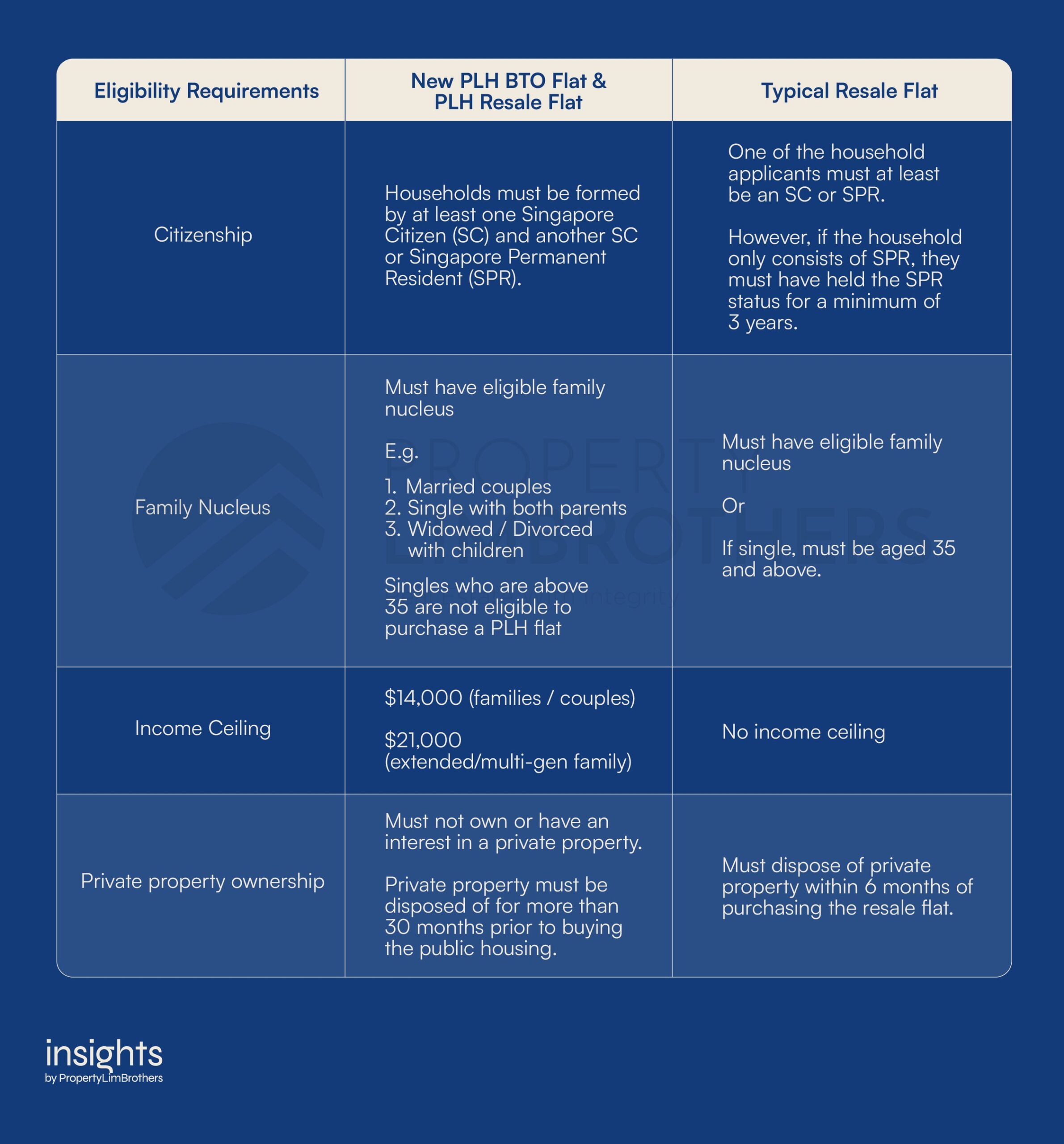

1. Eligibility Conditions

PLH Flats have the same eligibility requirements as existing BTO eligibility conditions with certain slight differences.

However, the biggest thing you must consider when applying for PLH is its resale requirements.

The pool of buyers for the PLH resale flat will definitely be smaller than the pool of buyers for a typical resale HDB flat because even those buying a PLH resale flat are subjected to prevailing BTO eligibility conditions.

According to the Straits Times, these resale restrictions placed over PLH flats will be here to stay for at least half of the 99 years tenure before HDB considers whether to review them.

You can find out more information about eligibility on HDB’s website outlining Flat and Grant Eligibility. You can also head to an HDB’s website for an eligibility check.

For more information about HDB’s definition of “family nucleus”, you can check out this document provided by HDB on the general conditions for purchasing a flat.

2. Minimum Occupation Period (MOP)

Unlike the 5 years minimum occupation period (MOP) that typical BTO flats have. Flats that fall under the PLH scheme will have a 10-year MOP.

This 10-year MOP is intended to safeguard public housing in prime areas for Singaporeans who genuinely need an affordable housing option and aimed to prioritise families whose sole intention is to occupy the flat, instead of flipping the house onto the open market for resale profits.

As outlined by HDB, flat owners are to physically occupy the flat during the MOP period, which obviously means they cannot sell the flat in the open market.

Additionally, one is not allowed to purchase private residential property, both locally and overseas. Those awaiting the MOP to be up cannot rent out the whole flat.

3. Subsidies

In the case of PLH flats, there are additional PLH-specific subsidies on top of existing BTO subsidies.

However, the caveat to these subsidies is that there is a “Subsidy Recovery” upon resale in the open market. The Subsidy recovery only applies to the first resale, affecting only the first BTO owners.

In other words, when the first owners of the PLH flat sell their home, they will have to pay HDB a percentage of the resale price. The percentage of Subsidy Recovery is only announced upon the launch, and corresponds to the size of the additional PLH subsidy given on the initial purchase of the sale.

River Peaks at Rochor and King George’s Heights at Kallang/Whampoa, which were the first two ever PLH projects to launch, announced a 6% Subsidy Recovery upon its launch.

Meaning to say, upon the resale of any unit within these 2 projects, owners would have to pay 6% of the resale price back to HDB. So if the first owners were to achieve a resale price of $800,000, $48,000 would be returned to HDB. Assuming, the capital gain for this sale is around the $100,000, around half of that would be returned.

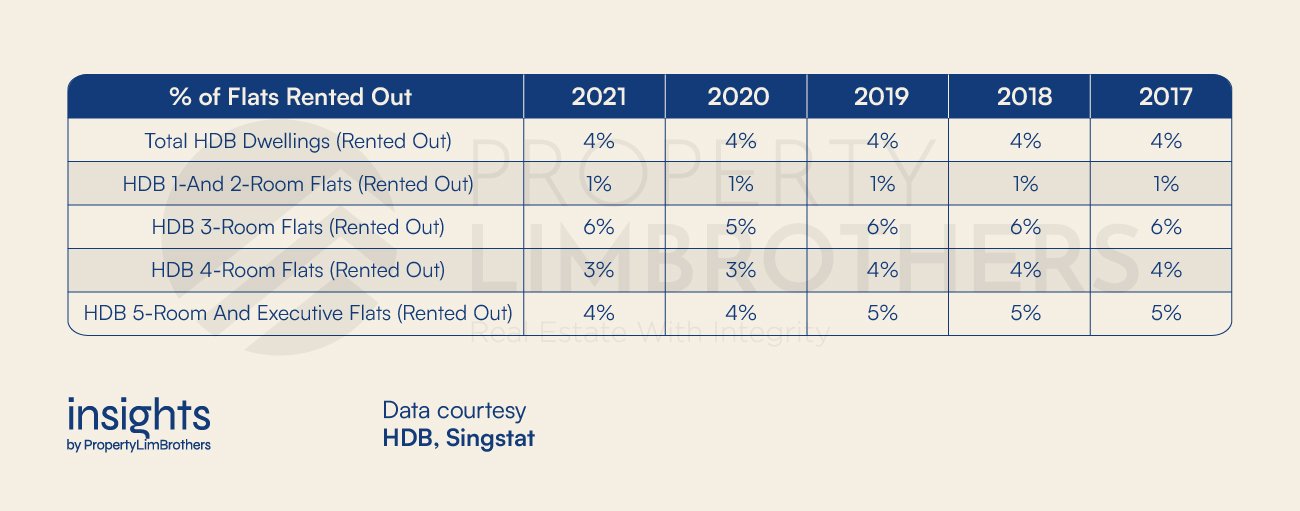

4. Rental Conditions

Specifically for PLH flats; homeowners may not rent out the entire unit even after the 10-year MOP. They are limited to only renting out a portion of the flat which may not be comfortable for some who prefer not to be living with strangers.

Again, these conditions are meant to safeguard Singaporeans with genuine housing needs and to strengthen the owner-occupation intent

But, do these rental conditions really matter to those who eventually want to monetise their flat as they upgrade their housing portfolio?

According to HDB statistics:

There is only a minute number of HDBs being rented out, so we believe that this condition should not have much of an impact, but instead was put in place just to cover all bases in meeting the goals of securing public housing for public housing and reducing the “lottery effect”.

Other quirks of buying a PLH HDB Flats

1. Adjustments to priority allocation quota for Married Child Priority Scheme (MCPS)

The percentage of flats reserved for households applying for flats near their parents or married children under the MCPS will be reviewed and adjusted according to the location of the site.

This is done in order for prime central locations to be more inclusive, giving more opportunity to Singaporeans whose families don’t live near the area, to live in these neighbourhoods.

Such details will be made available when a PLH BTO project is launched for sale.

2. Integration of public rental flats

Where feasible, HDB has said they will build public rental flats for lower income households in order to keep the public housing community inclusive throughout Singapore.

As our National Development Minister, Mr Desmond Lee, outlined at the Singapore Economic Policy Forum that this move is a commitment to ensuring that all housing estates are inclusive of those with lower income who work in prime central areas who would benefit from living much closer to their place of work.

How will PLH affect the resale market of HDBs?

What will the Resale Price of PLH Flats look like?

Going back to the fact that PLH HDB flats have additional subsidies, and a longer Minimum Occupation Period (MOP), this could give rise to a “compounding effect”.

In other words, the value of the subsidies is able to appreciate over a longer period of time, and is “unleashed” at once, when the MOP is completed.

However, as mentioned earlier, the first owners of PLH HDB shouldn’t rejoice so quickly upon selling their flat; they will have to pay a percentage of the resale price back to HDB for utilising the additional subsidies provided to them on purchase.

When PLH BTO flats complete the 10 years minimum occupation period (MOP), the sale of these flats brings in a new supply into the resale market.

While theoretically, the Subsidy Recover prevents the first owner of the PLH from experiencing the “lottery effect”. That does not control the resale purchaser from having to fork out a more premium price on the resale flat. However, it can be said that the smaller pool of buyers will slow the increase in the resale prices of PLH flats.

Estimated maximum PLH Flat Resale prices

Since buyers of resale PLH flats are to meet prevailing BTO eligibility conditions, the household income ceiling to purchase a resale PLH flat is set at $14,000, or $21,000 if purchasing with an extended/multi-generation family.

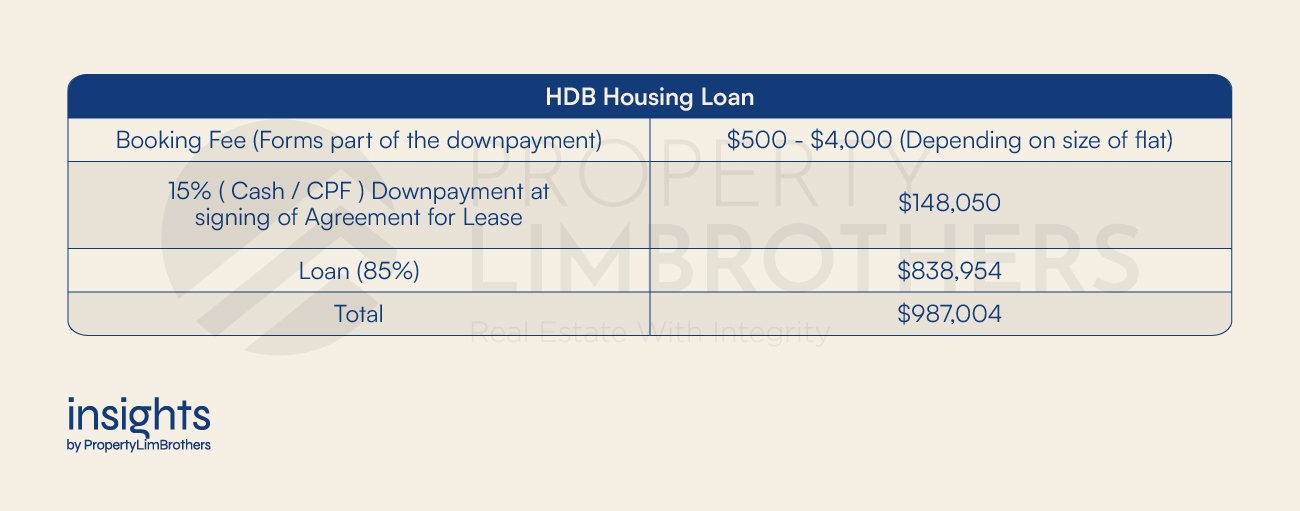

Using an HDB Housing Loan:

Assuming a married couple who are both 30 years old, each earning $7000, resulting in a combined income of $14,000. Their maximum loan would be $838,954.

Following the maximum MSR.

The current Loan-To-Value (LTV) limit for HDB-granted loans is 85%.

Using a Private Bank Housing Loan:

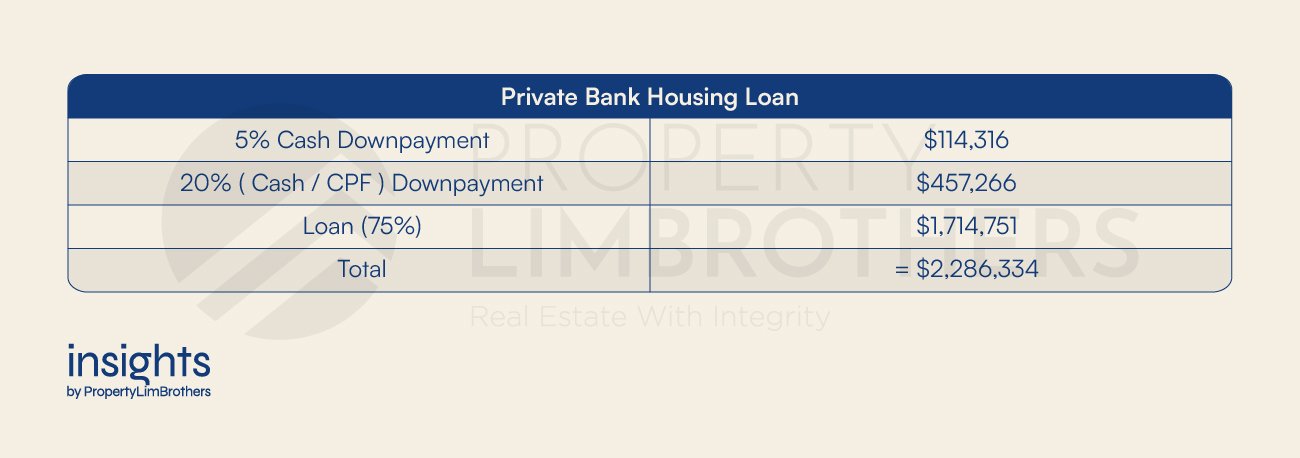

Assuming a married couple who are both 30 years old, each earning $7000, resulting in a combined income of $14,000. Their maximum loan would be $1,714,751.

The LTV limit for loans obtained from financial institutions to purchase HDB flats is 75%.

While the income ceiling caps the amount of loan they can borrow, potential buyers who fall under the income ceiling but have substantial cash reserves can offer even higher by paying cash on valuation. And we should not be surprised if this pool of buyers already exists and could potentially be huge with the trend for freelance work and self-employment on the rise.

What could prevent PLH Flat Resale prices from reaching higher?

Undeniably, there will be a significant reduction in the pool of buyers for PLH flats compared to newly MOP typical BTOs.

Resale buyers have to meet prevailing BTO eligibility; hence those with higher monthly income will not be eligible to purchase resale PLH flats due to the income ceiling requirement. Also, those looking for a rental yield investment play will not be interested, and potentially the smaller units may lack appeal for those looking for a bigger space or foresee having children.

Higher demand for neighbouring resale flats

With the bountiful restrictions imposed on PLH flats, buyers, in a bid to avoid these restrictions, may opt to buy neighbouring properties, driving demand and prices and could have an unintended effect of the “lottery effect” on neighbouring HDBs. And in the far future when all public housing options in prime locations are replaced by the PLH model, more may turn to private housing options for flexibility on the terms of stay.

However flats with a shorter lease may not be able to sell at a price higher than their PLH counterparts simply due to its healthier balance lease, which could, in turn, cool the real estate market, especially in mature estates.

So, where are we going with PLH?

It is hard to tell how PLH flats will likely impact the open market in the shorter horizon. The impact will only be felt once the first few PLH flats are eligible for sale in about 15-20 years.

Existing Prime Location HDBs will see greater demand and this price appreciation as they are not restricted by these new restrictions imposed by the PLH scheme.

Buyers who strongly prefer central regions and a larger space may opt and even offer top-up in cash to purchase resale PLHs

Should you go for the PLH Flats?

If you were hoping for a PLH flat to reap the profits, we, unfortunately, think that would not be the wisest decision. The scheme was put in place precisely to eliminate this intent.

Since there are currently no PLH flats out on the open market, investors will have to take the first mover risks if they plan to use these flats as a real estate investment avenue. We think that it would be more appropriate for home buyers intending to occupy the place who are ready to commit to the size of the flat for at least a decade.

We think that the target demographic of PLH flats would be younger couples who only plan to have no kids or plan to have only 1 or 2 kids in the near future and/or work in the central business district area, as living close to their place of residence will be a convenience and cost-saving measure as opposed to renting or even owning a car to get to and fro from work.

However, each house and each housing type will have its own unique characteristics, surely there will be one to address your real estate needs, and we will be more than happy to show you the right place!